Saving is an essential habit for every family. But where you put what you saved is an equally important matter. Based on a report, at least 50% of adults have bank accounts. That means roughly 50% still keep their money in unproductive locations such as safety vaults, cabinets, or under their beds.

In this post I will present to why it is imperative to keep your family’s savings in digital banks.

Summary

A regular savings account doesn’t protect our money from inflation. The interest rates they offer aren’t high enough to beat the rising cost of goods and services each year. Digital banks, on the other hand, offer rates that are beyond the inflation rate. It not only helps us preserve our money, it also makes a small profit.

Digital Banks Give High Interest Rates

The biggest reason why you would want to keep your savings in digital banks is its interest rate. They offer interest rates that are 50 times higher than regular savings accounts, 7 times higher than high-yield accounts, and 3 times higher than time deposit accounts.

| Digital Banks | Traditional Banks | |

|---|---|---|

| Savings | 3.5% | 0.0675% |

| High-yield | 3.5% | .50% |

| Time deposit | 3.5% | 1% |

Digital banks can offer higher interest rates because they generally have lower overhead costs than traditional banks. They do not have a physical store, thus they don’t need to spend too much on manpower, lease, and equipment. All the amount they saved is added to the interest rates of their depositors as part of their marketing strategy.

Protects You From Inflation

Ever wonder why it seems like you still struggle financially despite the increase in your savings, salary, or sales? There’s a big possibility that you are not aware of inflation.

As of this writing, the inflation rate of our country is at 3%. It means the prices of general goods and services have already gone up at that rate over time. There are multiple ways to look at this. But for the sake of simplicity, this information also means we are losing 3% of our savings annually. It’s an invisible expense that eats our hard-earned money every year.

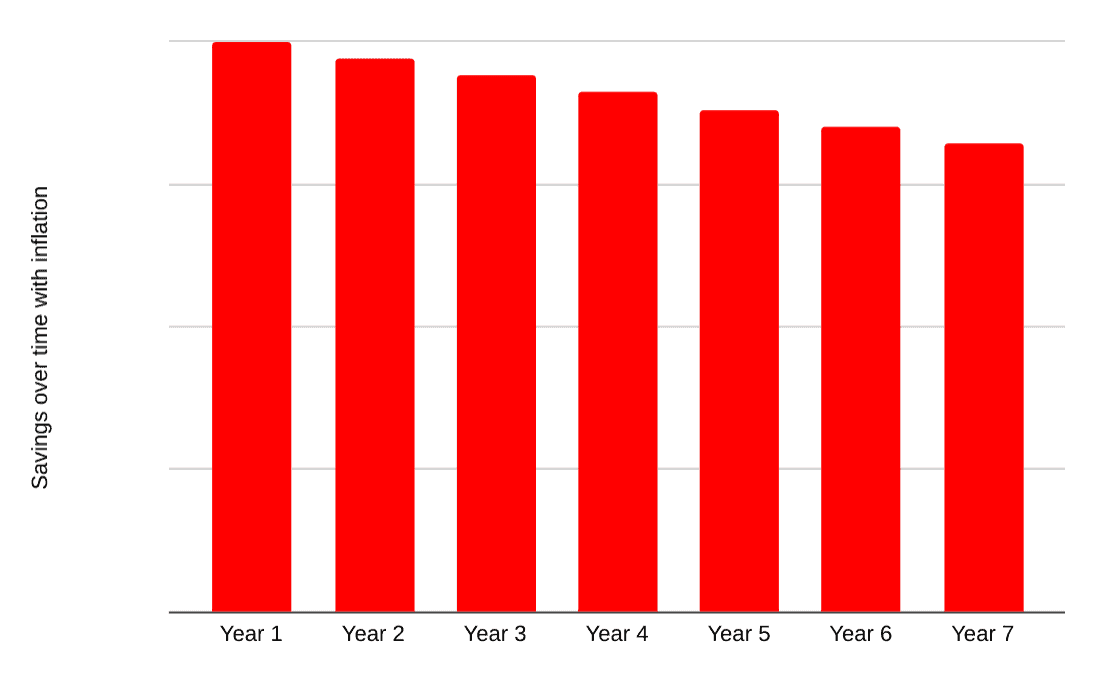

Here’s how our family’s savings will look over time due to inflation:

Unfortunately, there’s nothing we can do about inflation as a whole. It is a guarantee that the cost of living next year will be more expensive than today. What’s good is there’s something we can do about it on a personal level. One way to protect our savings is to keep them in an account with an interest rate equal to or higher than the inflation rate.

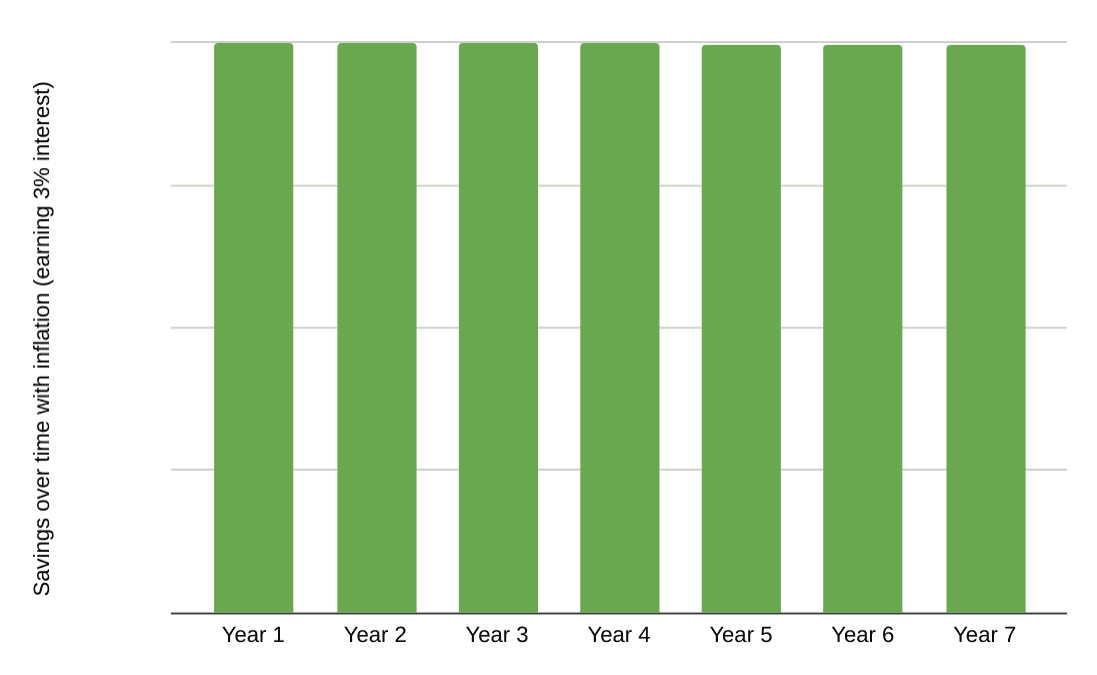

Here’s what our savings will look like when kept in accounts that give at least 3% interest rate per year:

Maintains Your Liquidity

One underrated perk digital banks offer is they don’t require lock-in periods, minimum deposits, or a maintaining balance. I’m sure you’ll understand the importance of this feature when you have an emergency fund. Besides higher interest rates, digital banks also enable you to stay flexible in times of need.

So far, no other financial institution can offer this type of service. The table below in a way summarizes what most banks offer: higher sum + longer duration = higher interest rate.

Sadly, most people aren’t liquid enough to pay for their emergency expenses. A good majority often rely on their credit cards, which would eventually lead them into debt. I know because my wife and I have been there. It took us a couple of years to pay off eight credit cards.

Your Money Is Insured

Another notable attribute of digital banks is that deposits are insured. If a bank closes, the Philippine Deposit Insurance Corporation (PDIC) will cover up to Php 500,000 of your total deposits. There are many digital banks popping up here and there lately. Sign up with financial institutions licensed by the central bank and covered by deposit insurance.

Watch Out For The Transaction Fees

Most, if not all digital banks are now starting to charge transaction fees. They charge a small amount for every transfer, deposit, or payment you make. It’s wise to be mindful of your transactions to avoid overspending on those surcharges. It will be pointless to earn good interest, only to spend them on transaction fees.

Enjoy It While It Lasts

Digital banks are businesses, at the end of the day. They are here to make money. But based on a report, not all digital banks are profitable. All of them are still operating at a loss and see themselves getting returns in 5 to 7 years. Of course, it’s not a guarantee. Will digital banks be successful in the future? Can they sustain the high interest rates they currently offer? No one can tell for sure. But for us, consumers, it’s our job to enjoy the benefits of their services while it lasts.

Personal Use Cases

Here are two ways I use digital banks for my family’s savings:

- For emergency.

It’s smart for every family to prepare for life’s unpredictability. One way to do this is to set aside a sum that can cover six months to one year of our living expenses. The money allocated for this purpose is called an emergency fund.

I used this allocation to fix my car when it broke down last December. Saving in a digital bank made it easier to access money for repairs.

Before the existence of digital banks, I used to place our emergency fund in the money market. It earns good interest, but would take a few days to withdraw.

- To build a nest egg.

We recently went on a one-week family vacation in Osaka. It took us two years to save up for that trip. In 2021, my wife and I committed to set aside a portion of our income to our digital account each month. The interest we earned during the entire duration covered half of our food budget in Japan. It’s something we wouldn’t accomplish had we built our travel fund in a regular savings account.

Nest egg is a term used to describe the amount of money kept for a specific purpose. It could be for investing, home repair, car, or, in our case, travel.

Final Thoughts

The benefits of keeping our family’s savings in digital banks are too good to pass up. It’s the only financial medium where you can enjoy growth and flexibility at the same time. The only concern thus far is whether they can sustain this offer long term. As for me, I’ll take advantage of the service for as long as possible.

Hi Jed,

Great blog! Could you give an example of the “Other high-yield savings account has an average interest rate of 1.5%. But to qualify, you need to make a minimum deposit and maintain a balance of at least P30,000 to P50,000.”

Thank you and more power!

Hello Kenneth!

Thanks for the comment! I found this list. Hope you’ll find it helpful:

ING Savings Account* 4.0%

GSave by CIMB Phlippines* 4.0%

Citibank Peso Bonus Saver Account 1.56%

BDO Optimum Savings Account 1.25%

Security Bank eSecure Savings Account 1.200%

BPI Family Savings Bank Advance Savings Account with Passbook 1.00%

Security Bank Premium Build Up Savings Account 1.00%

Sterling Bank of Asia Bayani OFW Savings Account 1.00%

Citibank e-Savings Account 0.75%

BPI Advance Savings account with Passbook 0.75%

Citibank Peso High Rate Saver 0.70%

Equicom ATM Savings Account 0.60%

Regards,

I’m usinh gsave but i only put very little amount bcos im worry is that what if the app is closed down how i will prove that i have savings with gsave?

Hello Dadz,

Thanks for the comment! I understand your concern.

Two things:

1. GCash is not a bank. Your money is actually transferred to CIMB when you put it in GSave.

Even when the GCash app closes down, you’re money is still accessible via CIMB’s app.

2. GCash issue receipts of your transactions via email and/or sms. You can use those receipts as proof for the amount of money you have in GCash if ever.

I hope I answered your question. 🙂

Godspeed!

Thanks for this article. I’ve been wanting to save in GSave ever since I heard about the 4% interest rate. If ING offers the same 4%, would you think that it’s safer to invest there than in GCash? I’ve been hearing faulty things with the GCash app and I’m so afraid that my money would just crumble to dust. What if I just invest directly into CIMB would that do?

Hello Bee!

Thanks for the comment!

The problem with ING is their 4% interest p.a. is only a promo, as of now. If I’m not mistaken, it will end in July.

I understand your concern, but you don’t have to worry because your money is not technically with GCash. It’s with CIMB. It means anything happened to GCash, you can still access your money via the CIMB app. 🙂

Yes, I think it’s better to save with CIMB directly if you’re not comfortable with GCash. They have another product which is exclusive to them which is UpSave — where you’ll have a free insurance coverage of up to P2M, on top of the 4% interest.

Hope this answered your question. 🙂 Please feel free to share your thoughts.

God bless!

Jed

Hi there. Amidst covid19 is the interest for gsave still 4.%?

Hi Joanne!

Thanks, because of your comment I checked the latest rates.

GSave now actually gives 4.1%, but for accounts with P100,000 maintaining balance only. Less than P100k, it gives 3.1%.

I already updated this post. Thanks again!

Stay safe and healthy!

Jed

First time here and I applaude how you explain every details and aspects about it and the updates its just awesome and will make me comeback more often. ???

Thanks Mark! See your around. 🙂

Hi. I’m quite curious of the Money Market. Where is that? Hahah sorry

Hi DJ!

Thanks for the comment. I already sent you an email. 🙂

You can put money in money market through these brokers:

1. COL Financial

2. First Metro Sec

3. BPI Trade

4. BDO Nomura

Just open an account with them and you now have access to the money market.

I personally use COL Financial.

Let me know how can I help you further. 🙂

Godspeed!

Is that Mutual Fund?

Yes it is. 🙂

hi I’m also interested to learn aboit money market, could you recommend a website that can help me understand more or guide me with the process? ty

Hi El,

I appreciate your interest to learn more. Money market is accessible via Mutual Funds. You can check this page from Col Financial: https://bit.ly/2YRqbyg

Hope this will help you. 🙂

Tama po ba na ang mutual funds would still depend on the time you enter or open an account? What’s your best reco on when to enter or what to look for before starting a Money Market fund?

Hello KMan!

Thanks for the question.

I believe in the saying, “The best time to plant a tree was 20 years ago. The next best time is today.”

I’m not really a fan of “Timing the market,” as what others call it. To me is not how you time the market, but how much time you spend in the market. This means that the longer your money stays in the market the better.

The Money Market is generally a safe investment vehicle so my suggestion is just to go with it. Park your savings there to prevent inflation from eating it. If you want a quick recommendation, my money is on ALFM Money Market Fund. 🙂

Stay safe and healthy bro,

Keep learning!

Thanks for sharing! It helps me a lot because I’m considering using the Gsave as of the moment.

Hi Love,

Glad I was able to help! 🙂

Love this article! Thank you so much! I’m 20 years old and I want to learn more about financial management. This article just convinced me to start using Gsave 🙂

Hi Tine!

Thanks for the comment. Keep it up! 😉

Hello.

I already have my Gsave and I want to use CIMB app PH. The problem was when I sign in to Upsave and during the submission, my phone number and email address were already existed and I think this is due to I have already registered my details in Gsave. Can you help me with this?

Hi Ramil,

I also had the same problem before, but it was automatically fixed by CIMB.

Have you tried calling their hotline? +632-8-924-2462. 🙂

Regards,

HI, I’m new to these account things and I am really afraid in taking risk like putting my money in these kind of things. I have Gcash but it’s really hard here in our place because the signal is faulty so I don’t want to use it. Is it possible to just put money directly to CIMB without bothering about my Gcash acc?

Hello Jill,

Thanks for the question. Yes, you can put money to your GSave account directly via CIMB app. 🙂

Excellent blog sir, Could you also post or add a guide/explanation about CIMB’s withholding tax that is required by BIR. Thank you.

Hi Alex,

Thanks for the comment. I’m not an expert on taxes but the only explanation we can get now is……it is required by law. ?

Check out these FAQ about the 20% withholding tax:

CIMB: https://bit.ly/32PTnYc

ING: https://bit.ly/32Vjv4e

If you want to dig deeper, try this link from BIR: https://www.bir.gov.ph/index.php/tax-information/withholding-tax.html

Hi , ask ko lang po how can you withdraw you gcashsaving ??

Hi Rose,

Thanks for the comment. You simply go to ‘Save Money’ inside your GCash app. There, you’ll see the ‘Withdraw’ button. 🙂

Update on 2021 interest rate?

Hello Anthonio,

Upon Checking….

GSave – 3.10%

ING – 2.5%

CIMB UpSave – 3%

Happy to serve you man.

God Bless!