My wife and I went to a fine Chinese restaurant to have an all-you-can-eat dim sum for lunch. We don’t usually eat in this type of place unless there’s a promo. But today is an exemption, because we are celebrating a milestone: we completely paid off eight credit cards!

This post shares the method we used to settle our debts. Read on if you need a simple guide on how to pay off your credit cards.

Credit card debt is dangerous

Having credit card debt is like owning a pet Hydra. A Greek mythological monster with many heads. It’s extremely venomous and spits out acids. But what made this creature dangerous is that it can regrow its head twice after it’s been cut off. Much like credit cards, it continues to grow over time when you don’t have the intention to kill it. Most of us thought we’re making progress by only paying the minimum each month.

How do you pay off a credit card?

It starts with a goal.

Our primary goal after getting married is to be debt free. We are committed to establishing a stronger foundation for our marriage. Paying off our debts will prevent financial conflicts, and enable us to pursue the important things in life. Like better relationships, health, purpose, growth, and service.

I invested my time in learning. I read numerous books, attended talks, and listened to hundreds of podcast episodes about money. If there’s one key takeaway from those materials, it’s this:

To kill a hydra (debt), you need a system.

Create a system

Two books stood out during my study:

- The Total Money Makeover by Dave Ramsey.

- The Richest Man in Babylon by George S. Clason.

They stood out for being the simplest one to follow. But simple doesn’t mean it’s easy.

“Where does my money go?” is a better question than “Where did my money go?” Money is active. It will continue to flow whether we like it or not. Understanding the behavior of our resources is the bread and butter of the system.

How the money comes in, and how it goes out. The plan is to traffic them to their respective buckets. Dave Ramsey called this zero-based budgeting. Every peso should have a purpose. Our approach, however, is a simplified version:

| Funds | Budget Allocation |

|---|---|

| Tithe | 10% |

| Savings | 10% |

| Necessities | 50% |

| Debt payments | 20% |

| Giving | 5% |

| Fun | 5% |

| TOTAL | 100% |

Here’s how the funds work

Tithe (Giving back to God)

This is a personal commitment. Our first fruits belong to God. Tithing is sacred to both me and Lalaine. In our belief, the Lord is the owner of all things. We are only His asset managers. Returning the first 10% of our income serves as our worship and thanksgiving for allowing us to use the 90%.

Savings

George Clason says “Pay yourself first.” But since tithing is our first priority, we are paying ourselves second. Most people save what’s left after spending. But the better way is to be an intentional saver. Save first, then spend what’s left after saving. By this method, we were able to achieve Dave’s baby step one, which is to build a beginner emergency fund of $1,000 or PHP 55,000.

Two functions of the savings fund:

1. Emergency.

2. Investments.

After paying off our debt, the intention is to set up at least P250,000 worth of emergency fund. This will prevent us from borrowing, and using credit cards during any unforeseen events. Once achieved, we’ll use the subsequent cash flow to build an investment fund. Cash allocated here will only be spent on subjects that have future returns. Such as business, stocks, investment funds, and real estate. But to familiarize myself early with investing, I already put in a small amount to an index fund.

Currently, I keep all our family’s savings in a digital bank to protect them from inflation.

Family necessities

The function of this fund is self-explanatory. Yet it’s the most challenging to manage since it has the biggest budget allotment. What we did to control it better is to create a sub-allocation:

| Necessities (sub-allocation) | Budget |

|---|---|

| Household | 50% |

| Children | 20% |

| Wife’s allowance (most important) | 30% |

For special events such as anniversary and birthdays, the trick is to plan ahead. We determine the budget and save up by slicing a portion of the sub-allocated fund each month.

Debt payment

If I had a choice, I would spend every peso possible to speed up the process of killing our hydra. But I have a family to take care of. Patience in this area is something I have to cultivate. George’s proposal of 20% allotment works for us thus far.

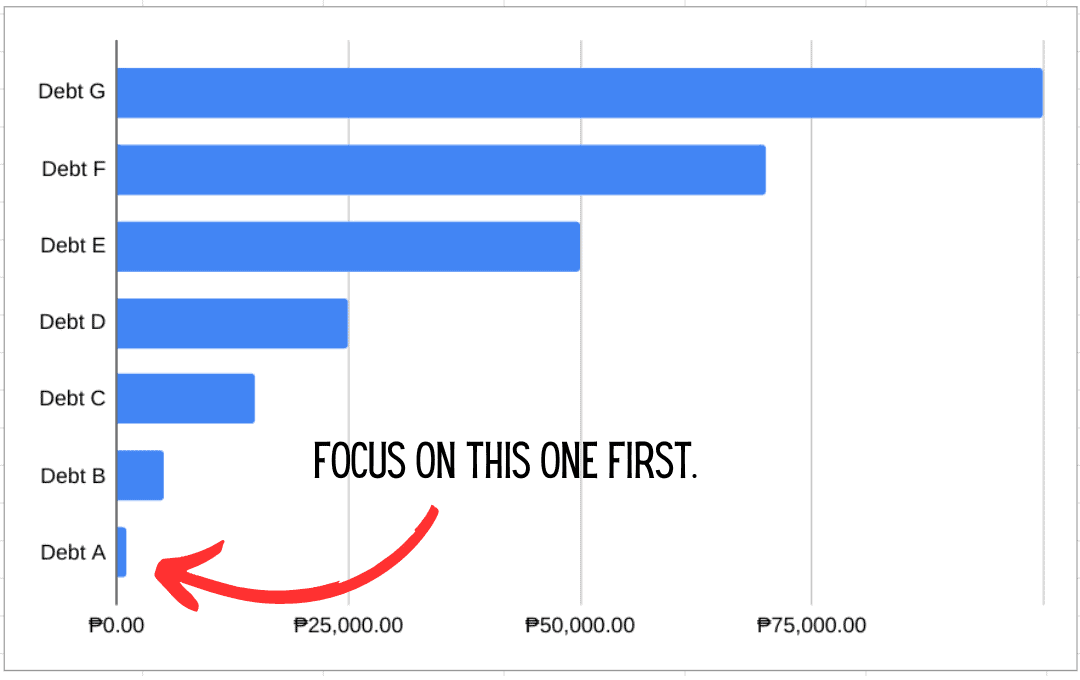

After allocating the budget, we use Dave’s debt-snowball method to attack the monster. First, we organize our debts from least to greatest. Then focus all our efforts on paying off the smallest one and move on to the next item after we settle a debt.

Charity

We use the charity fund to contribute. It is where we pull money for gifts and donations. With purposeful apportionment, it is easier to give whenever opportunity knocks. Of course, it is impossible to help everyone. We focus only on the causes we care about. We’re most active with children, the sick, and mission-related activities. Once debt free, our plan is to increase the giving budget to 10%.

Fun

Financial management is tough. It’s repetitive and boring. Fun may sound unproductive, or unnecessary. But on the contrary, fun is essential to the success of the system. This is where we get our reward for sticking with the plan.

I got the idea from another author, T. Harv Eker, Secrets of the Millionaire Mind. We use this budget to celebrate small victories and reinforce our habits toward the goal. My favorite feature of this fund is guilt-free spending. (Like eating french fries with no calories!) Lalaine and I find our movie dates and relaxation at spas a million times more enjoyable. It is because we never have to worry about overspending.

Several months back we decided to use only half of the budget and keep the other half for bigger buys. Last month we bought each other mobile phones without the aid of credit cards. Paid in full. Guilt-free buy!

Confession: this is my first mobile phone purchase without using a credit card.

Closing Thoughts

We’re in this hole because of my selfish ambition, arrogance, and foolishness. Yet God used it for good. He taught us to become better with money through this uncomfortable situation. We learned to live within our means and depend on His provision (which is never lacking).

I wish I could tell you that the system is the only weapon you need to kill a hydra. But there’s a stronger weapon. It might be even the strongest weapon of all against debt. Are you ready for this?

It’s your DECISION.

How do you pay off a credit card? You have to commit. Not even the perfect financial system would work until you genuinely decide to live a debt-free life.

Hello to every , because I am actually eager of reading this website’s post to be updated regularly. It consists of good data.

Hello!

Thanks for the comment. Will do my best to post more regularly. ?