Effective money management is vital for a family to thrive. Yet, only 35% of adult males are financially literate worldwide. This indicates that the majority of fathers today lack the necessary skills to provide economic leadership for their families.

This post will show you seven crucial reasons why dads should pursue financial literacy.

Summary

Financial education isn’t taught in schools. Dads must take the responsibility to learn about money through books and other means. Being financially literate will enable fathers to raise financially responsible kids and build an economically stable household.

Financial Education Is Not Taught In School.

If there’s one big idea to take away from this post, it’s this: schools do not teach about money. I hope this reason alone will spur you to learn about personal finance as a father. Schools not teaching financial literacy means our children won’t learn how to properly handle money unless we teach them to. Sure, they may learn it from someone else. But with such noise and conflicting views on this topic, how sure are we that they are learning the right way?

Three reasons why schools don’t teach financial education:

- There are not enough qualified instructors. Only one in five teachers feel qualified to lead a personal finance class.

- The concepts of personal finance are not standardized. If concepts are not tested, it can’t be taught.

- Lacks clarity. There is no governing body to mandate personal finance classes. Each state has its own ideas on how to go about it. As a result, there’s no clear agreement on what kind of method works.

Kids Emulate Their Parents.

Based on a study, parents who are financially responsible are more likely to have kids who:

- Discuss financial matters with them. (83% vs 66%)

- Exercises patience and delayed gratification. (52% vs 40%)

- Are honest about their spending habits. (43% vs 34%)

The keyword here is “parents”. Both mom and dad should exemplify financial responsibility to their children. We have already learned that only 35% of adult males around the world are financially literate. What about women? Well, they are even behind us by 5%. Only 30% of adult females worldwide are familiar with finance.

As heads of the family, we must ensure our wives are also capable of managing our finances effectively. When both parents demonstrate proper financial discipline, children are more likely to follow.

Create A Positive Financial Legacy.

The Bible says that, “a good man leaves an inheritance to his children’s children.” While inheritance involves more than just money and possessions, most parents choose to pass down riches to their children. I’m sure they are handing them over with good intentions and love. Unfortunately, inherited fortune often does more harm than good when handed to financially incompetent descendants.

The truth is, passed down wealth has the potential to ruin our children’s lives. The accumulation of money and possessions over time is usually accompanied by challenges that build one’s character. Those who did not earn the money will almost never appreciate how difficult it was to create wealth. We will only produce entitled heirs if we hand over our assets without giving them proper financial training.

It’s easy to pass down the wealth. Passing down the character is a different story. Let’s train our children to be capable of inheritance.

Protect Your Family From Scams And Fraudulent Schemes.

There are scammers out there who are always ready to pounce on the ignorant. Financial literacy is a weapon against those predators. Here’s an example. Did you know that you are already making great money if you earn 15% from your investments per year? With this knowledge, you’ll be more cautious when someone tells you that he’ll make your money earn more than this amount. Ignore, especially those who say they can double or triple your capital in three months. There’s no such thing.

Another red flag to watch out for is the word “guarantee“. The truth is, there are no guarantees in the financial world. We all play by the risks we can tolerate: high risks give high returns; low risks give low returns. If someone promises you a low risk with a high return investment, then it’s a potential scam. On the other end, I’m sure nobody wants to venture into anything high risk with low return.

Here’s a quick overview of risk tolerance:

- High-risk, high-return = Aggressive investor.

- Low-risk, low-return = Conservative investor.

- Low-risk, high-return = Scammed investor.

- High-risk, low-return = Foolish investor.

The more we pursue financial literacy, the better we protect our family from scammers.

Promotes Peace In The Family.

It’s not a mystery that most trouble families are facing almost always involves money. In fact, financial conflicts are one of the leading causes of divorce. Now, I’m not downplaying the complexities of this matter. But the usual culprit for this issue is the couple’s contrasting view about money.

Learning how to budget as a family will foster teamwork and unity. It enables us to be more accountable to one another, especially when making financial decisions. Where do we eat? Can we buy this one? When’s our next trip? Is it possible to help a friend in need? Most of our day-to-day questions about money can be answered objectively when we have a budget. It will no longer be who has the final say, but whether your budget allows it or not.

As you embark on studying financial education, you will discover that there are different budgeting strategies available today. There’s the 50/30/20, the zero-based budgeting, envelope system, and more. Find something that will work for your family. But for me and my wife, we initially followed the zero-based budgeting and revised it along the way. It’s the system we used to pay off eight credit cards.

Learn To Shop Smarter.

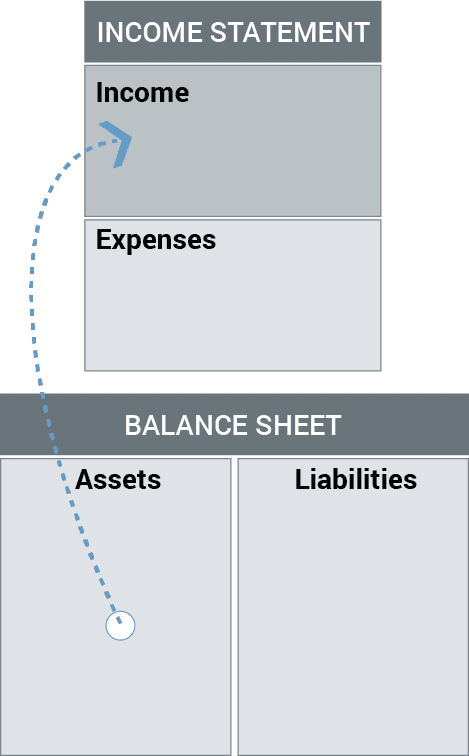

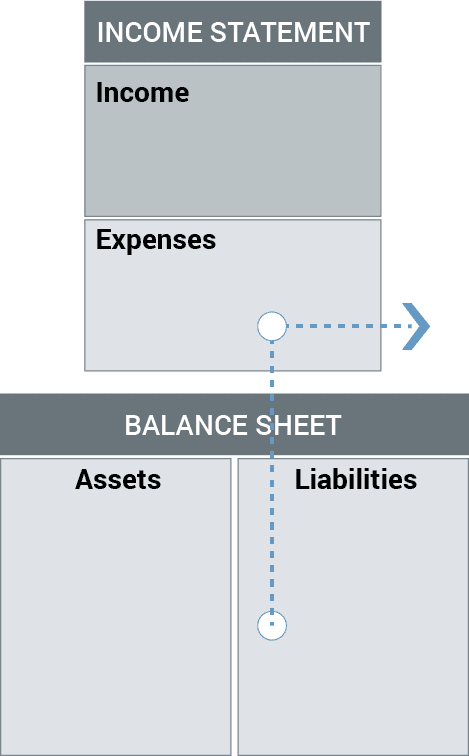

Here’s a question: if you have enough money for a property or a luxury car, which one will you buy? If you answered property, generally you are a smart consumer. Why? Because the property is an asset, while the car is a liability. Property values tend to stay the same or increase over time, whereas brand-new cars lose 15% to 20% of their value as soon as you drive them off the dealer’s lot.

The same concept applies to watches. I prefer buying expensive luxury watches that retain or increase in value over time, rather than cheaper watches that don’t. Assets are anything that has the potential to increase your cash flow, while liabilities are anything that decreases. Having the eye to differentiate between assets and liabilities is crucial to your financial health.

Let’s see another case. It’s on sale, which do you buy: a branded shirt or toothpaste? If you choose toothpaste, again, you generally are a smart shopper. Toothpaste is a need. You brush your teeth daily (unless you don’t). What you saved on needs are REAL savings. The branded shirt, in contrast, is a want. You can buy an equally comfortable shirt at a much lower price but without the logo.

Break The Cycle Of Bad Financial Habits And Concepts.

How are the majority of fathers leading their family financially today? Chances are, they simply apply what they saw and learned from their parents. I’m sorry if this may sound disrespectful, or even offensive. But it is essential for us dads to validate what we learned about money growing up. It’s crucial that we acquire financial knowledge and instill positive values in the upcoming generation.

I grew up learning that debt is a friend. My parents talk about it every day as if it’s part of our family. They often cite examples of how the tycoons started small but became who they are today because of loans. I had a positive view of debt overall, thus I always use credit when buying stuff and operating my businesses. I eventually learned things the hard way.

In June 2016, my business failed, and I was drowning in debts. I was so desperate to get out of the mess I’m in that I spent the next six months reading books and attending classes on finance. Now I know the truth that debt is something we should avoid at all costs. Our family’s concept of “debt is a friend” stops with me. What I’ll pass down instead are the habits of saving, investing, and having a simplified lifestyle.

Final Thoughts On Financial Literacy For Dads

Kids will likely never receive any financial education if their parents wouldn’t teach it to them. We play a critical role in ensuring our children have the financial skills and behaviors they need to succeed independently in society.

I’m sure there aren’t any parents who will give a car key to their child who is untrained to drive. The same idea applies to financial literacy. Why give them money when they still don’t know how to use them properly? Like cars, money has the potential to affect one’s life when mishandled.