Insurance vs investment: Which one should I give priority to?

Relax, I’m not here to sell.

You can let your guard down. I come in peace.

But why are you here? I suppose you already considered insurance but are kind of indecisive if it is the right move or not?

Now let me give you a chest bump for not diving into it right away. To pause and think about your next step is already a wise move.

Insurance is a big deal. It’s one of those buys that can make or break your financial wellness. Good job for giving it some thought first.

An email from a friend inspired me to write about this topic. I asked if I can use her predicament as my subject because I find it very relevant today.

Insurance vs investment is a struggle not only for us dads. — But to everyone who wishes to be responsible adults as well. As an ex-financial adviser, a.k.a. insurance agent, I hope to share a thing or two about this matter.

I promise I won’t sell anything. My only wish is to help you make a sound decision by the end of this essay.

An Email From A Friend

Hi Jed,

Hope you and your family are doing well. May I ask for financial advice?

Am considering buying a health plan for myself, for security reasons. I’ll pay for it for 10 years and coverage is until 100 yrs old. If I don’t get any critical illness (which I hope so), it will serve as life insurance.

At the same time, I’m considering investing in a mutual fund. This is to help me prepare for marriage and family (if it’s the Lord’s will, or for my personal goals if I stay single).

Which would you say I go first? For now, I can only manage to pay for one product. The reason is so I would still have an emergency fund on the side and maintain my liquidity for daily expenses.

And to add some more context and info, both plans would need me to set aside around P6,000 a month.

Thanks in advance!

C

Summary:

If she can set aside P6,000 a month for ten years, is it better for her to…

A. Get insurance to protect herself from life’s uncertainties?

B. Invest for a better financial future?

Insurance vs Investment: Which do you think is the better move?

You may say,

“Why not both?! Haven’t you heard of VUL insurance? It’s insurance and investment in one. Problem solved!”

Well…yeah. You are correct, such products do exist. In fact, VUL policies were the ones I pushed the most when I was still an agent.

Why?

Because it’s the easiest one to sell! — I’m not saying it’s easy to sell insurance. On the contrary, it is an extremely difficult job. But of all the products, VUL is the one I find most convenient to offer.

We are so used to call it “LIFE” insurance or “HEALTH” plan. But in reality, we do not talk about life nor health with a prospective client. What we talk about are death and illnesses. While these are important topics, is there really anyone who likes to talk about them? How do you even start the conversation if you are in our position?

This is where the “investment” part comes in. Everyone loves growth and progress. It’s far easier to approach a client with themes like saving and investing than those morbid kinds of stuff. This is the reason why VUL insurance is usually the go-to product.

Okay, so what’s my point?

I hope my colleagues won’t unfriend me for this. But here’s the point:

If you take a closer look, VUL’s investment side is more of a marketing front than a real service or benefit.

What?!

Let’s see the numbers below to give clarity.

The Truth About VUL Insurance

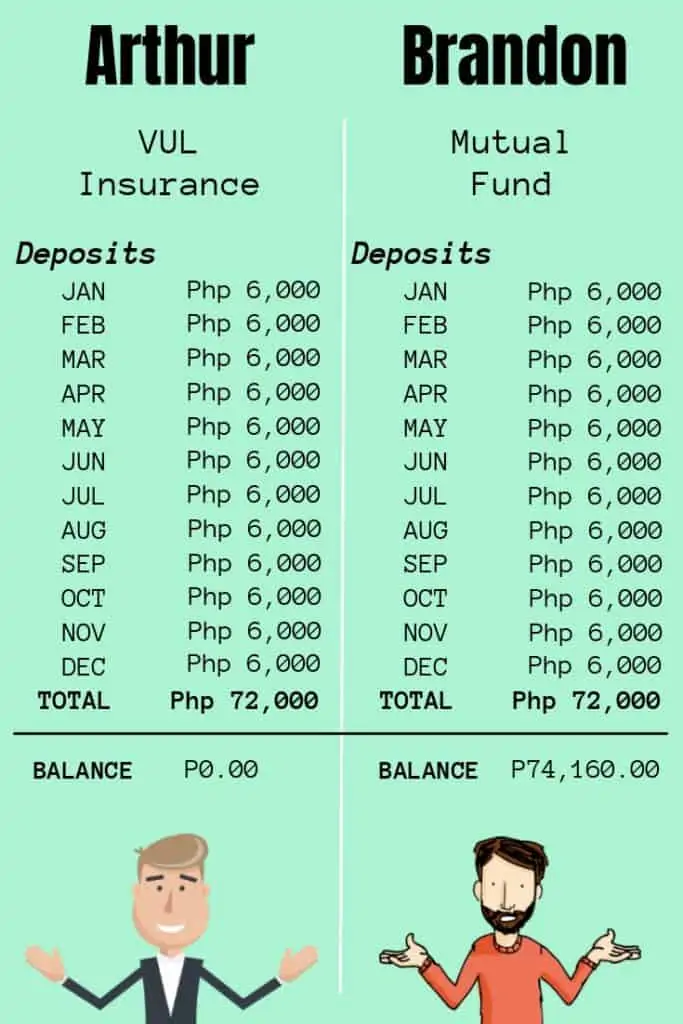

Check the image above. Here are two daddies who have the same budget but used their money differently.

Daddy A whom we’ll call Arthur got himself a VUL insurance. While Daddy B, Brandon, chose to put his money in a Mutual Fund.

Notice they both made a total deposit of P72,000 in 12 months. But how come Daddy Arthur has a ZERO balance in his account, while Daddy Brandon has P74,160.00 in its first year?

What do you think happened?

Here’s the simple explanation:

Please note the figures here are for illustration only. Actual fees and computation will vary from plan to plan, and company to company.

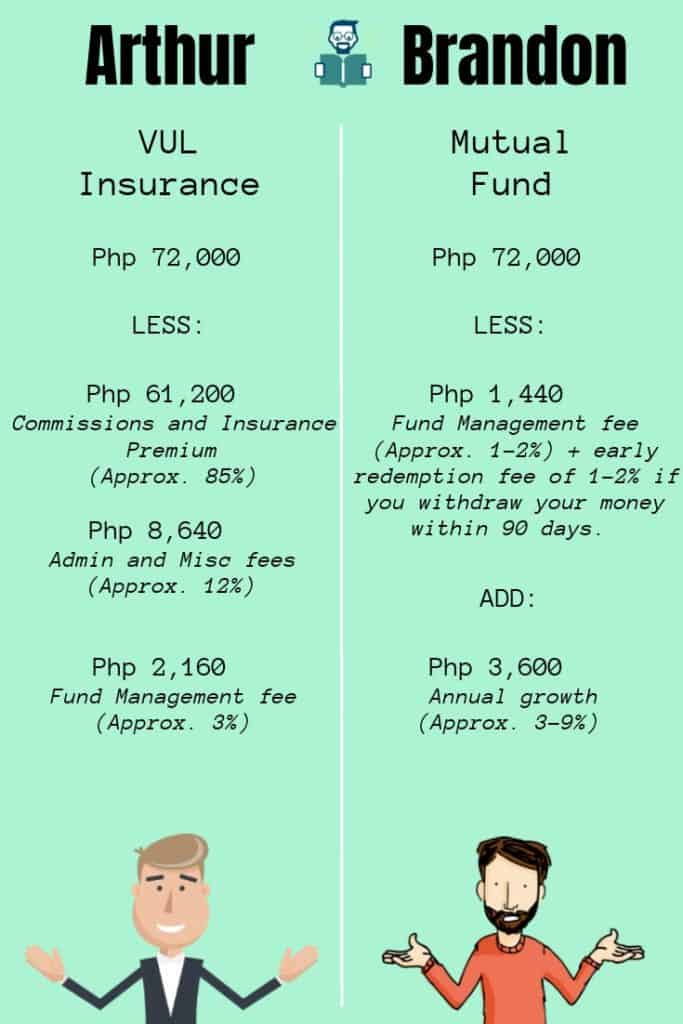

As you can see, the VUL insurance consumed Arthur’s deposits for the entire year.

85% of his deposits in year one goes to the insurance premium and agent’s commission. 12% to the admin and miscellaneous expenses. And only 3% for the investment management fee.

See the allocation? We front it as “investing,” yet it is the smallest part of the plan. Even we, financial consultants, do not earn from consultations. We make money from the insurances we have sold.

No matter how they dress their products as “investments,” at the end of the day, insurance is insurance.

Mutual funds, on the flip side, only took a minimal fee from Brandon’s deposits. This is the reason why his money has not only remained intact but has already grown in the first year.

I hope you now understand why I can’t simply tell my friend to get VUL insurance to resolve her dilemma. Money in VUL grows a lot lower and slower compared to “real” investments.

Does this mean we shouldn’t get VUL insurances because it’s only a marketing gimmick?

I’m sorry, but it’s not the message I wish to convey. VUL insurances can be great when you have the money and the knowledge.

Yes, daddy Arthur has zero balance this year. But if any unforeseen happens to him, the insurance company has got him covered.

We’ll look at several of the benefits of insurance and how we can use them the right way later in this essay. But for now, all I’m saying is VUL is not your easy solution when you’re torn between insurance vs investment. It is best to see them as separate tools for your financial needs.

PROS AND CONS

Now that we see insurance and investment on a separate team, let’s weigh a few of their pros and cons.

INSURANCE’S PROS:

- Plug and play

Let’s say daddy Arthur has a one million peso coverage in his P6,000 a month plan. If an insurable event happens to him now, his dependents can already request the benefit. Yes, they are eligible for the one million pesos even if Arthur has only paid P6,000 to his account. That’s a 16,667% return in one month!

If the same thing happened to daddy Brandon, he can only use what is available in his mutual fund for treatment. In case of death, his investments will turn into an estate. Consequently, his accounts will stay “frozen” until the family pays 6% estate tax.

The estate tax is a topic for another day. But if you wish to learn ahead, you can check out this post: What Happens to Your Investments When You Die?

- Guaranteed return

Daddy Arthur is in a ten-year plan. This means he has to pay P6,000 monthly for a decade to maintain his one million peso coverage for life. In ten years his total deposits would be P720,000.

If we are to put it in a nutshell, Arthur will pay P720,000 to get a return of P1 Million in ten years. That’s a guaranteed return of 39% in cash or paid services.

Unlike in insurance, the word “guarantee” does not exist in investing. Brandon can only hope his investments will one day grow.

Yet, of course, insurance’s guaranteed return comes with a catch. Arthur must first encounter the following to get his “return,”

- Death

- Disability due to an accident

- Critical illness

- Reach 100 years old

INSURANCE’S CONS:

- Flexibility

Insurances are not transferable. Arthur cannot use his one million peso coverage to aid his family in case they got sick or injured. He may withdraw his deposits (if it’s already available) but it may mean forfeiture of his policy.

- Difficult to maintain

Insurance is expensive. Arthur may get the lower tier insurances but it won’t protect him as much. He is better off with the higher ones which gives better protection or get nothing at all.

He who got himself decent insurance must prepare for the long grind.

A study by Wharton revealed:

“25% of permanent insurance policyholders lapse within just three years of first purchase. Within 10 years, 40% have lapsed.”

This is naturally due to economic reasons. People get into insurance without understanding its financial implications.

Want more numbers? 88% of universal life policies do not end with a death benefits claim.

What does this mean? It means out of 100 people who got into life insurance, only 12 would finish with claimed benefits.

You might say, “but these stats only apply overseas.”

It’s why I conducted a quick survey of my own:

Me – 1/1

Wife – 1/1

Parents – 2/2

Siblings – 2/2

Clients – 4/5

Total lapsed insurances in my circle = 10 out of 11 policies. (90.9%)

I don’t know, this figure might be unique within my area. — But it sure looks kinda identical to what the study has shown. Perhaps it’s best to do this exercise in your circle as well.

SIDE NOTE: BASIC TERM INSURANCE

Some people get basic term insurances rather than whole life to avoid this con.

Basic term insurance is a low-cost insurance with a fixed timeline. This is a good option if you only want to be covered for a specific period and not over commit to a plan.

The downside I see with this choice is you will be like in a betting game with your insurer each year.

You: I bet six thousand pesos that something will happen to me this year.

Insurer: I bet one million nothing will happen.

And more often than not, the insurer wins.

- Technicalities

In case you are not aware, insurers have the right to reject claims due to technicalities.

Here are the 4 most common reasons why insurers will deny (or delay) daddy Arthur’s insurance claim:

- His death happened during the first two years the policy was enforced. — This is also known as the contestability period.

- His type of death (or illness) wasn’t covered in the policy.

- He failed to disclose relevant personal information.

- He failed to keep up with policy premiums.

Be sure to read, ask, and be transparent when you apply for insurance. Lest you pay for nothing in the end.

INVESTMENT’S PROS:

- Liquid

Daddy Brandon’s money is always ready for action. He can withdraw them anytime from his mutual fund. This allows him to seize better investment opportunities, or even help a relative in need.

- Better potential

Investments can lead to a better career path. As an investor, Brandon may only earn 7% from his mutual fund this year. But in five to ten years, he will most likely have the money to start a business, or even buy a small real estate for rent.

What more in twenty? He sure has the potential to invest on a bigger scale when the time comes. That’s the power of compound interest!

With regards to daddy Arthur, in ten years he might just have paid off his insurance premiums. He is now covered for one million pesos but that’s about it.

- Move at your own pace

It’s best to invest regularly. But if you can’t, there won’t be any dire consequences. Brandon doesn’t need to worry about lapses nor penalties when economic difficulty strikes. His money in the mutual fund will continue to grow even if he missed his deposits. He can be at peace and responsibly invest at his own comfortable pace.

INVESTMENT CONS:

- Learning curve

One of the biggest investments an investor has to make is in learning. Daddy Brandon must give time and money to read books, attend seminars and find a mentor.

As for Arthur, he can simply entrust his money to his agent and let the insurance company take care of the rest.

- Slow

Compound interest is powerful but slow. It would take five, ten, or even twenty years before we can enjoy the harvest.

- “Risky”

Most people do not invest because they are afraid of the risks. But the truth is, it’s riskier not to invest due to inflation.

Yes, failure and losses are part of the journey. Yet, the more we fail, the more we learn.

We will certainly make foolish decisions on the way before we become wise investors.

Read Why It’s Smart To Save With GCash Today to learn about inflation.

INSURANCE VS INVESTMENT: Practical Application

Did the comparison help you? Or did it only make the decision more difficult?

If you still can’t decide, may I share some words to live by with you?

It’s found in Matthew 6:34 ESV.

It says:

“Therefore do not be anxious about tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble..”

I will also tell to you what I told my friend, “I encourage you not to decide based on what might happen in the future. Instead, make decisions to take care of what God has given you today.”

Here are a few examples to clarify what I meant.

INSURANCE

Why do you need it?

- If you are a parent, then you may consider insurance for your children’s sake.

It’s our responsibility as parents to provide for them. Our absence or disability will surely affect their future. The insurance benefit will serve as a buffer to supply their needs while they adjust to life without us.

- Also consider insurance if you work in high-risk jobs. (e.g. machine operator, driver, courier, construction worker, etc.)

Side note: The irony is you may be uninsurable if your work is too risky. Here are 6 High-Risk Jobs That Could Make You Uninsurable.

- It may be a good idea for certain professionals to get insured as well. (e.g. Surgeons, architects, dentists, and such.) This is because their livelihood is too dependent on a specific body part: Their hands.

Consider insurance as a saving point. It preserves your progress.

How would you feel when your computer crashes and you failed to save your 249 paged thesis?

Now imagine you got your hands disabled after spending a decade in medical school.

Insurance will help you restore the lost income from those unfortunate incidents. It can either help you with the treatments or give you a boost to start a new career.

HEALTH PLAN

Do you consider yourself as high-risk for certain diseases?

Are there any illnesses that run in your family?

Does your work put your health at risk?

If your answer is yes, it is worth it to get a plan. Otherwise, you can put your money elsewhere.

I hope I made my point clear. Not everyone needs insurance. Consider it only if there’s too much risk you need to manage.

I know people who insure their kids. Nothing wrong, but the question is Why?

- Are they high-risk?

- Will there be lost income in case they pass?

It’s always smart to ask these questions before you jump in.

INVESTMENT

Now while I encourage everyone to invest, there are certain prerequisites to qualify. Like, do you have adequate cash for day to day life? How about an emergency fund?

As mentioned earlier, investing takes a looong time. Be sure you have enough so you won’t have to invest in and out of the market.

Simply put, invest only if you have more than enough to sustain daily life.

The same goes for insurance. Don’t buy if you have trouble making ends meet.

Insurance vs Investment: CLOSING THOUGHTS

So what’s the final answer? Is it insurance or investment?

If you are still undecided, you know what? That’s fine.

Take it slow. Pray about it.

Yes, it’s prudent to think about these things. But the reality? Life will happen no matter how prepared or unprepared we are.

Insurance, health plan, investments? They can only do so much.

In the end, it is God who ultimately holds our life.

So don’t sweat about insurance or investment too much. Just get them when able. What’s best is to be faithful and make the best decisions with what you have today.

INSURANCE VS INVESTMENT: SUMMARY

Let’s summarize:

- It’s ideal to see insurance and investment as separate financial tools.

- Insurance saves your progress.

- Get insurance to manage risky areas of your life.

- Investment promotes growth and progress.

- Invest when you have more than enough to sustain daily life.

- Make decisions based on facts, not on the what-ifs.

If you decide to go with insurance, my tip is to look for an agent who is established and easy to keep in touch with. These professionals come and go. You would want someone who can be there with you for the long haul.

Side note: I would generally discourage a person to get insurance from a relative. This will prevent toxicity in the family.

If you wish to go with investments, I made a very short guide to help you get started. Simply sign-up and get the free e-book below.

In case you are curious about my friend’s decision, here it is:

The Decision

Hi Jed!

Found the comparative summary you’ve laid down very helpful! As in! ? Clear and simple. I’ve gained more clarity now by weighing the pros and cons.

That said, I think I’d go for the more flexible route which is an investment. My parents also agreed when I bounced off these thoughts with them.

We like the idea that investments have a better potential for growth in the long run.

Thank you for these insights that you’ve shared with me. With all sincerity, it has been refreshing. This is because you’ve incorporated the spiritual aspects as well.

I’ve realized I unconsciously became too anxious about the future. I mean it’s wise to plan and prepare ahead. But somehow, I realized that I may be trying to “predict” all scenarios instead of trusting God for my future.

So really, thank you for re-aligning my perspective! That will make me worry less! ?

C

Thanks for reading!

What do you think about this post? Did you find this insurance vs investment essay helpful?

Please give your feedback by commenting or rating below. This will let me know which topics to write more about in the future.

Until next time,

Let’s keep learning!

P.S. ~ Be sure to check out my compilation of excellent financial management ebooks. These are the books that helped me and my family get back on track financially. You don’t want to miss these gems.