What are assets and liabilities? Are they important in financial management?

2016 is the year when I finally realized how messed up I am, financially. I ignored all the symptoms for years, then one day, BOOM!

I found myself in Php 3.7 Million debt with zero cash on hand.

To make matters worse, it was also the same year I got married. I felt terrible to start our new life with such distress.

Plus and Minus

Assets and liabilities management is a special topic for me. Our finances began to turn around when I finally grasp what they mean.

I was at our dining table lamenting about my idiocy when I got myself a pen and paper.

I folded the sheet in half, then drew a “+” on the left and a “-” on the right. Under the plus sign, I listed how our money comes in, and under minus, how it goes out.

Here’s what it looked like after I finished:

+

- Merchandise

–

- Rent

- Utilities

- Wages

- Borrowed funds

- Credit card debts

- Mobile postpaid plan

- Car fuel and maintenance

- Charity

- NBA League Pass

“No wonder I am where I am right now,” I told myself.

I have nine items on the minus side and had only one on the plus side.

Later I found out what I listed were my assets and liabilities.

Assets and Liabilities

I’m pretty sure we already heard these financial terms somewhere before. Yet most of us would pay no attention.

I dived into the athletic wear business in 2012 and assumed hard work will do all the magic. As I look back, I wish there was someone who took the initiative to teach me finance. It could’ve saved me from the disaster.

Maybe it’s the reason why I’m compelled to write about assets and liabilities today. I aspire to be the “someone” to somebody.

Assets and Liabilities Management in its simplest form

There are two types of readers. One who reads everything from top to bottom, and one who browse for the big idea.

If you’re part of the latter, here’s the big idea:

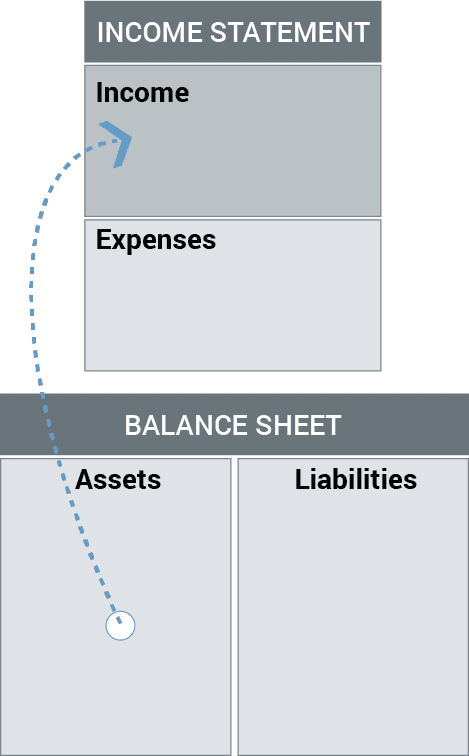

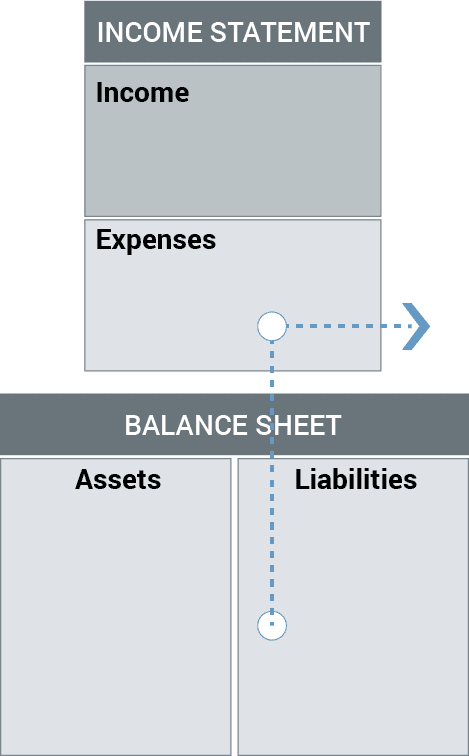

Assets are anything that puts money in your pocket.

Liabilities are anything that takes out.

Assets are the “+” and Liabilities are the “-“.

This is the simplest way to explain what they are. It’s one of the great things I learned from the book: Rich Dad Poor Dad.

In essence, the big goal is to cut liabilities and build assets.

Examples of Assets and Liabilities

There’s something I wish to clarify before we move on to the examples. The context of this essay may differ a bit from the accounting world.

I intend to cut the fat and serve only lean meat to make the subject easy to understand and apply. I suggest you hire licensed accountants if you wish to make formal reports.

Now it’s out of the way, let’s move on.

There are several types of assets and liabilities. We’ll only focus on the two essentials: Tangible and Intangible. But I’d rather call them Hard and Soft.

Hard Assets and Liabilities

Hard assets and liabilities exist in physical form. — You can touch, see, or feel them. Moreover, their value is easy to measure.

Hard Assets:

- Real estate

- Stocks

- Business

- Precious metal/stone

- Currencies

Hard Liabilities:

- High-interest debt

- Wages

- Car maintenance

- Subscription services

- Taxes

Soft Assets and Liabilities

Soft assets and liabilities, in contrast, have no physical form. They are difficult to measure yet, they are as important.

Soft Assets:

- Brand

- Patent

- Reputation

- Healthy relationships

- Skills

- Financial education

Soft Liabilities:

- Broken or negative relationships

- Poor health due to lifestyle (poor nutrition, lack of sleep, lack of exercise, etc.)

- Toxic beliefs

- Distractions

- Illiteracy

Assets and Liabilities Management: HOW TO DEAL WITH LIABILITIES

Eliminate

The journey to un-broke ourselves began with a lone hard asset against a gang of liabilities. It’s not a beautiful scene, but it could’ve been worse.

I initiated a plot to assassinate liabilities one by one to protect my sole asset.

I drew first blood when I got rid of the brick and mortar store and focused our efforts online. It was not an easy decision but I had no regrets. The shot I made crossed out RENT and UTILITIES from our list which takes up 50% of monthly expenses.

Next, we transferred all the stocks from the warehouse to our home basement. This saved us time and CAR FUEL from going back and forth the office.

Furthermore, it also removed WAGES from the list. Lalaine and I can now manage the business ourselves at home. Another tough call, but we had no choice but to let our employees go.

Negotiate

For liabilities we couldn’t cut such as BORROWED FUNDS, the only option was to negotiate.

One by one I met with all our creditors. I gathered all the courage I can to disclose our situation and capacity to pay.

I told them I couldn’t promise when we can pay them, but I swore we will pay them in full. As expected, no one was happy about it. Yet they eventually agreed on whatever amount we can pay each month.

Optimize

Aside from elimination and negotiation, we also used optimization to deal with liabilities.

My wife and I always look for ways to simplify our lifestyle. We have learned to live within our means.

I unsubscribed to NBA LEAGUE PASS and lowered our MOBILE POSTPAID PLANS. Moreover, I switched our CHARITY donation from auto-debit to manual. — We now only give as budget allows.

We also made a list of things we won’t spend money on unless badly needed, or on special occasions only. This includes junk foods, sugary drinks, and parking fees.

Little changes like these can go a long way. After all, it is these small efforts that ultimately helped us kill-off eight CREDIT CARD DEBTS.

From nine liabilities in 2016, we reduced it to only four by the end of 2017.

RentUtilitiesWages- Borrowed funds (Pay only the amount we can each month)

Credit card debts- Mobile postpaid plan (Changed to a lower plan)

- Car fuel and maintenance

- Charity (As budget allows)

NBA League Pass

But 2017 was also the year I became a dad, so we added a new liability:

- Child care

ASSETS AND LIABILITIES MANAGEMENT: HOW TO BUILD ASSETS

Learn

After we gain control of our liabilities, it’s time to work on the assets.

November 30, 2016, was a special day. We earned our first Php 30,000 in a bazaar since we got broke ten months ago.

Tears flowed down my cheeks as I thanked God for the new beginning.

I spent part of the money on education and skill development. I saturated myself on the topics of finance, investing, sales, and digital marketing.

The money we earned couldn’t afford any major hard assets yet, it’s why I focused on soft assets first. But as I look back, even if it could, I’d still give learning the priority.

The rule of thumb is to never get into anything we don’t understand.

Sell

Cash is the building block of hard assets. I took inventory of my possessions and turned everything possible to cash.

I sold my MacBooks, basketball shoes, golf clubs, and a lot more online.

Later I explored my circle to promote products and services of friends and family. Now I steadily earn Real Estate and Transportation Service commissions from them.

Save

Any amount I earn will go into two separate accounts: Savings and For Spending.

I used the 80/20 principle as a beginner. The first 20% of proceeds go to Savings, then the rest goes to For Spending.

I spend 80% on necessities and debts payment. While 20% is for emergencies and asset building. It might sound simple, but it ain’t easy. I struggled a lot with this discipline before I got the hang of it.

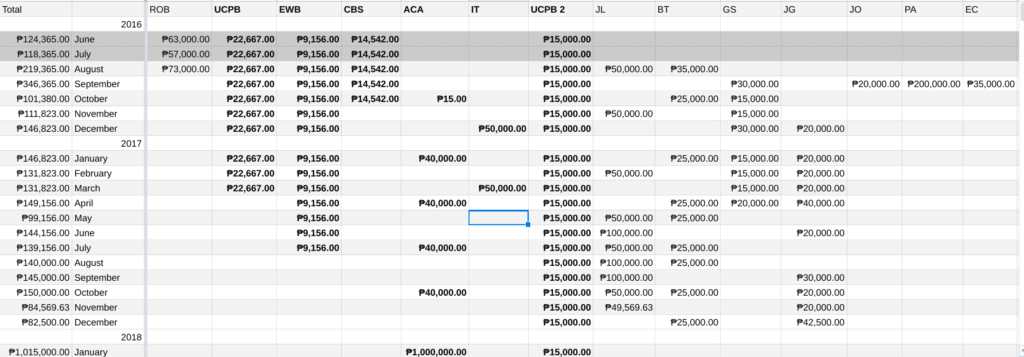

Today, my money allocation got a bit more complex than what it used to be.

Buy Assets

This is the most exciting part of the journey.

But before we continue, let’s hold our horses for a bit. I’d like to reiterate the rule of thumb: Never get into anything we don’t understand.

Be sure to study hard. There will be a certain amount of risks involved as we build our assets. It means there’s a possibility we’ll lose money. So let’s please do our due diligence before we buy any kind of assets.

Furthermore, I insist we build a strong buffer for protection. It’s called an emergency fund. It’s an amount saved to keep our household operational in case we screw up.

Once we got our emergency fund in place we can start to exercise our investing muscle.

Based on my study, Mutual Fund is the best place for me to start. Philequity PSE Index Fund is the first hard asset I bought. From there it led me to ALFM Money Market Fund and Philequity Peso Bond Fund. These assets on average have the potential to make my money earn 7% to 15% a year.

As I gain experience, little by little I experimented on other ways to invest. I bought assets with higher risks for hopes of bigger returns.

The first half of my high-risk fund went to a Friend’s Business which can make 24% a year. While the other half goes to my Buy and Sell gig. If I bought the right products, at the right price, it could make a return of 240% a year.

BONUS: Park Cash in High-Interest Savings Accounts

When we buy assets, we basically make money to make more money. Every peso should be at work. Unfortunately, not all our cash is meant to buy assets. Some funds are destined to sleep in the bank until needed. The best example of this is the Emergency Fund.

Yet we can still use our parked cash to earn some acceptable interests.

I closed a couple of bank accounts and moved the funds to a high-interest savings account. Some examples of such accounts are GCash’s GSave, CIMB’s UpSave, and ING.

There, my emergency fund and other parked cash can enjoy a 4% return per year. It is far cry compared to 0.25% from BDO, BPI, and other local banks.

It may not be much, but even tiny drops of water can fill a bucket in the long run

A Php 50,000 parked money can earn around Php 166 a month in CIMB, versus Php 10 in BDO. It’s like one bank buys you a venti of Caffe Americano a month, while the other serves a sachet of instant coffee.

We started with one asset in 2016 and built a team of nine by the end of 2018. Scratch that. Make it ten. I almost forgot my wife’s jewelry business.

- Merchandise

- Real estate (Commission)

- Transportation service (Commission)

- Index fund

- Money market fund

- Bond fund

- Friend’s business

- Buy and sell fund

- High-interest savings account

- Jewelry business

The Fruit Of Assets and Liabilities Management

Late 2019 to early 2020 was another uncomfortable season for us financially. We moved out of our parent’s house to welcome our second baby. I struggled to leave and cleave because I know our finances will take a hit. We braced ourselves to new liabilities such as Groceries, Rent, Utilities, and Child Care – Part 2.

Moreover, the granddaddy of our assets has expired. We gave what’s left of the Merchandise to charity and retired the business completely.

Add to it the devastation of the economy due to COVID-19. Most of our assets are either paralyzed or has lost its value.

Yet despite all that, we’re okay. More than okay actually. We’re still better off than four years ago.

The Php 3.7 Million debt is now down to Php 580,000. The seed money of Php 30,000 has grown to roughly Php 600,000 in assets. On paper, we are already debt-free!

To top it off, we have even saved enough emergency fund to weather the crisis today. God is so good!

To be honest, I’m kind of uncomfortable to put our financials out in the open. But it’s a small sacrifice for the greater good.

At the end of the day, all I want to attest to is this:

It’s not about what we HAVE. It’s what we DO with what we have.

One who is faithful in a very little is also faithful in much, and one who is dishonest in a very little is also dishonest in much.

Luke 16:10 ESV

Closing Thoughts

What are Assets and Liabilities? And why are they important?

I hope this essay has answered those questions by now.

You may be on your way to where I am four years ago. All I can say is, TURN AROUND! List down your assets and liabilities. Make the necessary steps to cut the minuses and add more pluses.

And if ever you find yourself in the same scenario as I, don’t lose hope. Start learning, have faith in God, and be patient.

Financial education is essential in whatever situation you are in. It’s the only asset that will give you guaranteed returns. So please don’t withhold yourself from learning.

It will be a long boring journey but hang in there. Great things take time.

Very helpful! Took note and breaking down my assets and liabilities as of this writing. More of this please!

Thanks for the comment! Haha I like the proactivity! You can download the workbook to guide you deeper. 🙂

Thanks for reading!

I always get inspired and learn a lot from your articles. This article is especially relevant to me as I’m at a point in my life when I’m beginning to be mindful of my finances. Looking forward to more articles on investments. I really want to learn more!

Hi Chrissie!

Thanks for sharing your thoughts. I’m glad to see you here!

I appreciate the support and encouragement. This is noted. I’m also a student and will more than happy to share my notes. 😉

God bless!

Great read. Thank you for sharing your experiences. Looking out for the next article.

Hello!

Thanks for reading. See you again soon!

Great article! I’m not a dad but I found this very helpful, so thank you!

There was a speaker who talked to us about this in High School. He had 6 jars: savings, charity, shopping, misc spending, recurring liabilities, and investment. Every time he earned something he would divide it by % in those jars. He used your 80/20 rule too but divided it into specific uses. That talk truly stuck with me, and I’m still desperately trying to maintain that state of mind. Right now I want to increase my hard assets but am in want of a bigger income to do that.

Thank you this is helpful. I love these articles. I’m so glad I stumbled upon them.

Hi Bee!

Thanks for the kind words! Thanks also for sharing about the lesson you learned in High School!

Yes, we also use that jars concept. I wrote about it here: How we killed 8 credit cards. Hope you’ll find it helpful as well!

Keep it up! Just be patient. Start small and grow it little by little. 🙂

Regards,

Jed

Hello there, Jed. You wrote at the beginning about aspiring to be that “someone” to somebody, well count me as one of those “somebody”! I would like to thank you for your honesty with this article. It has helped me alot to reflect on my current situation. I just became a dad last year with no prior education and preparation financially. For that, I‘ll probably be kicking myself for the rest of my life. Now i’m trying my best to catch up for lost time. Your honest account of your financial experience in this article inspired me and gave me hope that I can do this. So for that, from one dad to the next, Thank you. Looking forward to read more of your articles.

Thanks for the warm comment brother. All glory to God.

Keep it up bro. Don’t lose hope. Just push, and you will be in a very different situation 3 to 5 years from now.

All the best!