It is not a mystery. Everyone knows there is tension between family life and work. They are both important aspects of life, and both also impact one another directly. It’s like trying to look at your left and your right at the same time. If you say yes to family, you are in a way saying no to some areas of your career; and vice-versa.

Studies have shown that family life generally has negative effects on work. Based on surveys, working parents say their careers are either being slowed down or worse, interrupted because of their responsibilities at home. Children are considered to be the biggest roadblock to career advancement.

Read on to learn how family life can impact your work. This post contains research data from trusted sources to give you an objective outlook on this matter. Overall, this article serves as informational material only. It does not, by any means, intend to give any professional advice.

5 ways family can affect work

I gathered some data, so we can have a more tangible idea about the effects of family on work. Here are the results of the study conducted by the Pew Research Center on this matter.

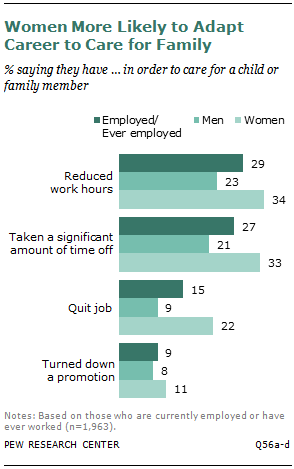

- Reduces your work hours.

In total, 29% of adults in the workforce said in a survey that they have reduced their work hours to care for their families. Based on the data, women are more likely to do this. 34% of women stated they have cut back on their working hours, while only 23% of men said the same thing.

- Make you take a significant amount of time off.

27% said they took a significant amount of time off from work, at some point in their career, in place of family. There is a similar gender gap on this matter: 33% of women, versus 21% of men, said family life has affected their work this way.

- It can cause you to quit your job.

Overall, 15% said they had to quit a job for their families. Again, men are less likely to have done this: 22% of women and 9% of men report having to quit a job for family reasons.

- It could stir you to turn down a promotion.

Approximately one-in-ten working adults (9%) say they have turned down a promotion, so they can take care of their child, or other family members. For this part, men and women almost share equally. Women, 11%. Men, 8%.

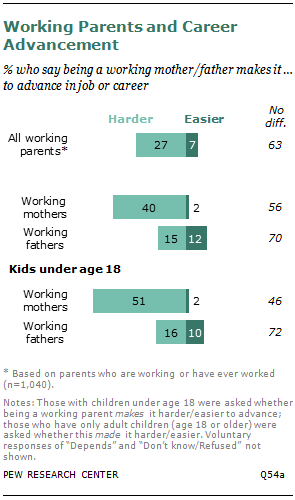

- Harder to advance in career.

Referring to the data below, 27% of parents said that family has made it harder for them to advance in their careers; while only 7% said this has made things easier. There is a significant disparity between mothers and fathers here. 40% of mothers said raising their children made it difficult for them to progress in their jobs. While only 15% of fathers said the same.

Among moms whose kids are under age 18, 51% said motherhood makes it harder for them to advance in their careers (only 16% for fathers). Yet, as a whole, mothers with grown-up children are less likely to say parenting has made it harder for them to get ahead at work.

Family issues and work-life balance

Both family and work-life require time and involvement. Since no human can be in two places at the same time, this would cause irreconcilable pressure between them — also known as work-family conflict. Here is a report by the European Agency for Safety and Health at Work about the prevalence of work-family conflict in the EU; which is also seen in the whole world:

- 27% of workers in the EU perceived they spent too much time at work;

- 28% felt they spent too little time with their families;

- 36 % felt they did not have enough time for friends and other social contacts;

- 51% believed they did not have enough time for their own hobbies and interests.

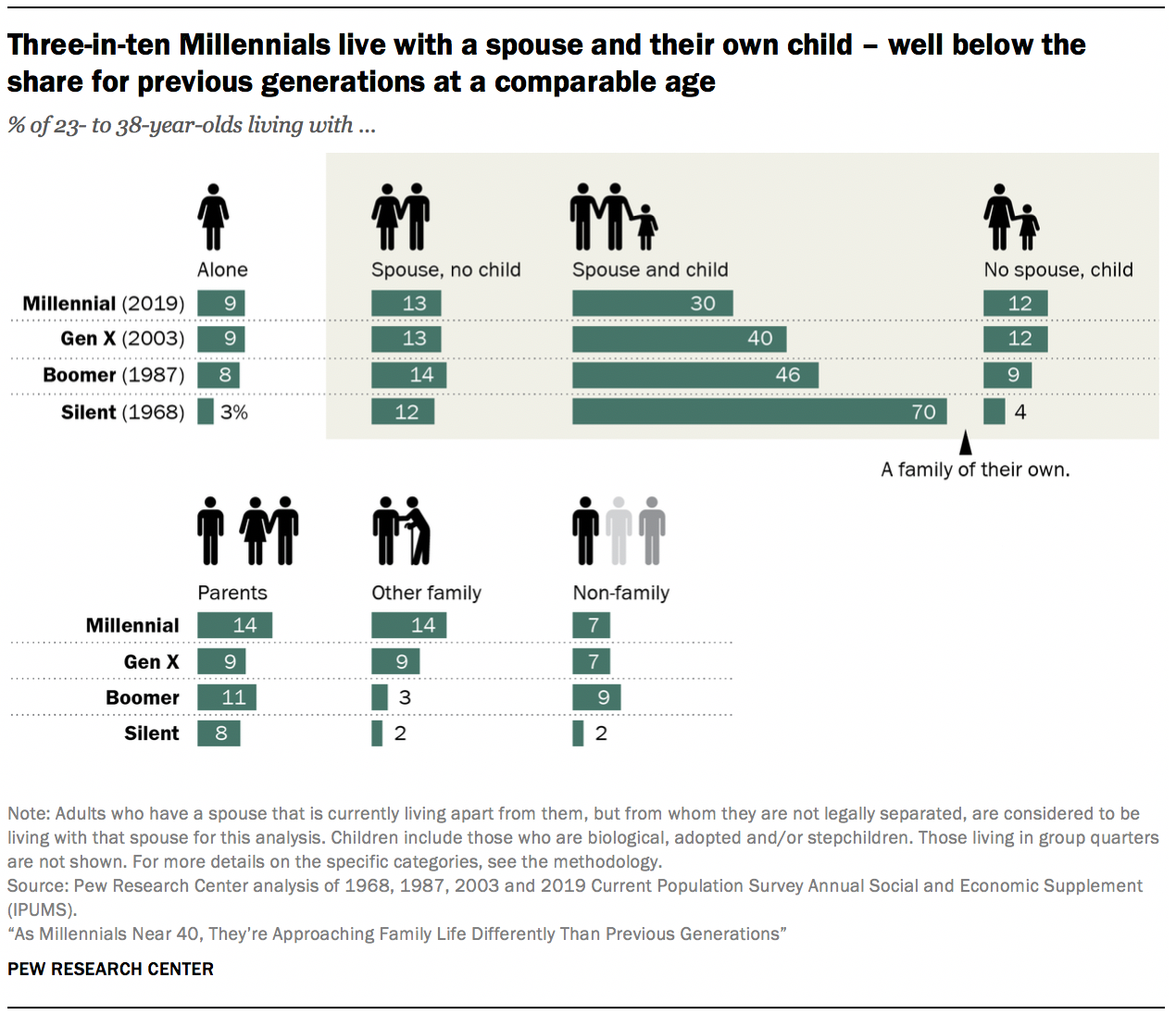

Most people try to resolve this matter through what is called work-life balance. But many have seen the inefficiency of this approach, thus they opt for a “smarter” tactic: staying unmarried, or marrying later in life. According to an article by the Pew Research Center, only 30% of Millennials have a family of their own — that is, living with a spouse and a child. This makes them the least likely to have a family before the age of 40 compared to the previous generations:

Business Insider said millennials tend to marry later because they take their time to get to know their partner, grow their assets, and give priority to becoming financially successful.

Is it ok not to marry?

It is fine to remain unmarried if that is what you desire. Many people enjoy their singleness. What is not okay, however, is when you choose not to have a family due to purely economic reasons. While many deem family life as a hindrance to their careers, study shows it actually complements wealth building.

It’s only practical for people to consider the financial aspect of their decisions, a lecturer at Bentley University says.

“The economy shapes the choices people make about whether or not to get married. During the Depression many people didn’t get married or postponed marriage because it was not financially viable and there weren’t enough men who had the money to feel like they could provide for a family.”

— Clarissa Sawyer, Teacher of Gender Psychology and Adult Development and Aging at Bentley University.

We have already seen how family life can slow down your career. But here is the plot twist. It also has the potential to boost you financially. Below is a statement by Bentley’s senior lecturer in law and taxation, Steve Weisman:

“To me, there are so many things that encourage people to marry for financial reasons… from social security to income taxes, married couples benefit economically.”

Thomas J. Stanley (1944 – 2015) spent most of his career studying millionaires. In his book, The Millionaire Mind, he presented a demographic sketch of what the rich look like. This is based on the average results he collected from surveying approximately a thousand self-made millionaires. There’s a lot, so I will only list down what applies in the context of family life:

- I am a 54-year-old male. I have been married to the same woman for 28 years. One in four of us has been with the same spouse for thirty-eight or more years.

- On average, we have 3 children.

- 92% of us are married. And of those married, 95% have children.

- Only 2% of us have never been married. About 3% are widowed.

- Most of us believe having a family complements, not competes, with the process of building wealth.

- We live in fine homes in quality neighborhoods, but only 2% of us inherited all or any part of our homes and property.

- Some of us have inherited a portion of our wealth. Nearly 8% inherited 50% or more of their net worth. In sharp contrast, 61% of us never received any inheritance, financial gifts, or income from an estate or trust.

- 97% of us are homeowners.

- 32% of us are business owners or entrepreneurs.

- Nearly 50% of our wives do not work outside the home. 16% who were employed outside the home are currently retired.

- We are not workaholics, and we spend a lot of time socializing with friends and family. When we work, we work hard. We focus our energy to maximize the return on our efforts.

- We believe having a supportive spouse is one of the top success factors.

What do you think? In essence, the premise of the survey about marriage and financial success is that you have to choose your spouse wisely. Two heads are always better than one. More than love and physical attraction, having a spouse who is frugal and has good business sense will have a healthy impact on your career.

Let me wrap this up with an excerpt from an article in the Boston Globe:

It’s not only the legal benefits of marriage — such as better tax treatment, visitation rights, and inheritance. Marriage is also a shield against poverty; the married are economically more secure (even when it comes to divorce). Then too — and of great consequence — children thrive better when raised in stable households.

— Tom Keane, Globe Columnist, July 27, 2014

Closing thoughts

There are always two sides to a coin. How can we connect the two seemingly contradicting studies about the impact of family life on work? Here is my key takeaway:

- Don’t make money the number one driving force for making life decisions.

Family life and work will always have tension. But choosing to have a family or not shouldn’t be treated entirely as a financial move. At the end of the day, whether you decide to pursue a lifelong career or settle down to a family-centered life, you will be better off picking the one that gives you meaning. As a follower of Christ, I believe God will ultimately supply our needs whichever path we choose.

See also

- How To Make Family Life Easier (Dad version)

- What Do We Learn In A Family?

- What Is A Successful Family Life?

- Is It Important To Find Purpose In Life? Let’s clear this up

- A Stay-At-Home Dad Schedule: What Do We Exactly Do All Day?

Sources

- Balancing Work and Family — Pew Research Center

- Why Millennials Refuse to Get Married – Bentley University

- As Millennials Near 40, They’re Approaching Family Life Differently Than Previous Generations — Pew Research Center

- 7 ways millennials are changing marriage, from signing prenups to staying together longer than past generations — Business Insider

- Work-Life Balance Is a Myth. Do This Instead — TIME

- Marriage Rights and Benefits — NOLO

- Millennials, reject timely marriage at your own risk — Boston Globe