If you are following this blog, you know I like to keep things simple. I am not an expert in many areas in life – which include investing – but I am a passionate learner. Learning and sharing what I learned is what I do. A few years back, I wrote a post about why it is smart to save with GCash. I explained in simple terms what it does and how it can help you protect yourself from inflation.

Today we will take a look at GCash’s investment feature called Ginvest.

As a whole, an investor earns money in GInvest through Capital Gains. It means buying shares (or units) low and selling them high via the GCash app. Your money generally will earn from dividends or interests depending on which fund you have invested.

To do this, you need to access GInvest in the GCash app and invest in the funds you are comfortable with. Those funds are managed by reputable asset management companies like ATRAM and BPI, so they are generally safe.

How GInvest work?

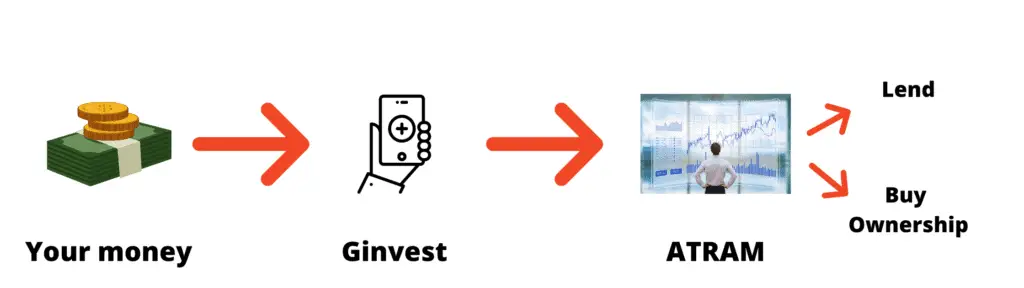

To put it simply, GInvest serves as your agent for investing in different mutual and trust funds offered by ATRAM and BPI. The reality is not everyone is eligible to invest in these funds. There are certain requirements you have to meet before you become an accredited investor. Investing via GInvest removed that barrier for you. You no longer need to go through that process since GInvest is technically investing on your behalf.

What happens to your money when you invest?

It varies on what investment product you choose. But in essence, GInvest forwards your money to the asset management company. The money is then used to lend or buy ownership (equity) from a business.

Fixed Income

When our money is used for short-term or long-term loans, it will earn interest upon return. This is mostly referred to as a fixed-income investment — because it gives regular monthly earnings. Fixed income investments are generally safe but make less profit.

Dividends

Another way to use our money is to buy stocks and become part-owners of different companies. As shareholders, we get to earn a percentage of the income known as dividends when the business performs. But at the same time, we can also suffer losses when their performance flounders. Consider equity as a high-risk, high-return investment option.

This is a quick overview of how we can earn in GInvest. But please take note, whatever we earned (or lost) in GInvest will only remain “on paper” until we sell our shares. As mentioned above, an investor only makes actual money when he sells at a higher price.

Where to invest in GInvest?

Where you invest in GInvest will depend heavily on your risk appetite and strategy.

Risk Appetite

All investing platforms, including GInvest, will require you to fill out a risk appetite assessment form before they allow you to start investing. Some call this risk tolerance form. They will ask questions that will help you evaluate whether you’re an aggressive, moderate, or conservative type of investor. This process will give you clarity on which funds are suitable for you.

- Aggressive investor: Your priority is to earn the maximum amount possible. You do not mind the risk too much.

- Moderate investor: You value growth but are also mindful about the risks involved.

- Conservative investor: It’s okay to earn little as long as you do not lose your money. Capital preservation is your main goal.

Here are the available funds in GInvest based on your risk appetite:

| Risk Appetite | Fund | Asset Manager |

|---|---|---|

| Aggressive | ALFM Global Multi-Asset Fund Inc. – PHP | BPI-IMI |

| Aggressive | Philippine Stock Index Fund (Units) | BPI-IMI |

| Aggressive | ATRAM Philippine Equity Smart Index Fund | ATRAM |

| Aggressive | ATRAM Philippine Sustainable Development And Growth Fund | ATRAM |

| Aggressive | ATRAM Global Equity Opportunity Feeder Fund | ATRAM |

| Aggressive | ATRAM Global Consumer Trends Feeder Fund | ATRAM |

| Aggressive | ATRAM Global Technology Feeder Fund | ATRAM |

| Moderate | ATRAM Global Health Care Feeder Fund | ATRAM |

| Moderate | ATRAM Global Infra Equity Feeder Fund | ATRAM |

| Moderate | ATRAM Total Return Peso Bond Fund | ATRAM |

| Conservative | ATRAM Peso Money Market Fund | ATRAM |

Strategy

You can start investing in the funds appropriate for you once you determine your risk appetite. Feed it with about 15% of your income a month for the next five to ten years, and you should be fine. But if you want to optimize the returns of your investment, you will need to apply some investment strategy. One basic strategy in investing is called diversification. It’s a practice of spreading your investment in two to three funds to minimize risk or earn better returns.

Here are some samples of a diversified asset allocation based on risk appetite:

Aggressive

| ATRAM Philippine Equity Smart Index Fund | 80% |

| ATRAM Total Return Peso Bond Fund | 20% |

| Philippine Stock Index Fund (Units) | 50% |

| ATRAM Global Technology Feeder Fund | 35% |

| ATRAM Total Return Peso Bond Fund | 15% |

Moderate

| ATRAM Philippine Equity Smart Index Fund | 50% |

| ATRAM Total Return Peso Bond Fund | 50% |

| ATRAM Global Health Care Feeder Fund | 50% |

| ATRAM Total Return Peso Bond Fund | 40% |

| ATRAM Peso Money Market Fund | 10% |

Conservative

| ATRAM Total Return Peso Bond Fund | 80% |

| Philippine Stock Index Fund (Units) | 20% |

| ATRAM Peso Money Market Fund | 70% |

| ATRAM Total Return Peso Bond Fund | 20% |

| ATRAM Global Consumer Trends Feeder Fund | 10% |

If you want to learn more about this and become a better investor, I highly recommend you take the on-demand video course below. This is the investing model I currently follow, and it has made investing become part of my lifestyle. Education will always be one of the best investments you can make for yourself.

The Lazy Investor Way is for people who want to have a more simplified approach to their investments.

What are the best investment products in GInvest?

The best investment products in GInvest are those with the lowest fees. Investing is not only about how much you earn, but also how much you keep. Mutual funds and Unit Investment Trust Fund (UITF) normally charge an annual management fee, an early redemption fee, and transaction fees. Investing in a high performing fund doesn’t matter when your profits only go to its expensive costs.

Upon checking, I couldn’t find the funds’ fees in GInvest. Looking for things isn’t one of my best skills, so I might have just missed them. Anyway, if you also couldn’t find them, I did my research and put them in a table below to help you make a better decision.

| Fund | Management Fee | Early redemption fee (holding period) | Transaction fees (approximately) |

|---|---|---|---|

| ALFM Global Multi-Asset Fund Inc. – PHP | 1% | 1% (< 180 days) | 5% |

| Philippine Stock Index Fund (Units) | 1% | 1% (< 90 days) | 3% |

| ATRAM Philippine Equity Smart Index Fund | 1.5% | None (0 days) | 0.07% |

| ATRAM Philippine Sustainable Development And Growth Fund | 1.76% | None (0 days) | 0% |

| ATRAM Global Equity Opportunity Feeder Fund | 1.15% | None (0 days) | 0.01% |

| ATRAM Global Consumer Trends Feeder Fund | 1.15% | None (0 days) | 0.02% |

| ATRAM Global Technology Feeder Fund | 1.15% | None (0 days) | 0.01% |

| ATRAM Global Health Care Feeder Fund | 0.96% | None (0 days) | 5.43% |

| ATRAM Global Infra Equity Feeder Fund | 1.03% | None (0 days) | 3.71% |

| ATRAM Total Return Peso Bond Fund | 1.10% | None (0 days) | 0.03% |

| ATRAM Peso Money Market Fund | 0.49% | None (0 days) | 0.04% |

What is the minimum investment amount required in GInvest?

You can begin investing with fifty pesos. GInvest made it possible for every adult to become an investor. Back in the day, only the wealthy were the ones who could afford to invest. It’s one of the reasons why the rich get richer.

Here are the funds you can invest in if you have at least Php 50.

| Fund | Minimum investment amount |

|---|---|

| Philippine Stock Index Fund (Units) | Php 50 |

| ATRAM Philippine Equity Smart Index Fund | Php 50 |

| ATRAM Philippine Sustainable Development And Growth Fund | Php 50 |

| ATRAM Total Return Peso Bond Fund | Php 50 |

| ATRAM Peso Money Market Fund | Php 50 |

It’s good to start somewhere, but I hope you won’t be content with investing Php 50 throughout your life. Don’t get me wrong. Fifty pesos is fifty pesos. With today’s economic challenges, I know people who struggle to save this amount each month. But the reality is that the returns for this investment capital are too small for your effort. Earning 1% from a Php 50 investment is very different from Php 1,000.

I am not suggesting you shouldn’t invest your fifty pesos. I would still encourage you to invest it with the intention of building your investing muscle. Don’t think about the profit first. Use this amount to learn the game. But from a purely return-driven perspective, my suggestion is to put your fifty pesos in GSave instead. There you can get a steady 2.6% return per year without the fees. The idea is to use GSave to grow your Php 50, then transfer it to GInvest when you have at least Php 1,000 or more.

These are the funds in GInvest with a minimum order amount of Php 1,000.

| Fund | Minimum investment amount |

|---|---|

| ALFM Global Multi-Asset Fund Inc. – PHP | Php 1,000 |

| ATRAM Global Equity Opportunity Feeder Fund | Php 1,000 |

| ATRAM Global Consumer Trends Feeder Fund | Php 1,000 |

| ATRAM Global Technology Feeder Fund | Php 1,000 |

| ATRAM Global Health Care Feeder Fund | Php 1,000 |

| ATRAM Global Infra Equity Feeder Fund | Php 1,000 |

I started investing with a sum of Php 7,000 on February 5, 2017. But prior to that, I have already been saving regularly for the past 6 months. I was broke and deeply in debt, so it’s really a struggle for me to save. I wasn’t even sure if it’s wise for me to start investing – given my pressing financial situation. You can read about my story here. And also here. But small steps can take you to great places if you do it consistently for a long time. Today I praise God that I am completely debt free, and my investment fund has grown from Php 7,000 to more than Php 500,000.

Investing is not a one-time big-time affair. It is a habit. Once you begin investing, make it a practice to put at least 10% of your income into the fund each month.

Can you lose money in GInvest?

No investment is 100% safe. Money in GInvest is also exposed to different types of risks that can diminish its value. Such risks include market risk, business risk, inflation risk, credit risk, and more. To manage them, an investor must be aware of his risk appetite, strategy, goals, and investing capacity.

As a rule of thumb, one should never invest in things they do not understand. That’s why I highly recommend you take an online course like the one above if you are serious about investing. Many people believe investing is in the same family tree as gambling or the lottery. They view it as a venture purely based on “luck”, thus, they see no sense in studying about it. But nothing can be further than the truth. As mentioned previously, there are strategies or approaches that will help you grow your investments the right way.

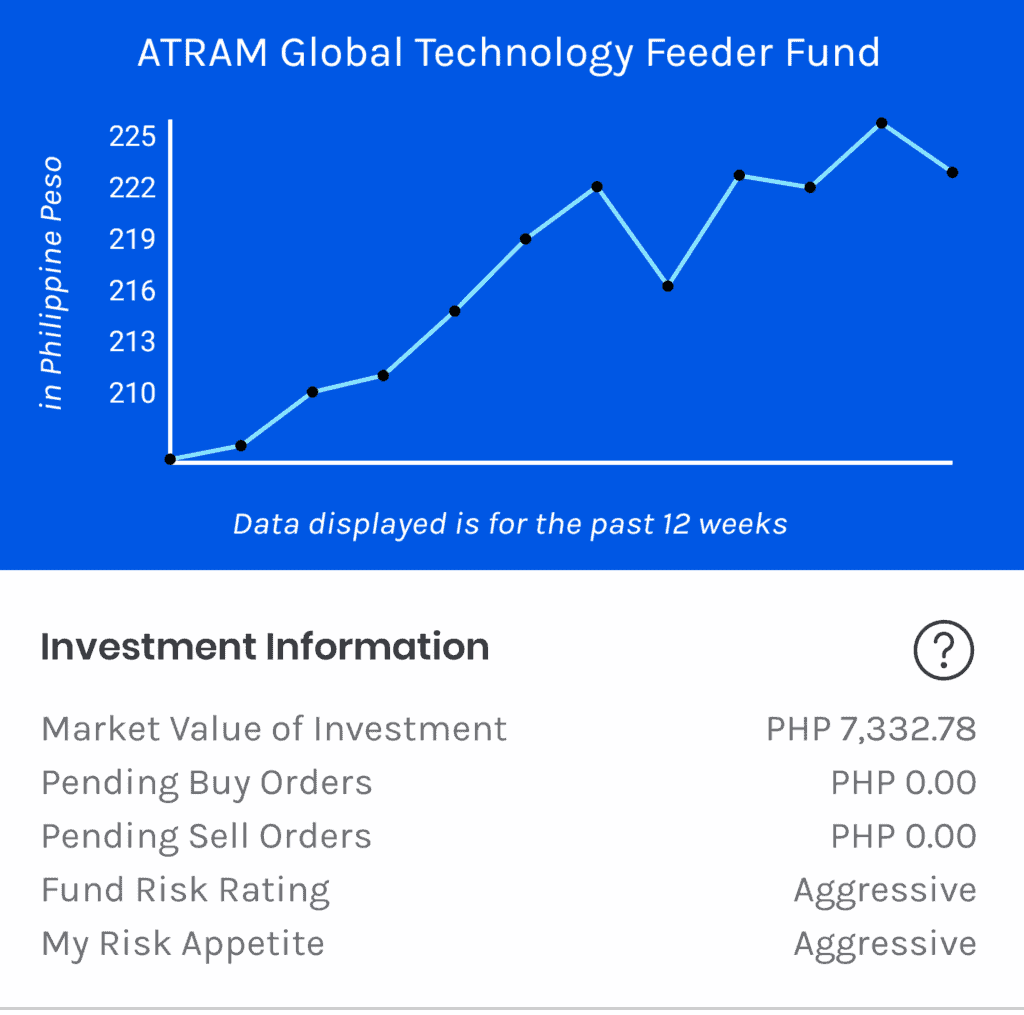

What’s good about investing is that despite the risks, you can win almost every time as long as you have patience. Do you remember what I told you at the beginning of this post? Earnings and losses will only be “on paper” until you actually sell your shares. Take a look at an actual example of one of the funds I invested in Ginvest.

In 2021, I put Php 10,000 into the ATRAM Global Technology Feeder Fund. As you can see, by the end of the year, my investment value was down to P7,332.78. If I sold my shares that day, I would have suffered an actual loss of Php 2,667.22.

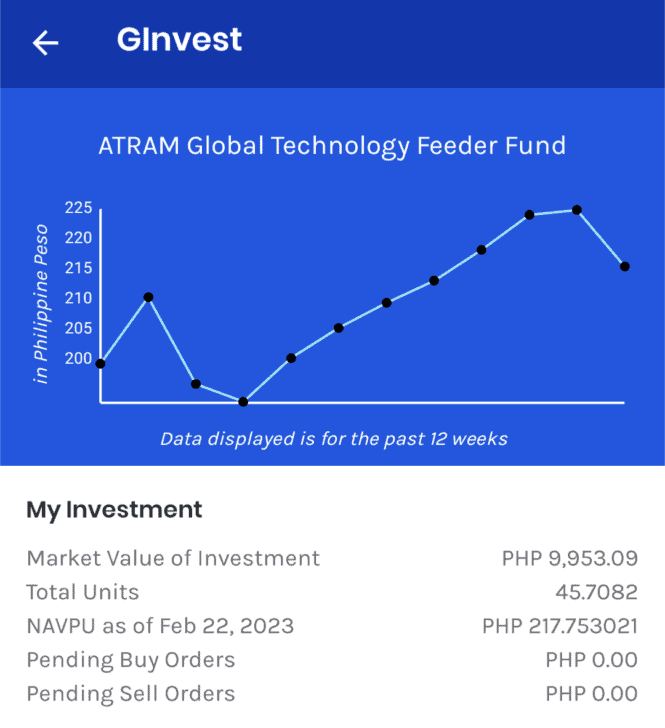

In 2022, I decided to not add anything to this account and just let it sit for a year. I checked on it recently and this is its value now:

It’s still down, but not as much as in 2021. I could sell my shares today and just get an actual loss of Php 46.91 instead. But why would I do that? I always play the long game, so I am not bothered by these losses as long as I see the potential to make money in the future. I plan to let it continue to sit for now.

So what’s the key takeaway? Do not sell your shares when they are down! (Unless, of course, you need the money for an emergency.)

Be patient. Play the long game.

When to sell in GInvest?

Generally, it is smart to sell your shares in GInvest when it reaches your goal. Alternatively, it is also prudent to exit when you find a better investing opportunity, or when the fund is needed for emergency situations.

Selling your shares or exiting from an investment fund is purely a personal choice. There is no right or wrong answer. While it’s always good to sell when your investment is up, this is not a good selling indicator overall. As a whole, I rarely sell my shares. But here are the situations where I had sold my shares:

I sell when there’s an emergency or a great need.

It’s imperative to have an emergency fund before you start investing. This will prevent your money from going in and out of the market. An emergency fund is a savings of at least 3 to 6 months of your living expenses, and you will only use this when unforeseen events arise.

Sadly, we lost our businesses during the pandemic. It’s more than what our emergency fund could bear. I had no choice but to sell my shares to sustain my family while we tried to bounce back.

I sell based on a goal or a target date.

My wife and I struggled mentally during the pandemic. This was late 2020 or early 2021. It’s a feeling of as if someone suddenly turned off the lights in the hallway, and we can’t see where we are heading. I’m sure many of you also felt this way. To keep our sanity, I told my wife that we should give ourselves something to look forward to. We both agreed to plan a trip to Japan by 2023.

By faith, we invested continuously into our money market fund for this purpose. We did it even though we were not even sure if it’s already safe to travel by then. Last month, I already sold some of our shares to buy our tickets.

I sell when there’s a better investment opportunity.

Another instance where I sold my shares was when I got a big deal from a client. Besides this blog, I also have another online business. It’s an e-commerce site for Chromebooks. I have a fund dedicated to it. Yet, I have to tap into my other investment funds every time a customer orders more than its capacity. I sold my shares even though the fund was down during that time because I know it will earn a hundred-fold more in that transaction. I’d then return the borrowed amount plus interest to the fund after I receive the payment from the client.

As investors, we need to determine our goals, purpose, and priority. This will help us make sound decisions every time we sell. Being a father, my overall priority is my family. I invest because I want to be more present in their lives. Investing as well as running online businesses are my one-two punch in providing for my children while being a dad at home.

GInvest Alternatives

If you prefer to invest with other investing platforms in the Philippines, here are a few of the notable ones:

- COL Financial

- First Metro Securities

- BPI Trade

- BDO Securities

- Philstocks

GInvest Review

Also, note that there are no perfect investment platforms. My suggestion is to find one you are comfortable with and easy to use. Here are my quick pros and cons I observed with GInvest:

Pros

- Easy to use.

- Partnered with reliable asset management companies.

- Very affordable minimum investment deposit.

Cons

- Limited fund options.

- Incomplete fund information or details.

- Some cash-in and transfer options are subject to service charge.

GSave or GInvest?

GSave is a form of high-interest savings account, while GInvest offers UITF and Mutual Funds. Both are helpful financial tools to make your money earn interest. GSave is the safer option as it gives a fixed monthly interest. GInvest, in contrast, can deliver higher returns but comes with a level of risk.

Summary

You make money in GInvest by buying low and selling high. Your money earns interest or dividends through fixed-income or equity. But these are only on paper until you actually sell your shares.

Risks will always be part of investing. So you should get familiar with your risk appetite and strategy. Losing money in GInvest is highly possible, especially if you do not understand the proper techniques of investing. This is why it’s imperative to take a class such as this one before you start. If you find investing too risky, perhaps GSave is a better option for you.

More From The Learning Dad Blog

- Insurance Vs Investment: How to know which one is right for me?

- Which Is Better GSave Or UpSave?

- Why Use GCash? Here are 9 reasons why you should

- Is GCash Safe? 5 things we need to know

- What First Time Dads Need (They Thought They Didn’t Need)

Your blog helped me a lot as a beginner. Thank you very much!!!

Happy to help! 🙂