Financial stress is one of the leading causes of physical, mental, and relational issues. That is why I cannot emphasize enough how vital it is for everyone to learn personal finance, especially you as a father. Personal finance will teach you how to manage your money effectively. You will learn how to save, budget, and invest. But these are only the tip of the iceberg. Because the reality is, personal finance is more than just about money.

Personal finance will impact you (and those around you) by helping you become a better person overall. Saving teaches discipline, budgeting instills commitment and investing develops patience. Financial management is beyond head knowledge, it is also a reflection of character.

Personal finance is a topic dear to me. It has helped me get back on track when I got myself deep into debt in 2016. The intention of this article is to encourage you to study personal finance, so you can better manage your resources and live a healthier life. Read on to learn how personal finance can generally help you, and what are the changes you can expect when you begin to engage with it. But please also note this content is for informational purposes only, and is not intended to provide professional financial advice.

How does personal finance help you?

Overall, personal finance will help you manage your money well. It shows you the proper way to raise, keep, and spend money effectively, so you can always make sound financial decisions. Doing personal finance will keep your spending habits in check and improve your financial well-being as a whole.

Listed below are four practical ways personal finance can help you:

#1: It helps you identify the real problem

Most people attribute their financial distress due to the lack of income or having too many expenses. But these are obvious reasons. An outflow greater than an inflow indicates financial trouble. The question is what is the underlying cause of the problem?

When I found myself broke and deeply in debt in 2016, the first thing I did was to sit down with a pen and paper. As I grieved about my current situation, I folded the paper in half and drew a plus sign on the left; and a minus sign on the right. I then listed all my sources of income under “+” and under “-“, the expenses. Here is what I found out:

- I only have one source of inflow and a bunch of outflows!

- I pay too much interest because of my debts.

- I have unnecessary expenses.

| + | – |

|---|---|

| Merchandise | Rent |

| Utilities | |

| Wages | |

| Borrowed funds | |

| Credit card debts | |

| Mobile postpaid plan | |

| Car fuel and maintenance | |

| Charity | |

| NBA League Pass |

After I learned about this, I spent the next couple of years eliminating the minuses and adding more pluses. Later, I learned these are called assets and liabilities. By 2018, thank God, I was able to cut my liabilities in half and built ten income-generating assets. Personal finance helped me identify the problem behind the problem. If not for it, I may have put myself in an even more dreadful position. You can read more about this story in a separate essay: Assets and Liabilities Management. There, I shared step by step on how I have minimized my liabilities and ramped up my assets.

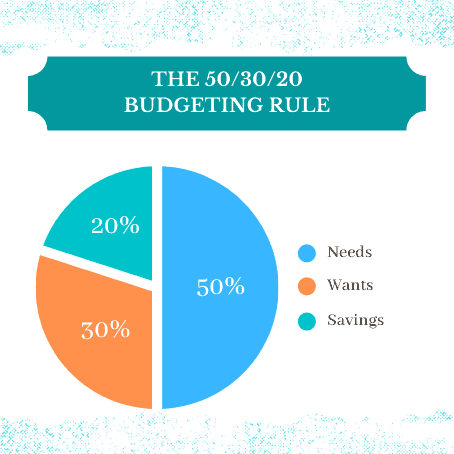

Believe it or not, the root of most financial issues we face today is simply because we do not track where our money is going. If you were to put all your expenses on a pie chart, what would it look like? Are you spending more on your wants or your needs? Basic finance will teach you the right way to track your money as well as guide you on how to spend it wisely. Try doing the simple plus and minus exercise above, you might be surprised by what you’ll discover. And since we are talking about icebergs, more often than not, the real issue behind the money problem is not about money per se. It can be envy, addiction, or the desire to prove yourself.

#2: It helps you prepare for life’s uncertainties

Life is uncertain, and the truth is we cannot be 100% prepared for it. But that does not mean we shouldn’t do anything. Wouldn’t it be nice if we can at least block a percentage of those uncertainties? Illnesses, accidents, calamities, and such may result in significant expenses or loss of income. Personal finance will help protect you, your assets, and your loved ones from life’s uncertainties by educating you about the importance of emergency funds and insurance.

- Emergency Fund

A 3 to 6 months worth of your living expenses saved in the bank. Money here is only going to be used in times of emergency. This fund serves as a cushion to pay for those unforeseen expenditures to impede you from getting into debt. It is advisable to set aside 10 to 20 percent of your income regularly until you build a solid amount of emergency fund. - Insurance

An agreement with an institution that will cover expenses usually related to critical ailments, disabilities, disasters, and death. Insurance is about preserving your assets and stabilizing your future. It can pay for hospital bills, replace the lost property, and support your children until they can stand on their own. The ideal insurance coverage is between ten to fifteen times your annual income. If you want to learn more about insurance, you can check out this post: Insurance vs Investment — How to know which one is right for me?

#3: It helps you keep out of financial trouble

Another way personal finance can help you is by keeping you out of money-related troubles. Most people who are facing money issues are those who are unaware of basic financial principles. Everyone wants to make money, but not all are interested in studying. They try to cut corners by going into investments they do not understand, and so they end up losing money or being scammed. Here are a few key money principles you should know to avoid financial disaster:

- Risks

There is no such thing as a “safe” investment or a “guaranteed” return. Everything in the financial world has its own form of risks. It is up to you if you are more of a high-risk high-return person, or someone who is happy with low-risk low-return. If you are being offered something low-risk with high-return, be skeptical. It is more likely a scam. On the other hand, I guess nobody wants to be part of anything with high-risk and low-return.

- Inflation

We lose money each year, and we don’t even know it. Inflation is an invisible expense. As the prices of goods increase, the buying power of our money decreases. The average inflation rate is about 3% per year. What that means is we are losing money at this rate annually. Like gravity, inflation is a law. It affects everyone and there is no way to stop it. The only thing we can do to counter it individually, is to spend less and invest our money in channels that can yield more than the inflation rate.

- Interest

They said there are only two kinds of people in the world: the ones who earn interests, and the ones who pay interests. Interests can be an ally or an enemy. If it is an ally, you can earn income passively through the assets you have acquired. If it’s an enemy, it makes you pay more than the value you are getting. Be sure to pay attention to which side of interest you are on.

- Compound interest

This is one of the most powerful concepts in finance. Compound interest simply means the interest has earned more interests. This principle alone will make or break your financial life. It can either accelerate you upward to prosperity, or crush you down to poverty. Suppose you did not pay your credit card balance of $1,000 at 3% interest per month (or 36% annually); due to compound interest, your payable will double in two years. The same is true with your investments.

#4: It helps you build a better tomorrow

The time will come when you can no longer do physical work. Your life after retirement will be based on how well you have prepared for it. This is another area where personal finance can help you. It will teach you how to acquire assets such as real estate, stocks, and businesses that can make you earn income passively. Passive income is a way of making money that doesn’t require your physical presence. The following are The Five Laws Of Gold, which you can apply as you build your passive income streams; They are taken from the book, The Richest Man In Babylon.

- Gold cometh gladly and in increasing quantity to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his family. As much as possible, save at least 10% of your income to build capital and acquire assets.

- Gold laboreth diligently and contentedly for the wise owner who finds for it profitable employment, multiplying even as the flocks of the field. Make your money work by investing it in profitable investment vehicles.

- Gold clingeth to the protection of the cautious owner who invests it under the advice of men wise in its handling. Always seek counsel from legit financial experts.

- Gold slippeth away from the man who invests it in businesses or purposes with which he is not familiar or which are not approved by those skilled in its keep. Rule number 1: Do not invest in things you do not fully understand. Make time to study first.

- Gold flees the man who would force it to impossible earnings or who followeth the alluring advice of tricksters and schemers who trust it to their own inexperience and romantic desires in investment. Be cautious. There are people out there who will take advantage of your inexperience. Always use logic more than emotion when making decisions.

How does personal finance change you?

The good news is that it is not rocket science. Personal finance is about 80 percent behavior. It is only about 20 percent head knowledge.

Dave Ramsey

As a whole, when a person changes, his financial situation changes. The concepts of personal finance are meant to guide us to the right mindset and behavior. Unless a person is willing to change, he cannot effectively apply these principles. Financial transformation can only be achieved by people who are willing to accept and let go of their bad money habits.

Let me close by sharing some notable changes you can expect to see in yourself with personal finance:

- You will read more books. Financial education is a continuous journey. You’ll find yourself reading more books and experimenting on the different approaches to better manage your finances.

- You become less interested in doodads. Doodads are unnecessary expenses such as the latest gadgets, toys, or junk food. You will become wiser with your spending. You see clearer lines between your wants and needs.

- You are less anxious. Most of the anxiety comes from being unprepared or not knowing what to do if calamities strikes. Learning how to protect yourself and your family will boost your confidence, thus making you less anxious.

- You will be more generous. “The more you give, the more you receive” — this is a basic concept in finance not many people find practical. But as you become generous with your resources, you will discover how true this ancient wisdom is up to this day.