Everyone deals with money daily. That alone establishes it as an incredibly important subject to learn. How a person manages his finances will not only have a serious impact on his life but the world around him as well.

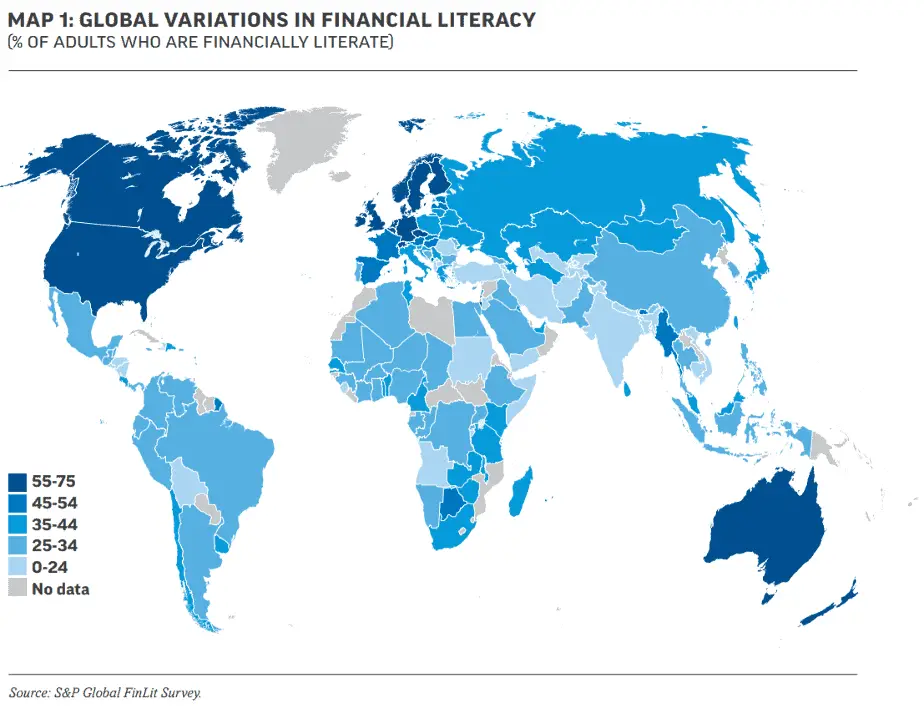

Yet, according to the S&P Global Financial Literacy Survey, only 1 in 3 adults worldwide understands money.

I asked my four-year-old son why he thinks we should learn about money and this is what he said:

You must learn about money, so you can buy toys, clothes, and something to eat…like cake!

Joab

I guess most adults these days still see money as to how children see it: as a means to buy something.

But money is much more than that. The topic is so complex that even God talked twice as much about it as He did with regard to Faith and Prayer combined. The Bible has over 2,000 verses relating to money and possessions. He knows riches have a significant influence on a person’s life.

Most of us already have an idea about why it is important to learn money. But let us double down on it today with some science.

Here are six reasons why it is important to learn money according to data:

- Financial literacy results in higher net worth.

- Couples who discuss money enjoy better marriages.

- Economic growth is tied to high financial literacy.

- A low understanding of interest puts you at risk.

- Money-savvy people seize more opportunities.

- Most homeowners are financial literate.

Read: Investment vs Insurance: How to know which one is right for me?

1. Financial literacy results in higher net worth.

A survey conducted by Financial Capability Strategy For The UK with 13,054 respondents showed financial literacy has a positive and significant correlation with total net worth. Their study estimates a difference of 0.2 increase in the financial literacy score would, on average, raise net wealth by $13,800.

Why is this information vital? Simply put, learning about money makes you truly rich.

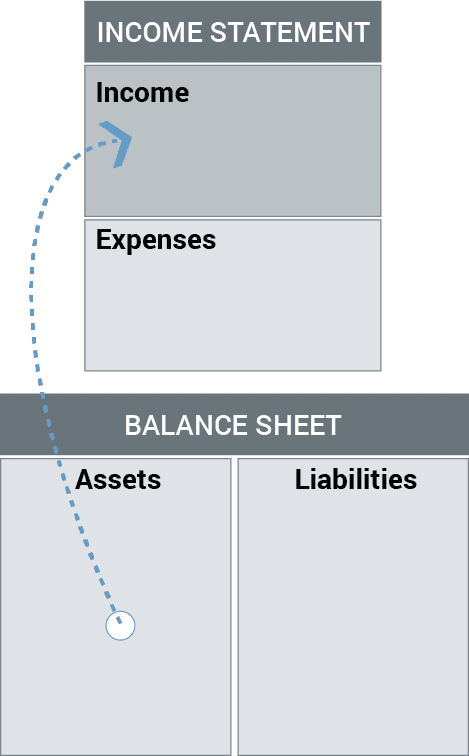

Net worth is the value of everything you own (assets) minus everything you owe (liabilities).

Most people see high-income earners as being wealthy. But that is not always the case. If a person makes $500,000 annually but spends $550,000, do you still consider him rich?

In his book, The Millionaire Next Door, Dr. Thomas J. Stanley differentiates these two types of people as:

- Income statement affluent

- Balance sheet affluent

Income statement affluent

These are individuals who have big incomes but little net worth. They usually live in large houses, drive luxury cars, but also deal with huge debts. These people work hard but play harder. As their income increases, so do their expenses and liabilities. They only see money as an instrument to get what they want. Thus, the more money they receive, the more toys they buy.

Many people are envious of the income statement affluent, thinking they are living “the life.” But if you take a closer look, what you will see are people who are actually living paycheck to paycheck. They do not have the means to support their lifestyle if their income gets cut off.

Balance sheet affluent

These are people who don’t necessarily have high incomes but have a high net worth. They live frugally and know how to invest their money to make it grow. This group puts a greater emphasis on simplifying their lifestyle, building their portfolio, and maintaining little to no consumer debts. Their assets always overpower their liabilities.

The balance sheet affluent is commonly invisible to the public. They are seen as ordinary people who wear plain white t-shirts and jeans. They are not flashy. Yet, if they are to stop working today, their investments can sustain them for many years to come.

To put it in a nutshell, having a high income does not make you wealthy unless you learn how to handle your money.

Read: Assets and Liabilities Management: Our simple plan to financial freedom

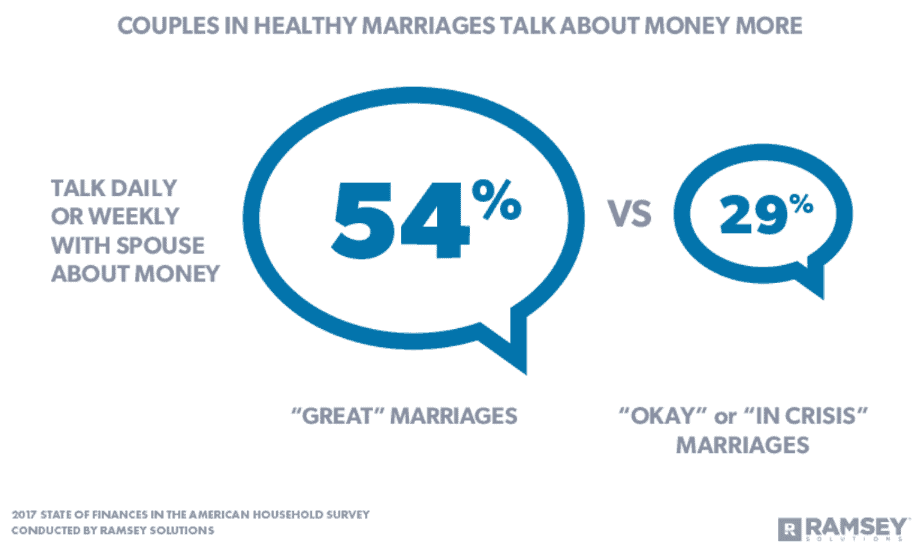

2. Couples who discuss money enjoy better marriages.

Infidelity is the leading cause of divorce. Do you know what is next? Money issues.

Wealth and relationships do not always go well, especially in marriage. There will always be tensions and disappointments attached to it. Why? It is because we all have different ideas and behaviors towards riches. Everyone has their own unique money mindset:

- Some are savers, while others are spenders.

- Some are comfortable living with debts, others do not.

- Some are natural givers, while others are takers.

- Some think it is better to invest in assets, while others think experience is the better investment.

And hundreds more reasons could spark a financially related argument inside a marriage. But what we can pick up from the data by Ramsey Solutions is these differences can be resolved by learning about money.

54% of married couples who discuss money say they are having “great” marriages; versus 29% who say their marriages are “okay” or “in crisis”.

Being financially literate in marriage is not only confined to knowing the overall concepts and theories about money. It also includes discovering and understanding our spouses’ views towards it. Differences in personality, background, preferences, and experiences are not the real root cause of money issues. The problem lies in communication.

So, if you find yourself in a toxic marriage due to financial concerns, ask your spouse to sit down and talk.

Read: How We Killed 8 Credit Cards

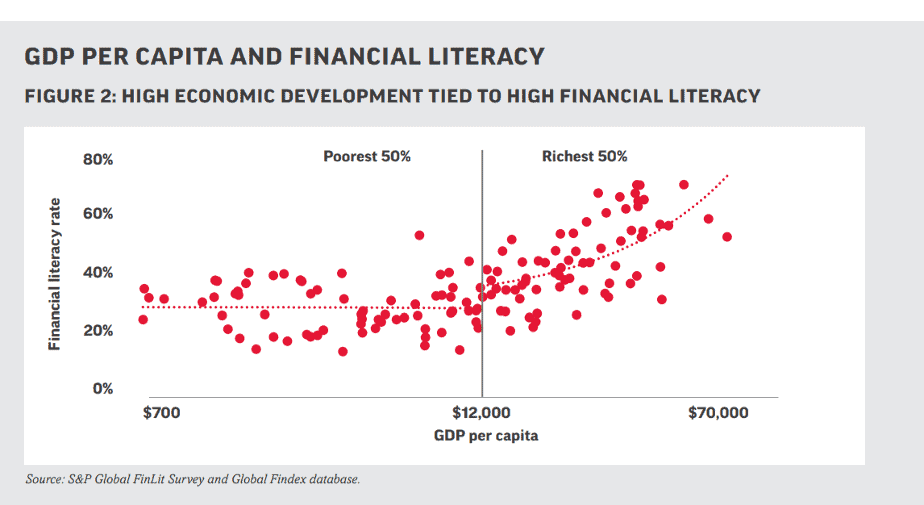

3. Economic growth is tied to high financial literacy.

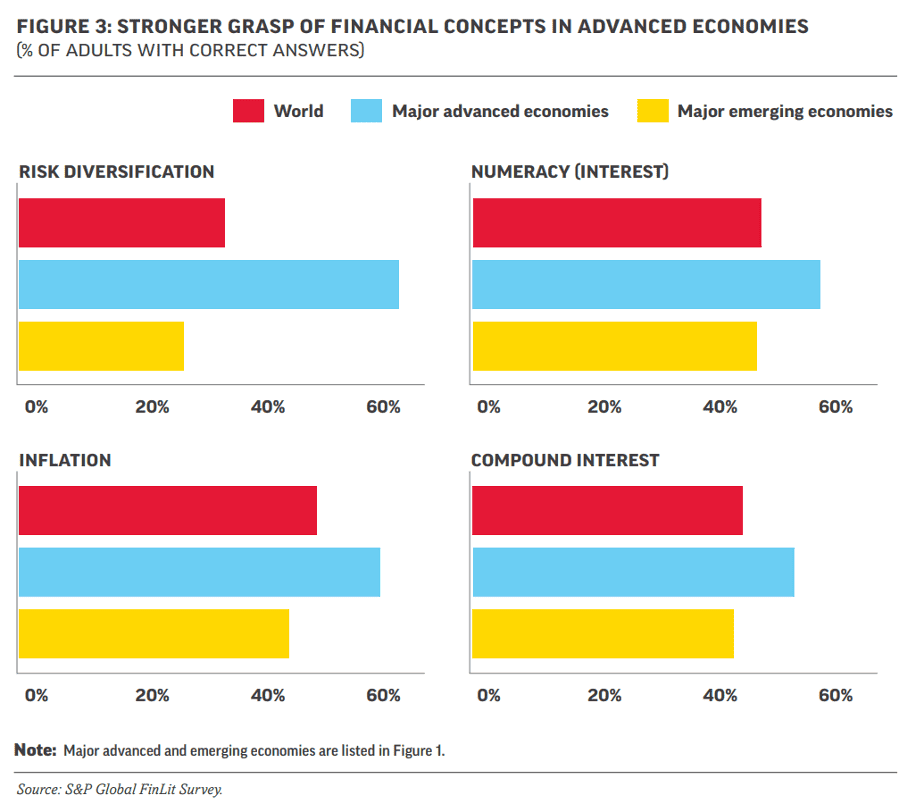

Rich countries tend to have higher financial literacy scores based on the chart.

There are four main topics used to define financial literacy:

- Risk diversification

Is it safe to put your money into one investment or multiple investments?

- Inflation

If you buy something in ten years. Will it cost LESS, the SAME, or MORE than it costs today?

- Numeracy

You need to borrow $100. Which is the lower amount to pay back: $105 or $100 plus three percent?

- Compound Interest

Suppose your money is earning 15% interest per year. Do you make the SAME, MORE, or LESS amount in the second year compared to the first?

Here is another one.

Let’s say you have $100 and are earning 10% interest per year. How much money would you have in five years if you did not make any deposits and withdrawals from the account? MORE THAN, EXACTLY, or LESS THAN $150?

As you can see, countries with major advanced economies (rich countries) generally have a stronger grasp of these financial concepts.

Read: 10 Important Skills Of A Successful Entrepreneur As Per Starbucks & Disney

Here are the 10 richest countries in the world (in GDP) and their financial literacy rating (as of Aug 2021)

Financial literacy benchmark:

| Excellent | 71% and above |

| Good | 61% ~ 70% |

| Above average | 51% ~ 60% |

| Average | 41% ~ 50% |

| Below average | 31% ~ 40% |

| Low | 21% ~ 30% |

| Poor | 20% and less |

| Country | Nominal GDP at $ billion | % of adults who are financially literate | |

|---|---|---|---|

| 1 | United States | 20,807.27 | 57% |

| 2 | China | 15,222.16 | 28% |

| 3 | Japan | 4,910.58 | 43% |

| 4 | Germany | 3,780.55 | 66% |

| 5 | United Kingdom | 2,638.30 | 67% |

| 6 | India | 2,592.58 | 27% |

| 7 | France | 2,551.45 | 52% |

| 8 | Italy | 1,848.22 | 37% |

| 9 | Canada | 1,600.26 | 68% |

| 10 | South Korea | 1,586.79 | 33% |

6 out of 10 top wealthiest countries in the world have an average to good financial literacy rating. Yet, it is vital to note these countries listed above are only the richest in terms of GDP or Gross Domestic Product.

What this means is they are wealthy as a country, but the same cannot be said of their citizens — as GDP only measures the economic value of the country as a whole. To put it simply, GDP assesses the size of an entire pizza, but not how big the slice a person gets.

But there is another measurement to determine the living standard of the residents in a country. It is called GDP per capita. This is basically GDP but divided by the nation’s overall population.

GDP per capita determines the slice a person gets based on how big the pizza is.

Here are the 10 richest countries in the world (in GDP per capita) and their financial literacy rating (as of Nov 2021)

I’m surprised with how different the countries qualified on this list.

| Country | GDP per capita | % of adults who are financially literate | |

|---|---|---|---|

| 1 | Luxembourg | 120,962.2 | 53% |

| 2 | Singapore | 101,936.7 | 59% |

| 3 | Qatar | 93,851.7 | No data |

| 4 | Ireland | 87,212.0 | 55% |

| 5 | Switzerland | 70,276.6 | 57% |

| 6 | United Arab Emirates | 69,957.6 | 38% |

| 7 | Norway | 67,978.7 | 71% |

| 8 | United States | 65,279.5 | 57% |

| 9 | Brunei Darussalam | 64,724.1 | No data |

| 10 | San Marino | 61,006.8 | No data |

Again, 6 out of the 10 richest countries in the world as per GDP per capita showed a favorable literacy rate — with 3 having no data.

To sum this up, learning about money is not only good for us but the entire country as well.

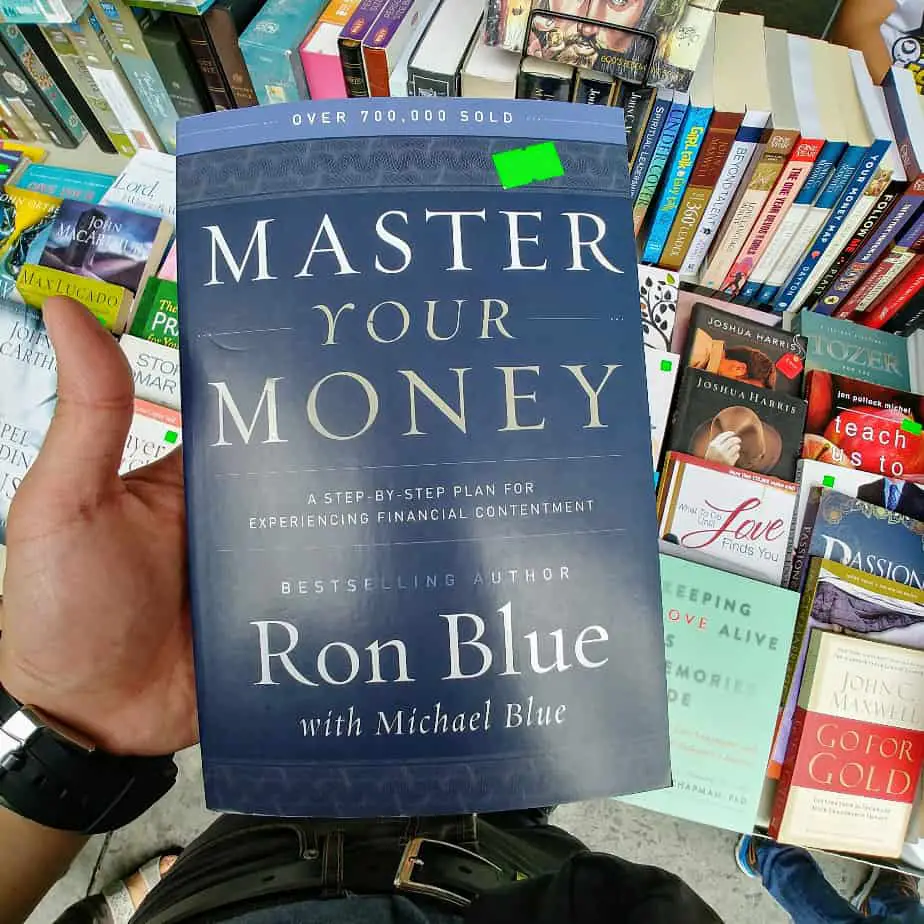

Read: 9 Good Financial Management Ebooks Worthy Of Your Time and Money

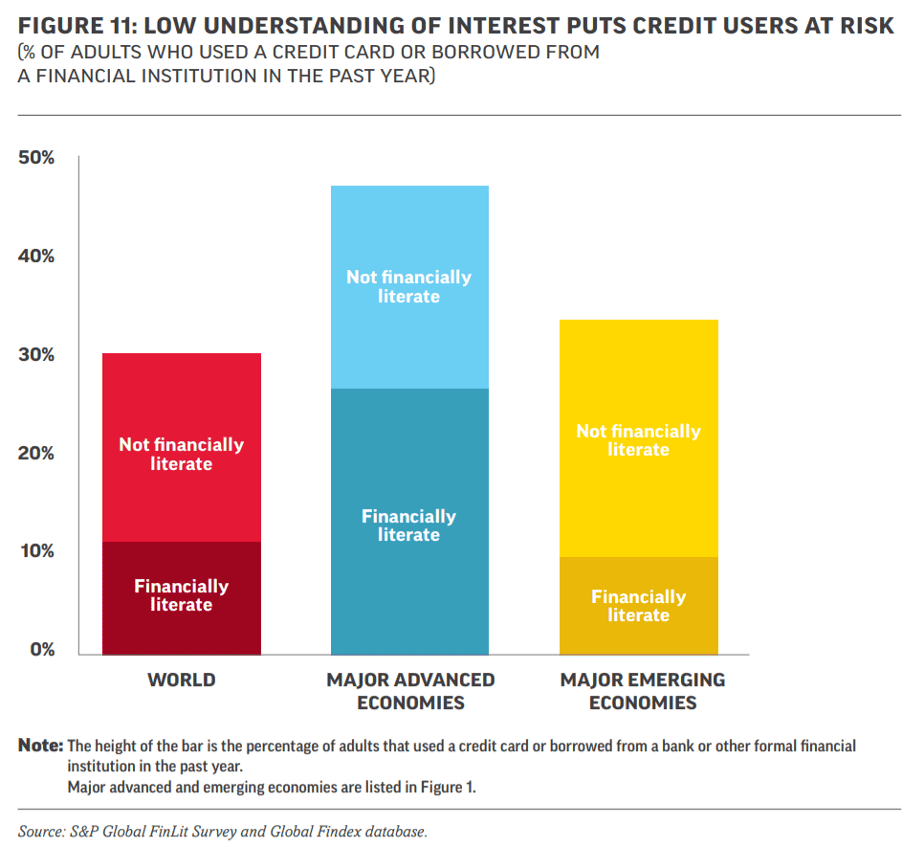

4. A low understanding of interest puts you at risk

Credit cards, personal loans, and other lending programs are gaining traction, even in many poor countries. Yet, the percentage of adults who understand the concept behind it remains stagnant. Many short-term credit users do not fully grasp the idea of interests, and the pace at which it compounds the total amount owed. Only a handful can perform simple calculations related to interest.

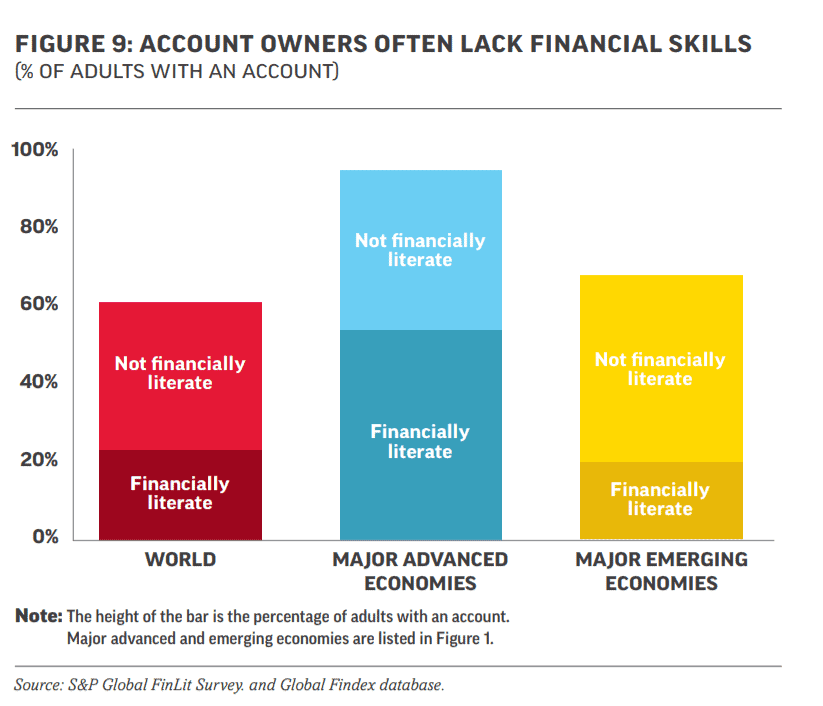

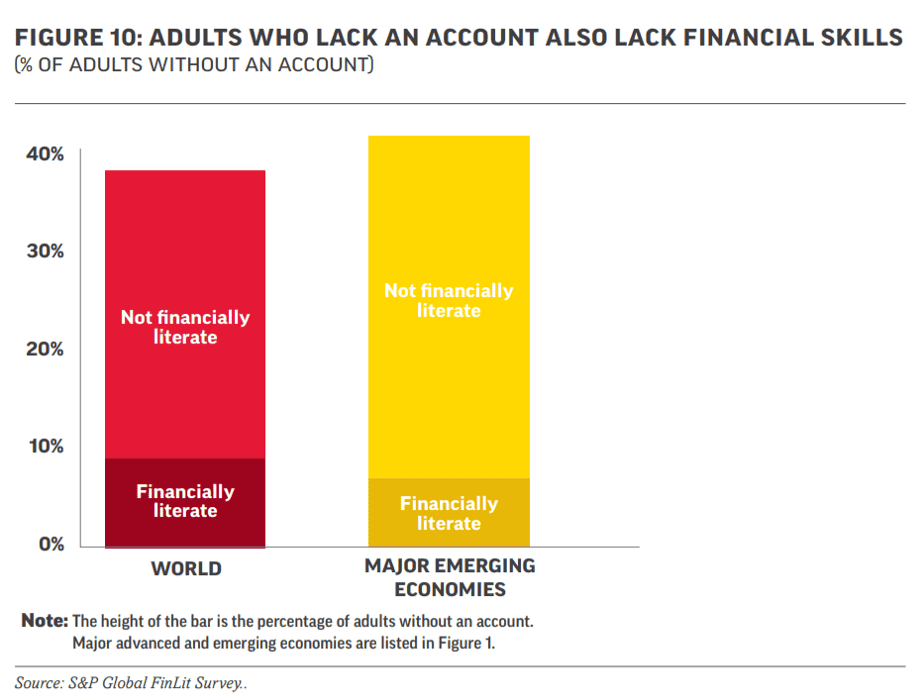

Based on the chart, there are generally more financially illiterate adults worldwide and in the major emerging economies (poor countries) who borrow money — and the reason, perhaps, is they are not aware of their implications.

For instance, 32 percent of adults in Brazil own a credit card. But of the 40% of them who are financially literate, only half understand compound interest. The same case in Turkey. 33% are credit card owners, yet merely half of the 29% of the financially literate population knows the concept.

The costs of financial ignorance are significant. Those who do not know how compound interest works may spend more on transaction fees, incur higher interest rates on loans, and get into greater debt. As a consequence, they borrow more and save less.

Now let us contrast that to the 53% of adults in major emerging economies who use credit. They have more financially literate individuals who borrow money — and the reason may be because they know how to use it properly. Researchers have found financially educated adults will generally be less likely to default on loans and more likely to save for their retirement.

I am a firm believer in living within your means, thus I do not advocate borrowing money. But if you really need to, understanding the concept of compounding interest will minimize your risk of financial disaster.

Read: Learn Finance Basics Online: 8 Reasons Dads Need to be Good with Money

5. Money-savvy people seize more opportunities.

Learning about money allows us to take advantage of various opportunities to secure and grow our assets. It is especially vital today since there is an increase in financial products that are easily accessible via mobile devices. One of the fastest-growing is Mobile Banking.

Opportunities in mobile banking

Mobile banking allows its customers to transact remotely via smartphones, tablets, and computers. Some of its notable services are:

- Pay, send, and receive money digitally.

With digital payments, users will not only save time in paying their bills, but it also empowers them to improve their businesses by being able to accept cash or credit transactions online.

- Get higher interest rates on savings account.

Most digital banks do not maintain a brick-and-mortar store. The expenses they saved allow them to give more interest to their customers than what traditional banks offer.

If a traditional bank gives 0.125% per year, a digital bank can offer 2.5% to 4%.

- Apply for personal loans.

Some digital banks, like Tonik, allow you to apply for a loan within its app.

- Invest in various investment funds.

Digital wallets such as GCash enable you to invest in various funds such as index funds, money market funds, bond funds, and some international feeder funds.

If you would like to learn about these mobile banking apps, you can check out these posts:

- How To Use Tonik Bank? (Here are 7 Uses)

- How to earn money in Ginvest? (Simplified, tips, stats)

- Why It’s Smart to Save with GCash Today

For many, having a bank account is an essential step to participate in the country’s financial system. Account holders who have access to digital payments are, in general, more able to save money, provide for their families, and withstand economic setbacks. This is the reason why governments in many countries are boosting the use of these financial services.

Most account owners and non-owners are not well versed financially.

Unfortunately, due to their lack of knowledge about money, both account owners and non-owners worldwide are underutilizing the benefits of financial infrastructures available today.

Account owners tend to be savvier, but plenty of them still lack financial skills.

- 38% of adult account owners worldwide are financially literate.

- 57% for the major advanced economies;

- and 30% in major emerging economies.

With that said, there are also micro gaps existing in financial literacy among account holders even though they typically have stronger financial skills than the general population.

For instance,

- A man with an account is 8% more likely to be financially educated than a woman with an account.

- Similar disparities can be found between households in the richest 60% and the poorest 40%.

- Primary education holders are half as likely as their secondary education counterparts to be financially literate.

One banking feature account owners who lack financial knowledge might not be fully benefitting is savings.

- 57% of adults save money, but only 27% entrust their funds to a bank or other registered financial institution.

- Others tend to lean toward unsafe and less lucrative methods, such as keeping cash in a depository safe or stuffing it under a mattress.

- Only 42% of these adult account owners worldwide actually use their accounts to save — and 45% of them are financially literate.

If only these savers improve their financial skills, they are sure to make their money yield better results.

But adult non-account owners exhibit even weaker financial skills.

- 25% of non-account owners worldwide are financially literate.

- 22% for the poor countries.

There is no definitive evidence of whether low financial knowledge makes people shy away from using any financial services. According to research, 59% of “unbanked” adults say they do not have enough cash to use an account. But in actuality, most people in poverty also make various payments and other financial transactions every day. The only difference is they do it informally, which puts their money at risk in many ways.

The most basic explanation for non-account owners having low financial skills is their background. Most of them come from poor or less educated households and were not exposed to the different financial facilities.

If they were only more aware of how money works, these non-account owners would definitely be more inclined to open one. The notion of interest in a savings account, for instance, would show them how their money can make more money over time. Furthermore, their money inside the bank greatly reduces the chance of it being lost, destroyed, or stolen.

There are many more opportunities in the financial world right now. But most people are not maximizing simply because they lack knowledge about money.

Read: Can Parents Spend Their Children’s Money?

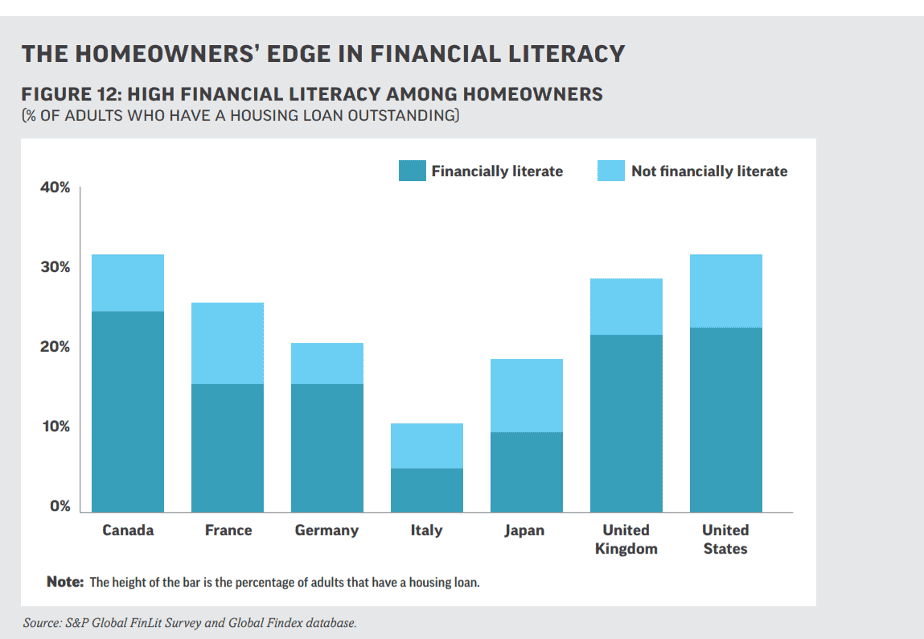

6. Most homeowners are financially literate.

Since purchasing a house requires advanced calculations, it is expected that most homeowners have better financial skills than the average person overall. The chart above indeed confirms it. 26% of adults in rich countries have outstanding home loans.

Nonetheless, it is still a fact that not all home buyers are financially literate.

In the United States, 3 in 10 adults with a housing loan are unable to do the basic interest computation on their monthly loan payments. Same problem in Japan. Only 37% of the one-fifth of adults with loans understand compound interest correctly.

In a nutshell, those who are financially literate have a higher chance of really owning their own homes because they are less likely to default on their payments.

Read: 8 Financial Benefits You Can Enjoy As A Stay-At-Home Dad

Bonus: Financial literacy helps reduce anxiety about life in old age.

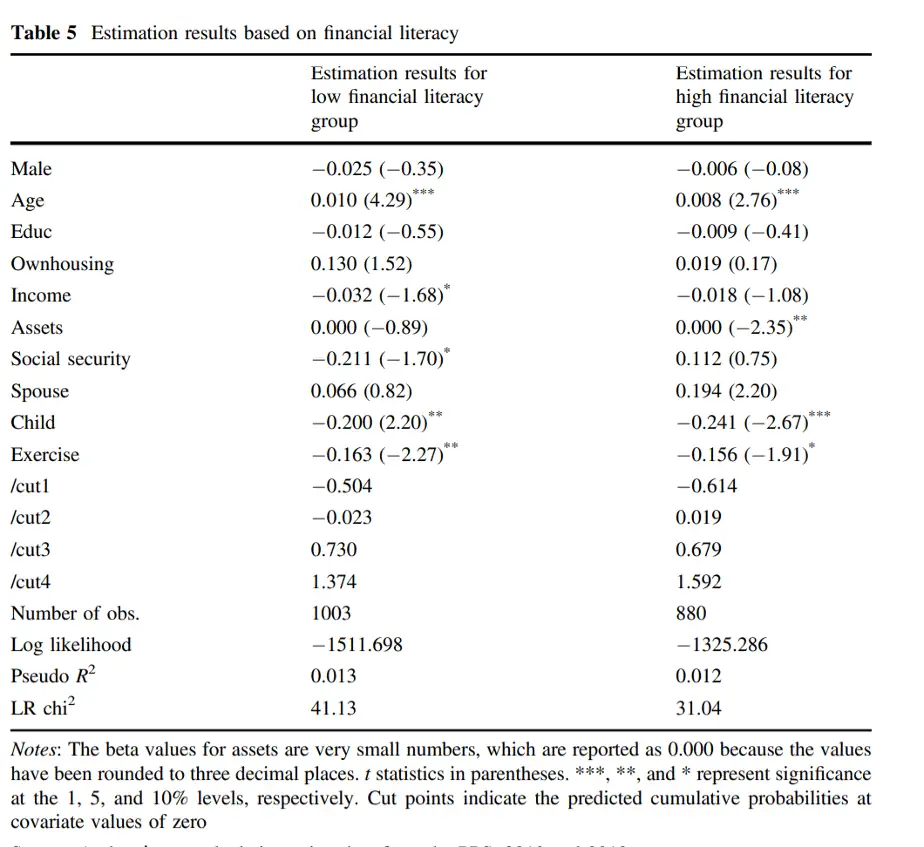

I was debating about whether to include this data or not. I would love to share the findings, but I am having difficulty interpreting the chart for you. So, to solve my problem, I will have this section as a bonus instead.

I hope you can grasp the table above. But what the data shows is that financially educated people are more able to earn income and build assets, which leads them to have a less anxious life in old age.

As for the less financially literate people, they rely more on social security to help them in their senior years as they are unable to accumulate sufficient income-generating possessions.

Besides these, other factors also help reduce anxiety in old age:

- Having a child.

- Doing regular exercise.

- Good marital status.

Many countries are facing aging populations with smaller public pensions. They are now calling on their citizens to take a more serious role in planning for their retirement. With recent changes to pensions, individuals now carry the financial responsibility for their twilight years. They are rather discouraged from depending solely on their employers or the government.

But study shows many are unprepared.

In Central and Eastern European countries, younger adults are not saving enough for old age. And senior citizens do not have the essential skills to deal with the economic challenges of retirement. As a whole, only 47% of those who do not prepare for old age in the EU show an understanding of basic financial concepts.

Statistically, people with strong financial skills are more likely to invest in several ventures to prepare themselves for life in old age.

Read: What To Do With My Child’s Money? Here are 5 ideas

Closing Thoughts

Financial literacy challenges and confronts both the rich and the poor alike. Although there are more financially skilled among the wealthy and educated, it is clear there are billions who are unequipped to handle the rapid changes in the financial world.

Unless people are willing to hone their economic abilities, these transitions can easily lead to high debt, mortgage defaults, or even bankruptcy.

A person will not be able to make sound financial decisions without understanding basic financial concepts. Only knowledge will give you the confidence to make wise choices about saving, investing, borrowing, and more.

Learning about money is one of the greatest investments you can make in your life.

Sources: