Can personal finance make you rich?

The usual motivation for a person to get started in personal finance is this: getting rich. I can totally relate. I personally had a similar idea when I read my first finance book, which is Rich Dad Poor Dad. I thought the main purpose of personal finance was to make you rich.

While getting rich is not the primary goal of personal finance, it definitely helps you get there. It covers topics that will aid in protecting and growing your money, such as saving, investing, and insurance. Furthermore, it also teaches about how taxes work, so you can optimize your income by reducing unnecessary expenses.

It has been almost a decade since I first stepped into personal finance and, guess what, I am still not “rich.” In fact, following certain teachers has even got me into debt! But I am not blaming anyone. It is on me. I take full responsibility for what happened. Yet, to be fair, it was also the knowledge I gained in financial management which ultimately helped me get back on track. I have weathered the storm, but there is still a long way to go.

What is the purpose of personal finance?

I hope I have not disappointed you. But being wealthy is only an aspect of personal finance. Riches are only a by-product of managing your money well. What it offers us is so much more.

Personal finance is meant to help you manage your money effectively. It provides you with the necessary techniques, tools, and knowledge to be able to take control of your finances. By managing your money well, you will be able to live a healthier lifestyle, as economic stress may cause physical, mental, emotional, and relational strain.

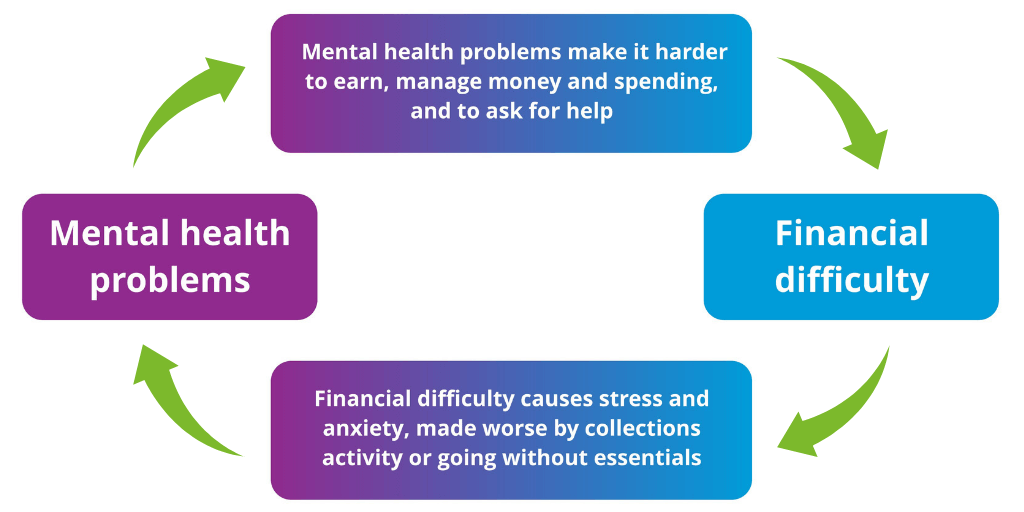

Based on a report, the number one cause of stress is… you guessed it: money. I am sure you are already aware of the negative impacts stress can have on our bodies, career, and relationships. Nevertheless, the most damaging part of money-related stress is it puts you in a vicious cycle of mental health problems and financial difficulty.

People with financial problems are more likely to suffer from mental health issues. People with mental health issues are more likely to have financial difficulties. No one certainly wants to step on this hamster wheel. Yet, a survey conducted in the United States alone found 77% of its citizens felt stressed about their finances.

As surprising as it may seem, money-related stress has nothing to do with money. I can vouch for this. Despite being in debt since 2016, praise God, I am no longer worried or stressed about it. Why? Because I already have a plan in place. It will only be a matter of time before I pay off everything I owe. You see, my stress wasn’t relieved by money. It was alleviated by learning how to deal with my difficult financial situation.

What personal finance ultimately offers us is peace of mind — and that is something money cannot buy.

If it costs you your peace, it is too expensive.

Read: Why Is It Important To Learn Money? Here’s what the data says

Where to start in personal finance?

I appreciate you for staying. Most readers might have already closed this window by now. Financial management is not a topic many people find appealing — especially when they’ve learned it doesn’t guarantee riches. But you are different. I presume you are willing to give personal finance a go?

Understanding your financial situation is the first step in personal finance. The way to do this is to track how your money comes in, and how it goes out. In short, your cash flow. Your financial health will generally depend on whether you are making money or not. Thus, keeping an eye on your numbers is the most crucial task in personal finance.

The most basic way to track your cashflow

You can start tracking your monthly cash flow with a spreadsheet or with the good old pen and paper. Here is a basic template you can use:

| Cash-in | Cash-out | ||

|---|---|---|---|

| Job | $1,000 | Rent | $600 |

| Side hustle | $500 | Utilities | $400 |

| Stocks | $500 | Debts payments | $400 |

| Real estate | $1,500 | Transportation | $200 |

| Business | $800 | Food | $300 |

| Hobby | $100 | ||

| Maintenance | $100 | ||

| Total | $4,300 | Total | $2,100 |

I still use this template to this day. It has changed the way I handle my money and make decisions. If you want to learn more, I have written about this topic in detail as well as attached a free workbook in a separate post. You can check it out here.

Does personal finance cost money?

If you strip personal finance to its core, what you will see is that it is all about helping you make prudent decisions. All the data gathering you do is meant to serve as a foundation for your next move. But mere data is useless until it is applied with proper knowledge and techniques. Personal finance needs to be learned.

Generally speaking, personal finance is going to cost you money in one form or another. Learning to manage your finances properly will require you to invest in books, classes, and workshops. On the other hand, the absence of personal finance in your life can also result in money loss as it puts you at risk of making poor financial decisions.

Recommended resources

If you are looking for good resources on personal finance, here are some I could recommend:

Books

- The Total Money Makeover by Dave Ramsey

If you are in debt, this is the book for you. You will learn how to pay your loans while still being able to support your daily life. - Rich Dad Poor Dad by Robert Kiyosaki

A must-read for beginners. This book teaches financial management in a simple and easy-to-understand fashion. - Your Money Or Your Life by Vicki Robin

Here, you will learn what money really is all about and how to develop a good relationship with it. - Money, Possessions, Eternity by Randy Alcorn

If you are spiritual and would like to know how money fits in the grand scheme of things, this is a must-read.

Online courses

- The Fundamentals of Personal Finance Specialization | Coursera

Learn how to meet your financial goals by understanding the core personal finance topics. - The Personal Finance Master Bundle | StackSocial

A track to budgeting, creating more wealth and setting up a promising financial future.

How studying personal finance now benefit you in the future?

Money is something we all must deal with for the rest of our lives. Whether it becomes a blessing or a curse generally depends on how we handle it. Money is a tool. You will put yourself at a great advantage if you become adept at using it.

Understanding the topics of saving, investing, protecting, retiring, and legacy planning will benefit you in the future. They will teach you how to grow your money over time, as well as how to protect it from certain risks. Time is a vital ingredient to a healthy financial life. What you do today will affect your life for years to come.

Things to do for a more financially stable future

Here are five fundamental lessons you need to know to build a secure financial future:

Save money for emergencies.

Emergencies are unforeseen events that can happen in your life. We don’t intend to get ill or be involved in an accident. But if they do happen, it will result in significant medical expenses and loss of income. The money you saved in the bank will serve as a cushion to fund these unexpected circumstances. The rule of thumb is to set aside at least six months’ worth of your living expenses. You can extend it to a year if you live or work in high-risk areas.

Invest in long-term growth.

Once you have completed your emergency fund, the next step is to invest. Investing is the act of spending your money in hopes of future gains. Besides financial growth, one of the main reasons why we need to invest for the long haul is because of inflation. Inflation is an invisible expense. They are like these little parasites that chomp on our hard-earned money each year without us knowing. As of this writing, the inflation rate is at 3.6%. What this means is we are currently losing money at this pace due to the increasing prices of goods. The way to counter this is to invest our money in funds that will allow us to earn 3.6% or more.

If you want to learn about inflation. You can check out this post.

Protect your progress with insurance.

Imagine writing a book for the whole day and then your computer suddenly crashed. What you realize later on is that you forgot to save your progress. Eight hours of work flew away just like that. What if this happens to your assets? All the savings were emptied by a critical illness. The house was burned down due to a faulty wire. The kids can no longer go to college because their parents have passed away or become disabled.

Getting insurance is like hitting the save button. It can pay for your hospital bills, replace the amount lost in your property, and support your children until they can stand on their own. It is somewhat similar to building an emergency fund but on a much bigger scale. The ideal insurance coverage is about ten to fifteen times your annual income.

You can read my article about insurance versus investment here.

Plan for your retirement.

There will come a time when we can no longer do physical work due to our age. How are you preparing for it? One of the strategies is to build enough assets to cover our monthly expenses. Assets like rental properties, stocks, or businesses that don’t require too much physical strength to operate. Some people take their children as investments. They expect their kids to provide for them when they retire. Please do not adopt that kind of mindset. Our kids have no obligation to support us in old age. We will certainly be thankful when they do, but they are not by any means required. We should make the most of building our assets while we can.

Learn how to pass on your assets.

I haven’t gotten to this area of personal finance yet. I still don’t have much to pass on to my children. Legacy planning is something we should study as we build our net worth. It basically talks about the efficient ways to transfer our assets to the next generation — as there are costs and technicalities involved in the process.

Read: How Can You Apply Personal Finance In Your Daily Life?

Closing thoughts

I hope you found this post helpful. In a sense, personal finance is a way to make yourself happier and more fulfilled later in life. Start doing today what your future self will thank you for.

Sources:

- And the number 1 cause of stress is … money.

- Money and mental health facts.

- Survey: 77 Percent of Americans Stressed Over Finances