Browse your list of friends. It is highly likely there will be a great number of them who work as financial planners (or advisors). Why is this? Is a career in financial planning really that good? It seems like you are curious. Are you also considering going into this industry? If so, let me share with you some of my experiences as a financial advisor.

Overall, financial planning can be a great career if you commit to it long-term. You sure will love this job if you desire personal growth, recognition, independence, satisfying pay, and tons of incentives. Yet, they are not without costs. To be successful in this career requires a massive amount of time and hard work.

Spoiler alert: I no longer work as a financial advisor. Like everything in life, we always have to consider the positives and negatives of everything we get ourselves into. Being an advisor is something I did not enjoy considering the love I have for finance. To put it plainly, a financial planning career is not for everyone. Read on if you want to learn the pros and cons of being a financial advisor.

What I Love About Being A Financial Advisor? (Pros)

There is a lot to love about being a financial advisor. But perhaps what attracts people most is their huge earning potential and massive incentives. Close second, I would say, is the awards and recognition they can garner from exemplary performances. As for me, what I love most is the access to high levels of learning available in this profession. To indulge you with more details, listed below are the pros I observed from being a financial advisor:

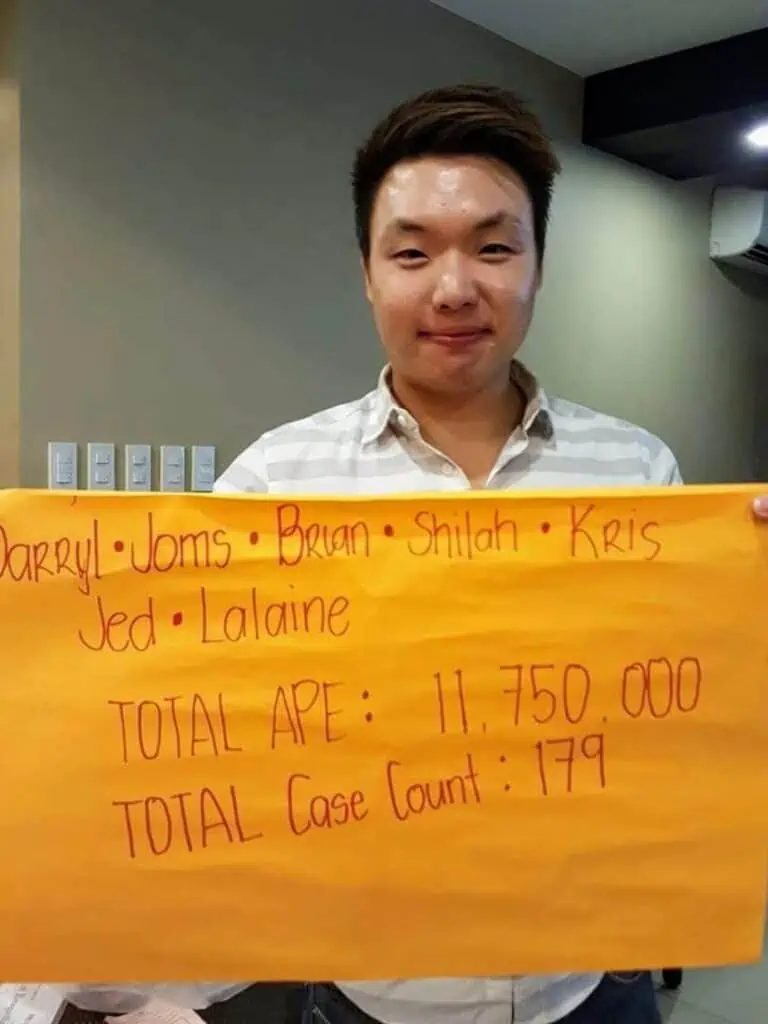

Huge Earning Potential and Incentives

Financial advisors do not normally receive salaries. But the estimated commissions they earn from ten sales are generally enough to cover them for the entire year. This is, of course, dependent on what type of products were sold.

Typically, a financial advisor takes about 30% of the insurance premium for the first year; and about 15% in the second year. Closing ten insurance policies with a $1,200 annual premium give them an income of $3,600 in year one and $1,800 in year two. But despite the huge commissions, most financial advisors do not care. They are actually more concerned about the incentives.

Who wouldn’t? Hitting your targets will not only make you eligible for bigger cash bonuses. It also qualifies you for exclusive trips. We are talking about all expenses paid to luxurious hotels, cruises, restaurants, or tourist attractions. The financial industry is outrageously generous. They do not hold back in rewarding those who perform.

Work On Your Own Time

Tired of working eight to five jobs? A career in financial planning might be for you. Aside from weekly team huddles and client meetings, you do not necessarily have to work at a specified time. It is up to you to design what your day would look like. This, of course, can be a double edge sword. Not all people thrive with having this amount of freedom.

I also struggled with this work style initially. It is like trying to tame a horse. Yet there’s no other feeling when I finally got the hang of it. Since then, I no longer use an alarm clock to wake up in the morning. I enjoyed work more and my sleep has never been better.

High-level education

As mentioned earlier, this was what I appreciated most in my financial planning career. Financial advisors are being continuously trained by their companies. They will invest in your education. All you have to do is make time for the classes they set up. There may be times when you even get tickets to seminars by renowned speakers. I know this may not sound inviting to most of you. But learning never stops in the financial planning industry.

Progressive career path

Another thing I love about being a financial planner is it is not a dead-end job. There are paths to choose from as you progress in your career.

The Personal Development Route

If you consider yourself a lone wolf, this path is for you. The focus is solely on yourself and your customers. Your aim is to be among the best in the financial planning industry. Your success is validated by becoming part of the Million Dollar Round Table (MDRT). MDRT is an association of life insurance agents who qualify by selling $1 million or more in one year.

Here is the usual roadmap for the personal development route:

- Trainee

- Financial planner

- Executive financial planner

- Senior financial planner

- Premier financial planner

- MDRT

The Agency Builder Route

This route is for people who want to be team leaders. Choosing this option will allow you to little by little turn your attention from selling to recruiting and training. Your ultimate goal as an agency builder is to put up and maintain your own branch one day.

The usual roadmap for the agency builder route:

- Trainee

- Financial planner

- Assistant unit manager.

- Unit manager.

- Branch manager.

- Senior branch manager.

Unceasing demand

Financial advisors come and go; thus, there is always a demand in the financial planning industry. Whether you are a fresh graduate, a housewife, or a person who recently lost a job, these insurance companies will welcome you with open arms. Actually, they even welcome those who have become inactive like me! This is big, especially for parents like us. It is reassuring to have something to go to, worse comes to worst.

What do I hate about being a financial advisor? (Cons)

I know what you are thinking. Good pay. Freedom. Prestige. Everything you want in a career is already in being a financial advisor. What’s not to like?! Well, as mentioned earlier, to enjoy all these you need to pay a high price. I don’t know what that exactly means for you. But on my end, these are what hindered me from excelling in my financial planning career:

It Is A Sales Job

You may be called a financial advisor, a wealth planner, or even a financial consultant. But no matter how we turn things upside down, what we are at the end of the day are insurance agents. We sell insurance. That is how we make money. We are generally not paid for “advising” or helping people “plan” their finances. We get paid when we “sell” them an insurance policy.

And since this is a sales job, there is a quota to be fulfilled. Not hitting the sales target may spell demotion or dismissal from your position as a “financial planner.”

Lack Of Transparency

In connection with the point above, lack of transparency is something I abhor in this career. Again, we sell insurance. It’s the way we earn our living. But no one really wants to talk about insurance because it is a morbid topic. You cannot discuss insurance without talking about death, disabilities, or critical illnesses. That is why we repackage it in such a way it will look like an “investment.”

Now we have an insurance product with an investment component. This is also known as VUL or Variable Universal Life Insurance. It sounds cutting edge, and it got people’s attention. Yet, if you look closely, what it is, in reality, is simply insurance. An overly expensive type of insurance. If you want to know more about this, you can follow this article: Insurance Vs Investment: How to know which one is right for me?

No Unique Selling Proposition

How many financial advisors like you work in one insurance company? Hundreds? Thousands? And all of you are selling the same products? And doing the same pitch? What now is the difference maker? What is so special about you that your friend in high school will get an insurance policy from you, and not from your other batchmate who is also in the same company?

Perhaps the answer is better service? Or more knowledgeable about the product? As a businessman, I do not see this as a sustainable opportunity. Every sale is going to be a bloody battle. Not only among colleagues but also with fellow financial advisors from other companies.

Stigma

Whether you like it or not, people will naturally be suspicious whenever you get in touch with them. This is not about being a financial advisor per se, but being a sales professional as a whole. And that is a problem.

Doctors do not need to call people asking if they are sick. Sick people will go find the doctor. That is the ideal influence we want to emanate as financial planners. We want individuals with financial troubles to come to us. But the truth is we do not work that way. Ironically, many financial advisors do not deal with broke people since they cannot afford insurance. Or they weren’t just equipped to handle complicated financial situations. It’s unfortunate, but we are mere pushy salesmen in the eyes of many people.

Takes A Long Time To Develop

The success rate in being a financial advisor is around 12%. Yes, twelve percent. It’s a difficult job. But regardless, it is also a product of a lack of patience. This career requires time. You won’t be effective in the financial planning industry if you are too young, have a small network, and do not have enough credibility. If you want to succeed in this career, you should find a way to stick to it at least for about five years. And those won’t be easy years. It is imperative to have a good support system while you let yourself “age” in this industry.

Why did I quit being a financial advisor?

I had a few, but they all have nothing to do with the financial planning industry as a whole. They are purely personal. The company and the managers I have worked with were nothing less than amazing. But perhaps the hardest part of being a financial advisor for me was building genuine relationships.

My work became a hindrance to many friendships. I struggled to draw a line between being a friend and being an insurance agent. Every time I meet with someone I always have this hidden agenda of selling them insurance. I tend to steer conversations so I can make an opening to my sales pitch. In turn, I have turned off many friends, and they became doubtful about my intentions – even at times when they’re truly genuine.

Today, I no longer sell insurance. But I can’t really say I have “quit” being a financial advisor. I still advise people about money through my writing and one-on-one counseling – and it’s free.

Summary

The financial planning industry can provide what most people are looking for in a good career. High income, prestige, and freedom. But achieving those is not a walk in the park. Most financial advisors fail because it takes a lot of time and dedication to make this career work. Yet, it is a job I would recommend even to fresh graduates because of its training. Even if you do not get paid, the level of education you will receive in this profession is already worth your stay.

See also

- What Is Good Financial Management?

- Why Is Financial Management Important In The Family?

- Financial Management Helps You To Do What? (10 things)

- Is Personal Finance A Good Class To Take?

- How To Understand Personal Finance (Here are 6 ways)