Financial management is one of the most essential life skills we must develop. It is a discipline that we can apply in many aspects of our lives — like self, business, and family. But out of these three, perhaps the family is the hardest, yet most crucial area to practice financial management.

As a whole, financial management is important in the family because it promotes healthier relationships among members. It enhances their marriages, teaches kids to be responsible, and protects everyone’s well-being from money-related stress. Every family should practice financial management.

Being dead broke five years ago allowed me to see the importance of managing your own finances. Since then, it has become my lifestyle and advocacy. I don’t want anyone around me to suffer the same financial stress I experienced (that includes you). If you want to learn the importance of financial management in the family, read on. I hope this article will encourage you to apply this discipline in your family, no matter how difficult it is.

Please note, however, that the information written here is based on my personal experience. It by no means intends to give professional advice.

1. Financial management is not taught in schools.

Among the biggest considerations why we should practice financial management in the family is that it is not taught in schools. Our children graduating with honors doesn’t guarantee they will be good at handling their money. It is safe to say that if we do not teach our children financial lessons at home, there is a possibility they won’t receive them elsewhere. It is our responsibility as parents to make them financially sound before they leave the nest.

Why isn’t financial management taught in schools? Here are the top reasons, according to Time:

- Not enough qualified instructors.

Only one in five teachers feel qualified to lead a personal finance class. - Personal finance concepts are not standardized.

If concepts are not tested, they can’t be taught. - Lacks clarity.

There is no governing body to mandate personal finance classes. Everyone has its own ideas on how to go about it. As a result, there’s no clear agreement on what kind of method works.

2. Kids emulate their parents’ financial habits.

Studies have found a significant connection between parents’ financial habits and their children’s. Parents who manage their money well are more likely to have kids who:

- discuss money with them (83% vs 66%)

- practice delayed gratification (52% vs 40%)

- are honest with their spending (43% vs 34%)

In essence, we as parents must walk our talk, especially when it comes to financial management. More than teaching, we should model the proper behavior, mindset, and approach to help our children become self-sufficient. There is no better place to do this than at home.

3. Promotes healthier family relationships.

Money is not only among the leading causes of divorce but broken relationships as a whole. I personally can attest to this as I have witnessed and experienced relational conflicts due to financial reasons. Wealth and relationships rarely go well as we all have different ideas, behaviors, and mindsets toward money. This is why practicing financial management as a family is vital.

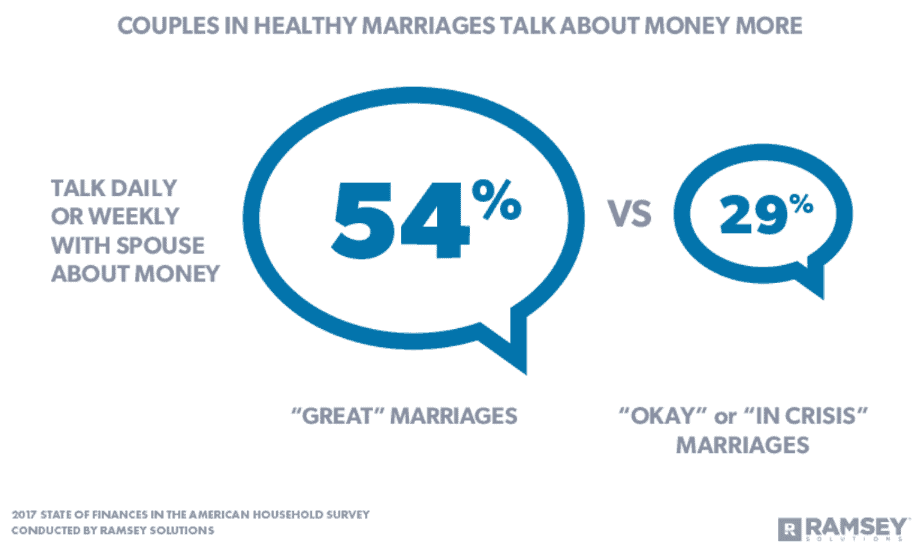

Getting every member involved in money management to a degree will allow them to be in sync with one another. In fact, based on a study by Ramsey Solutions, 54% of people who are enjoying great relationships talk about money regularly; contrast this to the 29% who do not.

4. It will establish your family for a better future.

There are two ways financial management helps our families move towards a thriving future.

- First, it will prepare us for crisis situations. Illnesses, injuries, job loss, business failure, and damages done by calamities can wreak havoc on our finances. Having emergency funds and insurance in place will protect us from these unforeseen circumstances — that may cost years’ worth of work.

- Second, it will position us to capitalize on great opportunities. All opportunities have a price. More often than not, it takes money to make money. It is senseless to have groundbreaking business ideas or to have encountered a once-in-lifetime investment opportunity if we do not have the means to make it happen. Use financial management to set a fund dedicated to these opportunities.

5. Enhances the family’s overall mental and emotional health.

Besides broken relationships, financial stress is also one of the leading causes of anxiety and depression. Due to my financial situation, I suffered sleepless nights, panic attacks, chronic stomach aches, migraines, uncontrolled anger, and hopelessness for three years. Those were the darkest moments in my life. But the worse thing is, I am not the only one who was affected by it. My spouse and kids have to deal with that version of myself as well. I hope you and your family will never encounter anything like this. Start managing your finances well.

Here are a few examples of the top causes of financial stress:

- Losing your source of income

- Upcoming due dates

- Unstable income

- Emergency situations

- Lack of savings for retirement

- Being seen as unsuccessful

- Growing debts

- Children’s education

- Wasted opportunities

- Cannot afford the lifestyle you want

6. Gives the family a better shot at owning a house.

If you dream of owning a house for your family, then financial management is non-negotiable. The normal route of purchasing a house is through getting a mortgage from the bank. It is borrowing a sum to purchase the property and agreeing to pay it back with interest over several years. This process requires a lot of money management:

- Borrowers must have a good credit score to be able to get a loan from the bank. In essence, they are checking if you are a capable and responsible payer — in other words, practicing good financial management.

- You should understand the numbers to see whether the deal is worth it or not.

- You must manage your money in such a way that you can commit to the monthly payments while maintaining enough to operate your household smoothly.

- You should have a backup plan for lean seasons, or if you lose your source of income.

7. Improves family teamwork.

Having debts and being broke are among the worst situations you can be in. But it is also a phase I wouldn’t change if I get the chance to re-live my life over again. I loathe, yet at the same time, thankful that I have experienced them because they helped me mature as a person. But even more, they also taught my family how to become financially responsible. They saw how debt and poverty affected us, thus we see them as our common enemy. As of today, we still have a few thousand dollars left to beat. And everyone, even our kids, is all-in in our battle for financial freedom.

Here are some personal observations on kids when financial management is practiced by the whole family:

- They become sensitive about the costs. When my kids like something, they ask first if we can afford it or not.

- Children understand (most of the time) when you say “no.”

- They tend to value and be more content with the toys they already have.

- They become curious on how to make money.

- They turn off unused lights and appliances without the need of telling them.

Summary

Financial management is challenging yet an important part of a family. Practicing it will impact the overall wellness of your household as it mitigates conflicts due to money-related stress. Managing your money as a family will improve your relationships, health, and future.

See also

- Financial Management Helps You To Do What? (10 things)

- How To Understand Personal Finance (Here are 6 ways)

- Which Financial Tool is Most Important?

- How Does Personal Finance Impact You?

- What Is The Purpose Of Personal Finance? Not what you think

Sources

- Why We Want—But Can’t Have—Personal Finance in Schools — Time

- Why Isn’t Personal Finance Taught in School? — Financial Educators Council

- Parents’ influence on children’s future orientation and saving — Journal of Economic Psychology

- Money and Marriage: 7 Tips for a Healthy Relationship — Ramsey Solutions

- Coping with Financial Stress — HelpGuide