Do you know anyone who doesn’t want money? I want it. You want it. Everyone wants it. While money is not everything in life, we can all agree that it is a great tool to help us live better lives. Unfortunately, the opposite is also true. Money can also make our lives miserable if we do not know how to use it well. The one thing that can make or break our financial lives is this: management.

As a whole, financial management helps you make, keep, and use your money properly. This is done through careful planning, administering, directing, and monitoring of your finances whether in family or business. Financial management is an essential skill for everyone who deals with money daily.

2016 was the year when I messed up financially. I was dead broke and had a huge pile of debts. Yet, it was also the year when I decided to attack it head-on by studying financial management. I have spent hundreds of hours reading books, attending classes, and listening to podcast episodes about money. If you want to get some insights on what financial management will enable you to do, read on. In this article, I will share with you how my life changed the moment I started managing my finances. Here are 10 things financial management helps you do:

1. Helps you identify the cause of your financial issues

The first thing financial management helped me do was identify the problem behind my financial mess — which is a huge deal. There is no way we can solve matters without knowing the root cause. I have shared the full story about my whole troubleshooting process in this post, but overall, the main issue was simply that my outflow overpowers my inflow. As soon as I learned about this, I was able to come up with a plan on how to tackle this problem.

2. Enables you to create better plans

The majority of what we want to accomplish in life always includes money to some extent. Financial management will allow us to develop more robust plans because it will ground us to the actual cost of our goals. I was in the athletic wear business and my aim during those times was to open one store per year. But when I understood my real financial situation, I changed direction. Instead, I closed all my physical stores and focused all my efforts online.

3. Aids you in making sound decisions

Financial management gives you actual data where you can base your decisions moving forward. This will help you decide logically rather than emotionally. Passing up on my ambition to build one of the most promising sports brands in our country is painful. But seeing where my figures are heading will not only spell disaster for my company, but also for my family. As I look back today, I thank the Lord for giving me the wisdom to make the right decision to let go and rebuild from what I have left.

4. Teaches you to utilize your resources

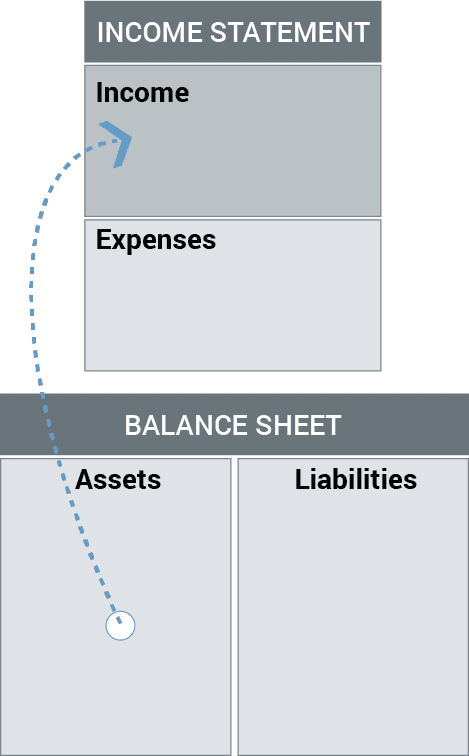

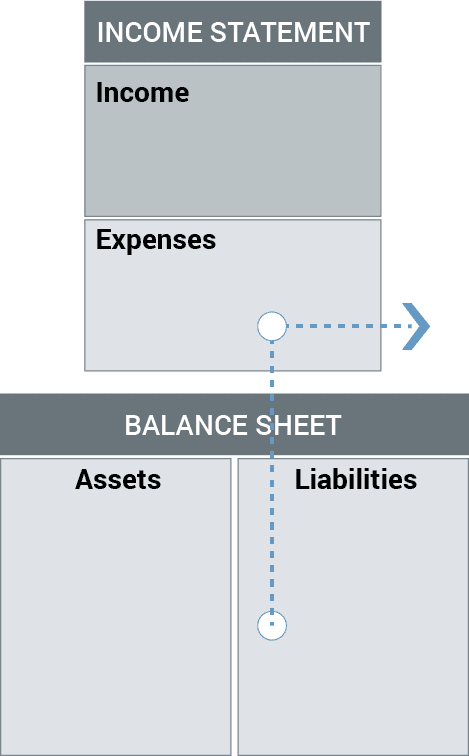

One of the most important lessons I learned in financial management is the concept of assets and liabilities. In simple terms, assets are anything you own that can earn money while liabilities are anything that takes away. The goal of financial management is to always increase your assets and minimize your liabilities.

Assets, however, are useless when they are not being utilized. Recognizing the valuable resources you have now — and being able to use them — will greatly boost your finances. As a matter of fact, this is how I bounced back to business. I simply used what I have:

- Sold all the stuff I no longer need to raise capital.

- Contacted a few friends whom I can help sell their stuff for a commission.

- Stayed with my parents for a couple of years to reduce my monthly overhead expenses.

- Used my skills and experiences in writing and online selling.

You can check out this post if you want to see the whole process I went through to start my online business: How To Start A Business With No Idea (A 4-Step Guide)

5. Makes you see and eliminates unnecessary expenses

We have already talked about liabilities previously. It is anything that takes away money from our pockets. While liabilities may sound like a villain in our income statement, they are actually an essential aspect of our finances. We cannot operate our family and businesses without any liabilities. We need to eat, pay for our bills, and maintain our cars.

Nevertheless, what makes liabilities dangerous are those which translate to unnecessary expenses we often overlook. It is those expenditures that do not add any value to our lives. They’re the things we see as important but in reality we can live without them.

Here are some of the examples of unnecessary expenses I personally cut and reduced:

- Junk food

- Vices like alcohol, cigarette, and vape

- Streaming services like Netflix, NBA League Pass, Disney+, etc.

- Interests paid from debts

- Insurances you’re not sure why you bought in the first place

- Unused (or seldom used) gym memberships

- Pricey mobile plan

- Frappés and bubble teas

- Bank charges and service fees

- Cable TV

6. Helps you improve your income

Utilizing your available resources and cutting down on unnecessary expenses will already improve your overall financial health. But as you continue with financial management, you will also discover some “invisible expenses” that affect your income. Two great examples of these are inflation and depreciation.

To put it simply, inflation is the idea that the cost of goods and services will continuously go up each year. While depreciation, on the other hand, is the reduction of the value of your assets due to wear and tear or passage of time. Understanding these concepts will allow you to include these unseen expenses in your budget or when pricing your products or services.

7. Alleviates crisis situations

Among the most basic lessons in financial management is to set aside a sum of money dedicated to unforeseen circumstances. This is called an emergency fund. The rule of thumb is to put at least three to six months’ worth of your living or operating expenses. The purpose of this amount is to cover your family or company during trying times. It serves as a cushion in case crises strike. Listed below are a few examples of what an emergency fund covers:

- Hospitalization due to sickness or an injury.

- Repair of damage done to assets by calamities.

- Car or other major repairs needed for day-to-day life.

- Loss of income due to failure of business or job loss.

8. Assists in developing good relationships with colleagues

I like people who are good at managing their finances. I’m sure you do too. People who know how to care for their money tend to become excellent paying customers or dependable business partners. Money is simply a tool. But the way a person handles his or her finances speaks a lot about their character. Looking back at how I managed my money a decade ago, I surely won’t strike any deal with myself.

9. Prevents you from getting into (more) debt

When you become adept at financial management, you will see that every interest counts. Compound interests — that is, interests making more interests — can make or break your financial health. 3% monthly interest may not sound too much for a person who doesn’t know financial management. But to those who are aware, they know that at this rate, their overall credit card debt can almost double in just two years.

To put this in perspective, you are already making good money with your investments when you earn about 15% per year. At 3% a month, this means credit card companies are killing it at 36% a year! My wife and I learned about this a little too late. We were already buried in debt. We paid a high price for this lesson, and I am teaching it to you for free. Small holes can sink a ship. Don’t underestimate the seemingly minute interest rates being charged to you. Check out this post if you want to learn how we paid off our eight credit card debts.

10. Allows you to prepare for the right opportunities

We all have equal opportunities to make our financial lives a little better each day. Yet, not all of us are prepared enough to capitalize on those opportunities. How many of us have told ourselves, “If only I have the money…”? If only I have the money, I’ll get into that business. If only I have the money, I will invest in that asset. I honestly have told this many times to myself.

But what I learned is we cannot magically have the means to clinch those opportunities we have in front of us. We must be intentional in preparing for it. Through proper financial management, we can dedicate a small portion of our income to investment purposes. As for me, I have disciplined myself to set aside 10% of my pay in an account where it can incur interest. It took a couple of years before I was able to use it to open my e-commerce business.

Summary

Overall, financial management is the discipline of taking care of your money. Engaging in it will enable you to do many wonderful things that will help you improve not only financially but also as a person. Financial management is not easy and takes a considerable amount of time to develop. Yet, it is a worthwhile investment as it is one of the most vital skills you can acquire in your life.

See also

- Is Personal Finance A Good Class To Take?

- How To Understand Personal Finance (Here are 6 ways)

- How Does Personal Finance Impact You?

- What Is The Purpose Of Personal Finance? Not what you think

- Why Is It Important To Learn Money? Here’s what the data says