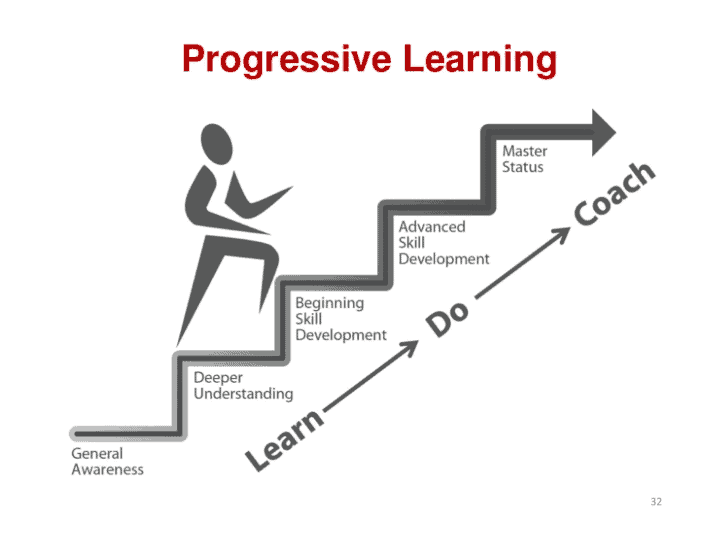

Learning about money can be intimidating. That might explain why only 1 in 3 adults are financially literate. But this should not be the case. Education has now evolved where it adapts according to what the student needs. This is called progressive learning. With progressive learning (or education), you can now learn personal finance regardless of your skill level. Whether you are a beginner, intermediate, or advanced, there is a class for you. So don’t back out from financial education. Pursue it whenever you get the chance.

Personal finance is generally not that difficult to learn and apply since it mostly involves simple mathematics. Anyone who knows basic math and is willing to practice self-discipline can easily learn personal finance. The area where the majority of people struggle is breaking their unwise spending habits.

Personal finance is an essential and highly learnable skill. This post aims to help you jump-start your financial literacy journey. Read on to discover how you can become proficient at managing your money, and discover several financial courses that are worth your time.

SlideShare.net

Personal finance classes for beginners

If you are looking for a good entry point into personal finance, here are some recommended online courses offered to you by Coursera. Most of the materials in these classes are free unless you intend to receive a certificate after you have completed them. Simply choose the Audit Only option once you have signed up for the course. See Coursera’s enrollment options to learn the advantages and limitations of audit-only courses.

- Introduction to Finance: The Basics

A general overview of basic personal finance topics such as budgeting, cash flow, taxes, and setting financial goals. This course is taught by two financial professionals through a series of videos, readings, and activities. Whether you are in college, about to retire, or anywhere in between, this class will help you understand money better and give actionable steps to manage it in the future. - Financial Planning for Young Adults

A course designed to provide an introduction to basic financial planning for young adults. Topics include saving, investing, financial risks, and debt. Each module offers traditional lecture-style videos, and real-world scenarios to encourage critical thinking in making financial decisions. This course is offered by the University of Illinois. - Personal and Family Financial Planning

Offered by the University of Florida, this course addresses many critical financial management issues to help you develop prudent habits throughout your lifetime. It teaches you the time value of money, introduces you to various financial tools, and guides you in developing your personal action plans. By the end of this class, you are expected to gain a better understanding of saving, investing, and insurance.

Specialization

Coursera Specialization combines a series of relevant courses, so you can delve deeper into a particular subject. This is ideal if you plan to embark on a long-term learning journey. Follow this link if you want to learn more about Coursera Specialization.

The Fundamentals of Personal Finance

This Specialization is for anyone who intends to take control of their finances. There will be five courses, and in each course, you will learn and apply the essential skills in personal finance. This enables you to build confidence in making the right call about your own money situation. This module is brought to you by SoFi Technologies Inc., an American online financial company based in San Francisco. Here are the five courses included in this Specialization:

- Course 1: Introduction To Personal Finance

- Course 2: Saving Money For The Future

- Course 3: Managing Debt

- Course 4: Fundamentals Of Investing

- Course 5: Risk Management In Personal Finance

Should I take a personal finance class?

In truth, you do not need to take personal finance classes. There are countless books out there that teach sound financial lessons. You can already make yourself financially literate by reading at least ten books about money. I personally am a product of self-study. You can check out this post to see some of my favorite financial books. But that was six years ago. If I had to redo it today, I would definitely take advantage of the courses currently offered.

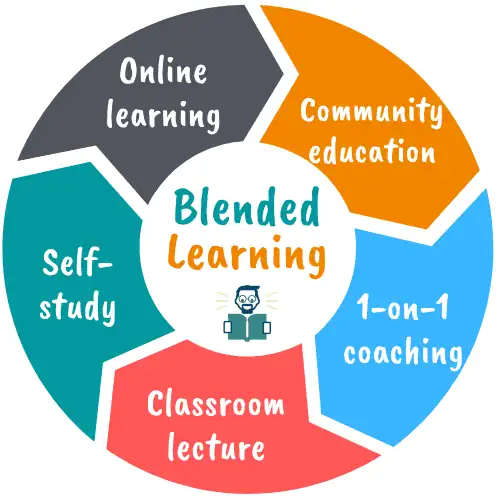

You can gain many benefits from taking a personal finance class. Online courses, in particular, have a method which combines self-study, traditional lectures, and peer interactions. They call it blended learning. You will have an expert to guide you, a community to support you, and a pace patterned to you.

As much as I enjoy studying by myself, I can’t deny some major challenges I faced:

- I have no one to ask to clarify a lesson.

- I do not have a clear road map. I simply read what I think is good.

- I was susceptible to false information.

- I do not have access to materials where I can test my ideas. All are applied directly in real-life life, which is risky.

Similar to progressive education, blended learning can help make studying personal finance even less intimidating. You will have access to different mediums to ensure you are learning efficiently and effectively. Another benefit of blended learning is that it prevents you from wasting your time, money, and emotional energy on trial and error.

How long does it take to learn finance?

On average, a personal finance course takes about twelve hours to finish. You can technically graduate from one class every thirty days if you can devote at least three hours per week to your studies. By the end of five to six months, you will already have a solid foundation of basic finance.

But financial education, to me, is an endless process. It is either we are learning something new, or we are re-learning some vital lessons we may have already forgotten along the way. In the era of new “investment” vehicles such as cryptocurrencies and NFTs, it’s now more crucial than ever to sharpen our financial skills. This will allow us to better identify the opportunities to take advantage of and also recognize the pitfalls to avoid.

What do you learn in personal finance?

As a whole, the lessons in personal finance are about making, keeping, and spending money. You’ll learn the different financial terminologies and concepts that will help you understand money better. It will show you various ways of raising capital, as well as how to use it to acquire and protect your assets.

Personal finance is a broad subject. The common topics it covers are saving, budgeting, investing, insurance, taxes, retirement, and so much more. But for someone who is just starting to learn about financial management, my recommendation is to pay close attention to these sub-topics:

- Jargon.

Your vocabulary is one of the most vital tools you’ll ever have throughout your learning journey. It will not only help you better understand complex financial concepts, but it also promotes clearer discussion with fellow students and mentors. - Risks

Personal finance, in a way, is about managing financial risks. Mitigating uncertainties is the heart and soul of financial management. You will benefit greatly when you become proficient at this topic. - Inflation

Every year the prices of goods go up, and thus making our money’s buying power decline. Like gravity, inflation is a law. Everyone is affected by it and there is nothing much we can do on a global scale. But there are things we can do on our own to counter it, and that is an essential lesson you need to learn in personal finance. One basic approach is to minimize our expenses, and invest our money where it can yield more than the average inflation rate. - Interest

This is the profit you receive for lending your money, or the price you pay for borrowing. The rise and fall of interest rates is the main influencer of many financial decisions, both individually and globally. Being familiar with the concept of interest will develop you into a better decision-maker. - Compound interest

This is the most powerful concept in finance. In a nutshell, compound interest means the interest has earned more interests. You have to master this principle because it has the potential to make or break your financial life.

How can I get really good at finance?

Self-discipline is the number one delineating factor between the rich, the middle class, and the poor.

Robert Kiyosaki

Finance is 20% knowledge and 80% behavior. To be good at it, you must be committed to learning and self-development. There are lots of ways for you to become proficient with money. You can read books, attend classes, and seek financial advice. Also, don’t forget to practice what you’ve learned.

Let me close with this. If you want to be good with money, remember to SIT:

- Study. Financial education is not taught in school because there is no accepted standard of practice for it (yet). What we have right now are generally opinions from various financial experts about what they think is the correct way of managing finances. With that said, there is indeed no one size fits all approach to personal finance. You must consume every book, classes, podcast episodes, and whatnot you can find to discover the right financial method for you.

- Inquire. Do not be afraid to ask questions. If you are unsure about your own knowledge or practice, be sure to open it up with the financial people you trust. Inquiring also applies when buying assets. If you do not understand what you are getting yourself into, ask. If you still do not grasp the idea, it would be better to move on to another opportunity. Never get into something simply because you are pressured to do so.

- Train. Despite all the knowledge you received, it is a given that you will eventually make mistakes. But do not fret about it, it’s just part of the training. It is better to apply and fail, than be crippled with fear. Training is putting what you learned into action.