A third of relational conflicts among adults in a family are caused by money issues. Thus, financial management is an essential discipline in raising a successful family. But sound economic management hinges on how good your plan is.

Financial planning is critical for having healthy fiscal well-being and healthy family relationships. It gives a clear picture of how you should behave to achieve your goals. Having a financial plan will provide peace of mind that allows you to enjoy your money and relationships better.

What is financial planning? It is the practice of analyzing your financial situation and writing a series of steps to achieve your financial goals. This typically includes other financial topics like investing, saving, retirement, insurance, estate, and taxes. If you want to know more about financial planning, read on. Listed below are some of the benefits of planning your finances.

It Moves You Toward A Clear Goal.

The most prominent benefit of having a financial plan is it helps you determine a goal and move towards it. What is your financial goal? For us, it’s to pay off all our debts. This has been our goal for the past five years. Since my wife and I started to embark in this direction, we have settled 90% of our obligations – including paying off eight credit cards. With today’s economic state, I wish I could say when we will be able to finally reach our goal. But the plan is to continue to press towards it. You can read our credit card story here: How We Killed 8 Credit Cards.

It Helps You See The Big Picture.

I got into massive debt due to the absence of financial planning. To put it plainly, I winged financial management for most of my adulthood. I spent money here and there without considering the implications of those actions in my life. The change began when I sat down with a pen and paper because I became intensely sick of my financial situation. I folded the paper in half and wrote a plus sign on the left and a minus sign on the right. Under the plus sign, I listed all my assets – the source of my income. While under minus, my liabilities – the cause of my expenses.

Lo and behold, there was only one item under the plus and nine under the minus. No wonder I’m struggling financially! The outflow overpowers the inflow by a large margin. Seeing a bird’s eye view of my finances has allowed me to make the necessary changes to improve my financial situation. Read more about this here: Assets and Liabilities – Our Simple Plan To Financial Freedom.

It Removes Distractions.

Before the session I had with my pen and paper, I planned numerous things for my life. That was 2016. I am newly married and intend to enjoy the honeymoon stage with my wife. We thought of going to the Maldives. And after we come back, we will start a business together, then buy ourselves new smartphones. But we changed our plans after I conceded to the terrible financial position we are in.

Instead of sipping cocktails by the beach, we started clearing off our liabilities. Rather than getting the latest Android phone, we started building our assets. We still intend to make our honeymoon plan work someday. But for now, we are laser-focused on getting ourselves out of debt first.

Shout out to my wife for being supportive and understanding since day one.

You Can See The Right Opportunities.

The strategy is simple: build assets and minimize liabilities. We eat, breathe, and live with this plan in mind. Because of this, my wife and I can easily spot the right opportunities for us. We will definitely look at anything that will help us improve our cash flow and reduce our monthly expenses. This has been our discipline since we started our journey toward financial freedom. Here are some of the moves we made over the years:

- We have set up a home office.

- We transferred our physical stores to the internet.

- We cut all but one credit card. We retained the one without an annual fee.

- We paid off all debts with the highest interest first.

- We unsubscribed to all unnecessary subscriptions like the NBA League Pass.

- We studied the various businesses you can do online such as e-commerce and blogging.

- We decided to homeschool our kids.

- We invest 15% of our income in index funds.

- We deposit 80% of our money in the money market fund or a high-interest savings account.

- We host our unused spaces on Airbnb.

These decisions have either saved us money from rentals, utilities, fuel, payable interests, and wages; or allowed our money to passively earn 4 to 10 percent interest per annum.

You’ll Become More Patient With Yourself.

Once you have your plan, you will realize the voyage of becoming financially free takes longer than you thought. Whatever your goals are, the realistic time frame to achieve them is at least five years. Why such a long time? Well, there are lots of strings attached when it comes to money. But one of those is our attitude. The author of The Total Money Makeover says, “personal finance is 80% behavior and 20% knowledge.” If we want to see progress in our financial statements, we must first improve ourselves. And that’s what really takes time. Breaking bad money habits, mindsets, and beliefs is not easy. So be patient with yourself.

Here are a few of the most problematic money habits I have to break:

- Saying yes all the time. (I was a people pleaser)

- Not taking note of my expenses.

- Impulse buying.

- Purchasing stuff on credit.

- Instant gratification. (I hate waiting)

- Telling lies, overpromising, and not being transparent on business transactions. (I will do everything to close a sale)

- Projecting a false image of me. (I want people to see me as someone who has already made it)

- Delaying payments.

- Living beyond my means.

- Using debts as leverage.

It Provides Peace Of Mind.

One of the priceless things financial planning gives me is peace of mind. I sleep soundly at night despite how volatile the economy is today. I am a Christ follower, so this kind of peace has some Spiritual aspect to it. But on the practical side, I am confident we will be alright if we stick to our financial plan.

I lost my bus transportation business in 2020 and three rental properties in 2021 due to Covid-19. Today, thank God we are still doing alright financially. We have enough savings to weather the crisis. It allowed us to continuously invest, pay our debts, and live comfortably.

It Allows You To Enjoy Your Money.

Financial planning isn’t about deprivation. Managing your finances is a tough job. You will not go far if you withhold yourself from enjoying the process. Having fun should be an integral part of financial planning. To do this, we have set aside a budget called the “Fun Fund.” We use the money here for entertainment purposes like eating out, watching movies, traveling, and buying stuff we like. This is also the fund we use to celebrate every time we pay off a debt.

Incorporating fun activities into your financial planning will allow you to enjoy them a hundred times more because you know you are not overspending. It is guilt-free spending.

It Permits You To Become Generous.

In connection to the point above, this is also how we train ourselves to be generous. As Christ-followers, we know “it is more blessed to give than to receive.” Even more, giving should be a fun exercise since “God loves a cheerful giver.” For this reason, we have also set aside a budget called the “Giving Fund.” Like the fun fund, the giving fund enables us to be generous without compulsion because the money is already allocated for this purpose. This is where we get our cash when giving tips, donating to causes, or helping anyone in our community.

Your Marriage Will Be Better.

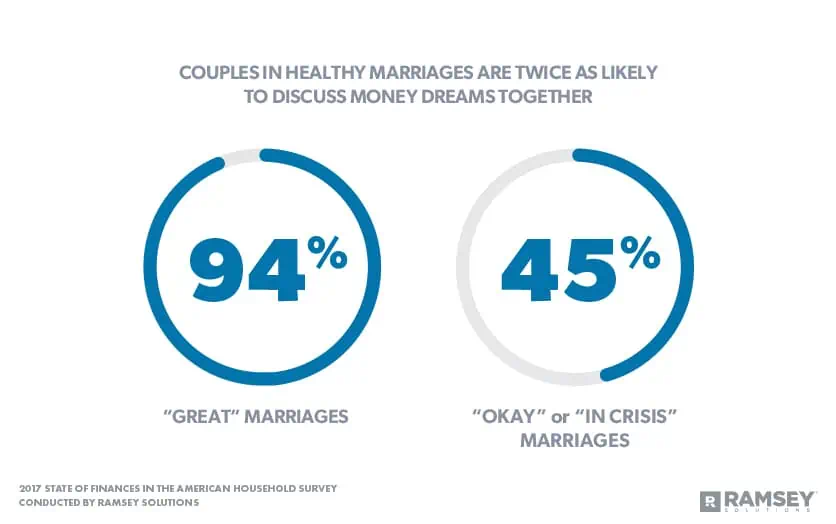

Planning your finances with your spouse helps your marriage. Based on a study by Ramsey Solutions, couples in healthy marriages are twice likely to talk about their financial dreams together. By God’s grace, I can confidently say Lalaine and I enjoy married life. And yes, keeping ourselves financially synchronized is a significant part of our relationship. Money is one of our favorite topics. We can spend the entire afternoon chatting about it – especially when it’s about looking back on how far we have come since our financial situation five years ago.

You Know When It Is Enough.

How much is enough? Without proper financial planning, you can be chasing money your whole life – and still don’t feel it is sufficient in the end. I know a couple who have always struggled with their finances. Little to no cash, always in debt, and unable to pay their bills in time. This has been their lifestyle for over 35 years, not because they are poor. It’s because they invested all their money in businesses and real estate. They didn’t set aside anything for themselves. Ten years ago, I asked them, “Why this kind of sacrifice?” They simply replied, “We want to multiply our money as many folds as possible.”

I got the chance to talk to them again the other day. They are now in their retirement age. They said they sold their house recently for more than $2,000,000. I was happy. They can finally enjoy a life without financial strain. Or so I thought. To my surprise, they are back in their usual financial position. They said they used half of the money to buy their new home, and the other half was invested in more real estate. When asked why, they again replied, “We want to multiply our money to as many folds as possible.”

I am not against investing. If you follow this blog, you know I actually advocate it. But why are you investing in the first place? What is your goal? How much is enough? Before you invest, be sure you have a plan to back it up. As for me, if I have $2,000,000, I will put it in a safe investment fund that yields at least 4% and live life off the interests.

More from The Learning Dad Blog

- Is Financial Planning A Good Career?

- What Is Good Financial Management?

- Why Is Financial Management Important In The Family?

- Financial Management Helps You To Do What? (10 things)

- How To Understand Personal Finance (Here are 6 ways)