I’m a leave-it-to-the-professional type of person. I have the contact numbers of plumbers, electricians, architects, doctors, accountants, and lawyers saved in my phone book. In contrast to my wife, who loves to DIY — do it yourself — my default is to delegate every task outside my expertise. Delegating is one of the most important functions in leadership. But there are certain aspects of our lives we cannot fully entrust to others; one of which is personal finance.

Personal finance is personal because there are no standards for money management. Despite what books, courses, and financial advisors teach you, the way people handle their finances is uniquely theirs. There is no guarantee that what helped them succeed, will also bring you the same results.

In short, personal finance is different for each person. No one has the same goals as you. No one has the same behavior as you. And finally, nobody cares about your money as much as you do. This is why I discourage people from letting their financial advisors take the driver’s seat when it comes to their finances. Everyone should do their due diligence in learning how to manage their own money. Don’t leave this task solely to the professionals. Let them guide you, but always be on top of every financial move you make.

This post is about helping you get on top of your finances. Read on to learn why it’s important to manage your own money, and also get some tips on how to do it well. But as a disclaimer, this content is for informational purposes only. It does not intend to provide any professional advice.

Is personal finance good for you?

The initial step to money management is learning the subject of personal finance. Personal finance essentially teaches you how to make, keep, and spend your money efficiently. It covers topics about saving, budgeting, investing, insurance, taxes, retirement, and much more. But like many other good things, personal finance can also lead to something unpleasant.

In general, personal finance is meant to be used for your own good. It teaches you effective money management techniques that can result in a more disciplined and less-anxious life. Yet, personal finance also has the potential to cause negative effects when a person becomes obsessed with numbers.

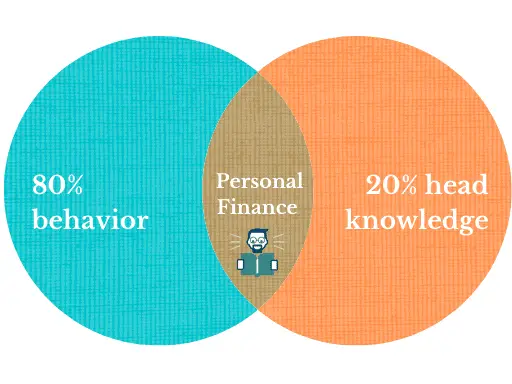

Money is neutral and how it affects our lives will be entirely based on our behavior towards it. To double down on what Dave Ramsey says, “Personal finance is 80% behavior and 20% head knowledge.” Whether you find personal finance to be positive or negative, keep in mind your attitude is the overall determining factor. This is the reason why money is often not the solution to our money problems.

The positive and negative effects of personal finance (examples)

Positive

- Control over your finances.

Having control over your finances is the most basic positive effect of personal finance. You know where your money is going instead of wondering where it went. You are aware of your priorities, and have a clear line between your wants and needs. Moreover, you are also not easily captivated by advertisements and other promotional campaigns because you are well aware of your budget. - Better self-knowledge.

Keeping track of your expenses is a core discipline in financial management. By doing so, you will be able to uncover a lot of information about yourself. Where am I spending the most? Is it on food, electronics, or travel? Where you put your money speaks a lot about what you value. It also, at the same time, exposes the areas in your financial life where you are most vulnerable. - Clearer financial goals.

“Financial freedom.” “Being wealthy.” That is what most people say when you ask them about their financial goals. But the truth is, the majority of them do not really know what they are talking about. Personal finance will help you clarify those goals. It will provide you with clear numbers, a series of actionable steps, and useful tools to achieve your targets.

Negative

- Legalism.

One of the destructive behaviors I have observed in personal finance is legalism. I know people who have become tightfisted as a result of their obsession with numbers. They are overly strict about how much money comes in and goes out each month. Nothing wrong with being zealous about your finances. But over zealousness to the point of legalism can lead to burnout, pigheadedness, and apathy toward others. I know because I have been one of them myself. - The risk of being scammed.

Many fraudsters use personal finance as a gateway to scam people. They project themselves as financial gurus who will teach you how to become rich. They will entice you to get on their financial courses or buy into their get-rich-quick schemes by flashing their mansions and sports cars. Once you’re in, you’ll discover their materials are low-quality — and you’ll be continuously upsold to more products. - Self-centeredness.

I personally struggled with this big time. I was so devoted to my financial goals that I became insensitive towards others. Every favor has a price — even from family members. I don’t do charity works. Every time I give, I expect something in return. The way I remedied this was by practicing generosity. To not get completely consumed by selfishness, I have committed to setting aside 5 to 10 percent of my monthly earnings for the purpose of giving. No strings attached. It was excruciating at first, but it got better overtime.

Why is personal finance dependent on your behavior?

Personal finance is a tool. And like any other tool, its effectiveness will be based upon how one uses it. Regardless of how educated you are about finance, it requires certain behaviors for it to be appropriately enforced in your life. Such behavior includes patience, diligence, and self-discipline.

The foundation of economic success

Dr. Thomas J. Stanley dedicated his life to studying millionaires. As part of his research for the book, The Millionaire Mind, he examined the behaviors of the wealthiest Americans, and he discovered they all share these characteristics: (Listed by order of importance)

- Integrity.

Being honest and transparent was rated one of the two most crucial success factors by the large majority of millionaires. They said they became rich because they did not compromise their integrity. People tend to do business more with those who are trustworthy. - Self-discipline.

Webster defines self-discipline as “correction or regulation of oneself for the sake of improvement.” Discipline is tied with integrity, as being the most essential factor in economic success (see the table below). A disciplined person sets a goal, and finds ways to reach it. They manage their own lives well and are not easily sidetracked. Dr. Stanley puts it this way, “Disciplined people could live in a warehouse filled with top-brand alcoholic beverages and not indulge themselves.” - Social skills.

It’s rare for anyone to become successful in anything without support from others. Thus, getting along with people is the third-highest rated behavior of the rich. Most millionaires would even choose social skills over intellect. Socially skilled people have strong leadership qualities, have the ability to communicate their ideas, and have the humility to learn from others. - A supportive spouse.

Almost all millionaires are married and most of them credit their success with having a supportive spouse. They believe having a family complements, and does not compete, with the process of building wealth. Married couples who work together as a team produce significant economic results. - Hard work.

Most millionaires believe hard work is a better predictor of success than academic experiences. They’ll take dedication, patience, and grit over talent and intelligence any time. Hard work means you are working harder than most people.

The table below shows other behaviors that are important to economic success:

| Behavior | % of millionaires indicating behavior is very important. | Rank |

|---|---|---|

| Being honest with all people | 57 | 1 |

| Being well-disciplined | 57 | 1 |

| Getting along with people | 56 | 3 |

| Having a supportive spouse | 49 | 4 |

| Working harder than most people | 47 | 5 |

| Loving my career/business | 46 | 6 |

| Having strong leadership qualities | 41 | 7 |

| Having a very competitive spirit/personality | 38 | 8 |

| Being very well organized | 36 | 9 |

| Having an ability to communicate my ideas or sell products | 35 | 10 |

| Making wise investments | 35 | 10 |

| Seeing opportunities others do not see | 32 | 12 |

| Being my own boss | 29 | 13 |

| Willing to take the financial risk given the right return | 29 | 13 |

| Having good mentors | 27 | 15 |

| Having an urge to be well respected | 27 | 15 |

| Investing in my own business | 26 | 17 |

| Finding a profitable niche | 23 | 18 |

| Having extraordinary energy | 23 | 18 |

| Being physically fit | 21 | 20 |

| Having high IQ/superior intellect | 20 | 21 |

| Specializing | 17 | 22 |

| Attending a top-rated college | 15 | 23 |

| Ignoring the criticism of detractors | 14 | 24 |

| Living below my means | 14 | 24 |

| Having strong religious faith | 13 | 26 |

| Being lucky | 12 | 27 |

| Investigating equities of public corporations | 12 | 27 |

| Having excellent investment advisers | 11 | 29 |

| Graduating near/at top of my class | 11 | 30 |

How do you know if your personal finances are healthy?

- You can pay for your needs.

- You have no debts.

- You are not worried about unforeseen expenses.

- Your money is earning more money.

- You can treat yourself to something you like from time to time.

- You are capable of giving.

- You are content.

This is how I would generally measure my financial health. But as the overall theme of this post, personal finance is personal. What I deem to be financially healthy may be different from what you think; and vice versa. Nevertheless, the general rule of thumb is if your income is greater than your expenses, then you are financially healthy.

How is personal finance best managed?

Personal finance is best managed by having a simple and repeatable budgeting system. A budgeting system is a method that helps you track and direct your spending in the right direction. Developing an approach you can consistently practice long-term is crucial to your financial well-being.

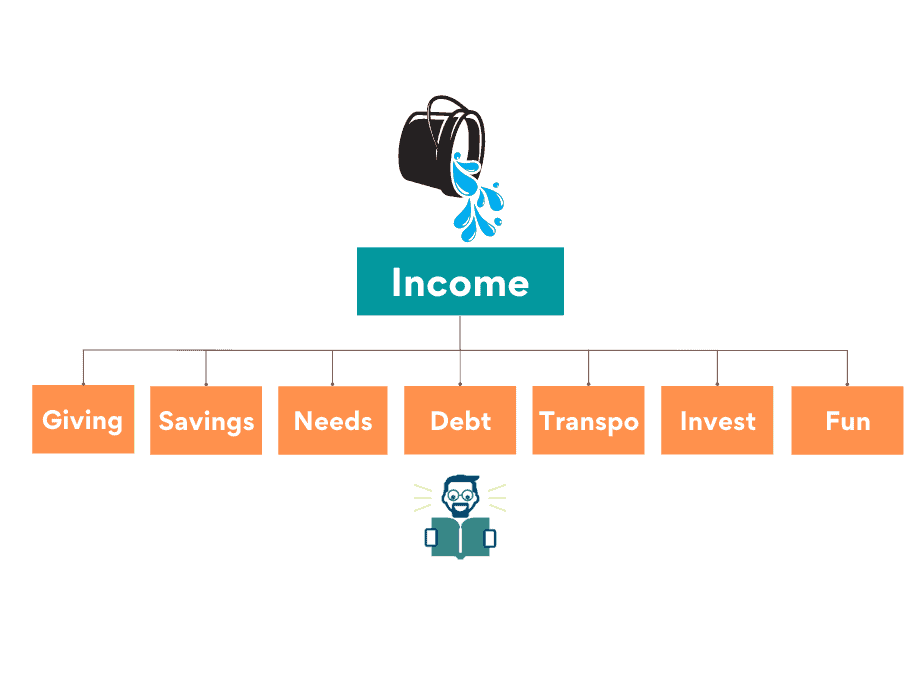

There are several ways to manage your finances. But what works best for me by far is the zero-based budgeting technique I learned from Dave Ramsey. The goal is to allocate your income to smaller funds until it reaches zero. Every dollar (or peso) should have a purpose. I simplified this approach by allocating a percentage based on priorities. Here is an example:

| Income | $1,000 |

| Less | |

| Giving (10%) | $100 |

| Saving (10%) | $100 |

| Necessities (30%) | $300 |

| Debt payments (15%) | $150 |

| Transportation (10%) | $100 |

| Business/Investment (15%) | $150 |

| Fun/Travel/Entertainment (10%) | $100 |

| Total | $0 |

Having this kind of system allows me to not let my emotions decide on what to do with my money. Whether it is $100, $1,000, or even $1,000,000, they are all going to be allocated the same way. This is how I have managed my money since 2017. There have been a few tweaks here and there, but the overall approach hasn’t changed. This is my simple and repeatable budgeting system. And this is also the system that helped me and my wife pay off eight credit cards.

What will happen if the budget is not met?

Not meeting your budget may result in guilt, frustration, and losing control of your finances. Worse, it may even become a habit that can lead to unwanted debts and graver financial repercussions. A budget is an essential part of personal finance. Without it, you will be putting your financial health at risk.

But don’t fret. The good news is, budgeting is a highly learnable skill. If you find yourself constantly struggling to meet your budget, perhaps you can start with something basic. Like the 80/20 approach. Save 20 percent, and spend the rest. Keep this discipline for now, then level up to 70/30, when you get better at meeting your budget. And then to 60/40. There will come a time when budgeting becomes second nature, and you will be able to make a more complex allocation such as 50/30/20. 50% needs; 30% wants; 20% savings.

Closing thoughts

A budget tells us what we cannot afford, but it doesn’t keep us from buying it.

— William Feather

Nonetheless, whatever your approach is, the bottom line is you have to partner it with the right behavior. Personal finance is personal. As William Feather says, “A budget tells us what we cannot afford, but it doesn’t keep us from buying it.” Here are some questions you can ask yourself when you are having a hard time meeting your budget; or in managing your finances overall:

- Am I saying yes too often?

- Do I have an accountability partner?

- Am I holding on to things I no longer need?

- Do I have more than one credit card?

- Am I committed to my budget?

- What are the factors preventing me from meeting my budget?

- What is one thing I need to improve on to better manage my finances today?